Understanding Your Mortgage Payment

Understanding Your Mortgage Payment

Your monthly Mortgage Payment consists of paying back the money you borrowed (principle balance) and the interest charged to borrower the money. This is commonly called your Principle & Interest or P&I for short. The actual payment is calculated based on how much you owe, the interest rate on your mortgage loan, and the term of the loan (amortization). Below is an example:

Amount Owed (Principle Balance) – $200,000

Mortgage Interest Rate – 5.5%

Term (Amortization) – 30 Years

Monthly Mortgage Payment (P&I) – $1,135.58

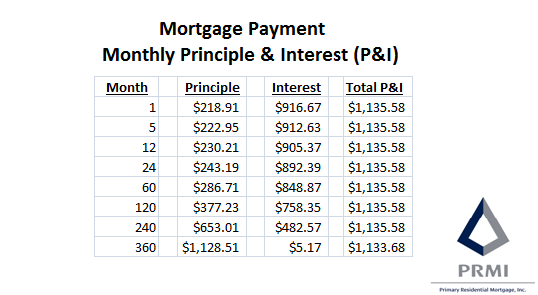

The total mortgage payment is broken between the principle and interest but it is not equal. The mortgage is front loaded for interest. If you look at the example below, there is a table showing sample mortgage payments at different months broken down for the amount going toward principle an the amount going toward interest.

In the table above you can see that most of your mortgage payment is going toward interest even in the fifth year (60 months). You don’t get to half and half until the 210th payment. After that you can see that at the 240th payment more is now going toward principle versus interest. Some good news is your very last payment, 360th payment the total is slightly less than the $1,135,58 you have been paying for the last 29 years.

Mortgage Payment – What is PITI?

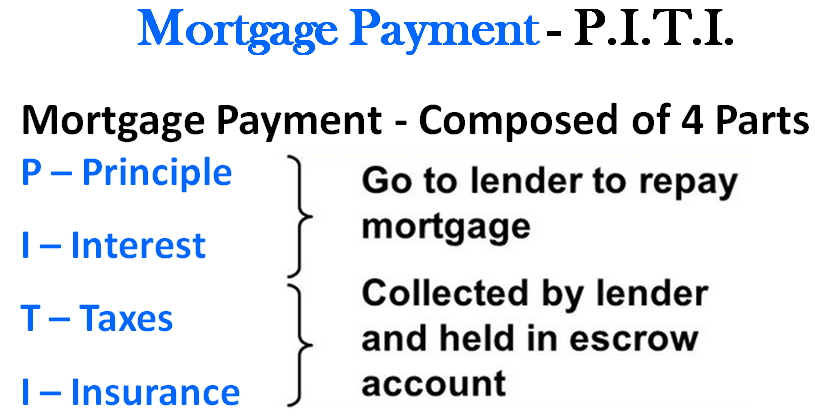

Your monthly mortgage payment will typically include not only the principle and interest each month but also the property taxes and the home owners insurance. This is abbreviated Principle (P), Interest (I), Property Taxes (T), and Home owners insurance (I) which is PITI all together. When you are budgeting for a mortgage payment or your mortgage loan officer asks you how much can you afford to spend every month on the mortgage, you should be using your PITI payment to calculate this.

In order to calculate your total PITI payment, the lender will use the principle, interest rate, and term to calculate the PI part just like the example above. In order to calculate the TI portion, the lender will take the yearly property taxes and divide by 12 months and also take the yearly home owners insurance premium and divide by 12 months. If we look at the same example from above and add in property taxes and insurance below:

Amount Owed (Principle Balance) – $200,000

Mortgage Interest Rate – 5.5%

Term (Amortization) – 30 Years

Monthly Mortgage Payment (P&I) – $1,135.58

Yearly Property Taxes – $2,400 (Equals $200 per month)

Yearly Home Owners Insurance – $600 (Equals $50 per month)

Total Monthly Mortgage Payment (PITI) – $1,385.58

What if You are Required to Pay Monthly Mortgage Insurance?

If your mortgage loan requires Mortgage Insurance (MI), then your total payment is actually PITI & MI. Mortgage insurance is required when the loan is a riskier loan for the lender, so the lender requires the borrower to purchase a mortgage insurance policy. The mortgage insurance is an insurance policy that pays the lender back for a portion of the loan amount in case the borrower defaults on the loan payments. The premium for the mortgage insurance policy is paid by the borrower so it is added to the monthly mortgage payment if elected to be paid on monthly basis. If we look at the example above and use a monthly MI premium of $141.67 then the monthly mortgage payment for PITI & MI is now equal to $1,527.25.

Mortgage Insurance is typically required on a Conventional Loan if you are putting down less than 20% of the value of the home. FHA Loans and USDA Rural Housing Loans ALWAYS require mortgage insurance no matter how much you put down. VA Loans do NOT require mortgage insurance even with 0% down.

What happens if You Make Extra Mortgage Payments?

If you decide to pay extra every month on your mortgage payment, then you want to make sure the extra is paid toward the principle balance. Paying extra toward the principle balance will pay the mortgage loan off sooner and save on the mortgage interest that you pay over the life of the loan. You can accomplish this typically in one of two ways. You can just add an extra amount every month in your normal mortgage payment or you can setup to make bi-weekly mortgage payments.

Option 1 – Adding Extra Every Month to Mortgage Payment

If you choose this option then you have the flexibility to decide if you want to pay extra and how much. If you want to make one extra mortgage payment a year, then you will take your monthly P&I portion of your payment and divide it by 12 months. For example if your monthly payment is $1,200 a month for P&I then you would pay an extra $100 per month to make one extra payment a year. This will reduce your mortgage term on a 30 year mortgage by 5-7 years.

Option 2 – Setting up Bi-Weekly Mortgage Payments

If you make your mortgage payments once a month you make 12 mortgage payments in a year. If you cut your payment in half then you would make 24 payments in a year. If you setup to make half your mortgage payment every 2 weeks then you will actually end up making 26 payments in a year as there are 52 weeks in a year. This will have you making one extra payment a year so you will cut anywhere from 5-7 years off the loan term on a 30 year mortgage.

How Do I Apply for a Mortgage Loan?

If you are interested in getting pre-approved for a mortgage loan to purchase or refinance a home in Delaware, Maryland, Pennsylvania, New Jersey, or Virginia then give the John Thomas Team with Primary Residential Mortgage a call at 302-703-0727 or APPLY ONLINE