Mortgage Rate Update for May 15 2017

Mortgage Rate Update for May 15, 2017

Mortgage Rate Update for May 15, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved higher last week as mortgage bonds broke through support and moved lower. If you look at the mortgage bond chart below you can see mortgage bonds broke below support that held last week and moved lower to test the next level of support. Friday mortgage bonds were able to bounce off support and rally higher so we are recommending FLOATING your mortgage rate to start the week to see if bonds can continue to rally and move interest rates lower.

In Economic News

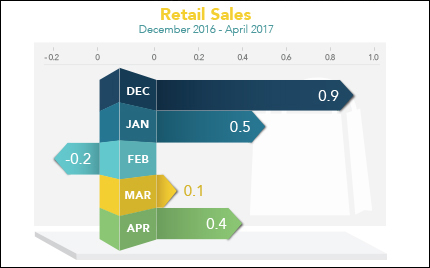

Retail Sales for April 2017 rose 0.4 percent from March’s revised 0.1 percent retail sales. Increased consumer spending could signal a boost in economic growth in the second quarter of 2017 as consumer spending makes up two-thirds of country’s economic activity.

Consumer Price Index (CPI) for April 2017 was up 0.2 percent. CPI measures inflation at the consumer level. The year over year reading for the CPI in April dropped from 2.4 to 2.2% which was bond friendly news.

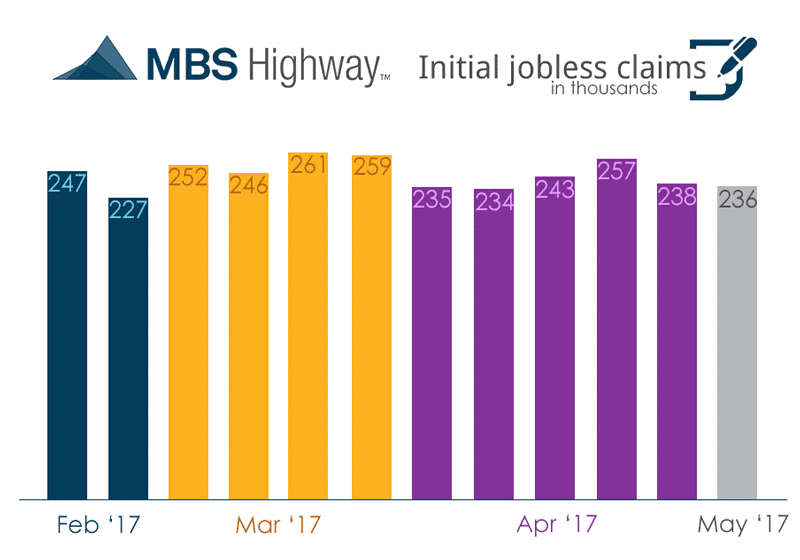

Weekly Initial Jobless Claims were released on Thursday and dropped 2,000 claims to only 236,000 claims for the week. Weekly Initial Jobless Claims measures the number of individual filings for unemployment benefits for the first time.

In Housing News

The Census bureau shows that 854,000 new-owner households were formed during the first quarter of 2017 versus the 365,000 new rental households for the first quarter. It’s the first time in 10 years that there were more new home buyers than renters, per Trulia. Seeing such a shift from buying a home rather than renting is a very good sign for the housing market.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday June 17, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday June 24 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate