Investor Cash Flow Loan Program – DSCR Loans

Grow Your Real Estate Investments! Take an Investor Cash Flow Loan

Are you a Real Estate investor who is hoping to maximize your earning potential? Then we’re excited to present you with the DSCR Investor Cash Flow Loan Program for the purchase or refinance of an investment property without having to document your income to qualify. We will qualify you off the cash flow of the property you are buying or refinancing. Call 302-703-0727 to get started today or you can APPLY ONLINE.

Now What Is an Investor Cash Flow Loan aka DSCR Loan?

The Investor Cash Flow Mortgage Loan or DSCR Loan allows a real estate investor to use the cash flow on the subject property to be used to qualify for the new mortgage loan. The program covers loans for non-owner occupied properties between one and four units. No tax returns or employment information is required to qualify for the loan. There is no limit to the number of financed properties. This innovative program can be used effectively to build a portfolio of income generating properties.

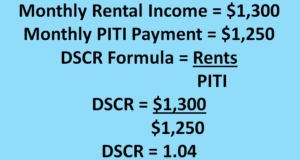

The debt service coverage ratio (DSCR) of the subject property is used to calculate the funds that can be used to qualify as follows:

- DSCR is defined as gross rents divided by qualifying PITI & HOA. 100% of the rents can be used for DSCR.

- DSCR is greater than 1 then the property is cash-flowing (The gross rent greater than the mortgage payment including principal, interest, taxes, insurance, and any property association fees then you have a cash flowing property)

- DSCR can be equal to 1 or less than 1 which means no or negative cash flow – If Negative cash flow then will need 12 months of reserves for the negative cash flow.

DSCR Sample Calculation:

Benefits of a DSCR Investor Cash Flow Loan

- No personal income used to qualify

- No limit on number of properties financed

- No DTI restrictions

- Minimum 600 Credit Score to Apply

- No employment required on application

- Qualification based on property cash flow (DSCR Ratio)

- Loans up to $3.5 million (minimum loan $75,000)

- Up to 85% LTV on 1-4 Units Residential Properties

- Up to 75% LTV on 2-8 Units Mixed Use Properties

- Up to 75% LTV on 5-10 Units Residential Properties

- 40 Year Term with Interest-only available

- Can Close in the name of LLC

- Up to 3% Seller Paid Closing Costs

- Can be Used for Purchase, Cash-out or Rate/Term Refinance

What Type of Properties are Eligible for This Loan?

The Investor Cash Flow home loan can be used to finance a variety of different types of properties. The Following is a list of the eligible property types:

- Single Family Homes

- Townhouses

- 2 – 4 unit residential properties

- Multi Units up to 25 units

- Mixed-Use Properties (2-10 Units)

- PUDs

- Warrantable Condos

- Non-warrantable Condos

- Condotels

What are The Requirements to Qualify for Cash Flow Loan?

In order to be eligible to qualify for this type of Real Estate Investor Loan, you must meet this minimum requirements to apply:

- Must have housing history and own a primary home already

- 2 years seasoning for Foreclosure, Short Sale, Bankruptcy, or Deed in Lieu of Foreclosure

- Minimum Credit Score is 600

- Must Be Purchasing an Eligible Property Type

- May Require Reserves of 3-6 months depending on credit profile

- Property MUST Meet Debt Service Coverage Ratio (DSCR) or Will Need 12 Months Reserve on Negative Cash Flow

- Max 85% LTV Minimum 680 Credit Score

- No DSCR Ratio Loans available

- 6 Months Seasoning to Use Appraised Value on Cash-out or Rate/Term Refinance

If you want to get into the real estate investing game and hold properties for rental income, this is a great loan product for you. The Cash Flow Loan has nowhere near the restrictions Fannie Mae and Freddie Max have for non-owner occupied mortgage loans for real estate investors.

What are the Requirements for Closing in the Name of an LLC?

In order to close an Investor Cash Flow Loan in the name of an LLC, you must meet the following guidelines:

- LLC must have been formed only for the purchase or management of real estate.

- For Multi member LLCs with varying membership interest , a fully executed Board Resolution authorizing the borrower to enter the loan contract.

- Borrowers must personally guarantee the loan

What Documents are needed from the LLC?

- Operating Agreement to include authorization to borrower & designates signers.

- Certificate of Formation / Articles of Organization

- Certificate of Good Standing or equivalent document

- Certificate of Foreign Qualification of other qualification to operate in the state where business is being conducted (if entity is formed in a state other than where business is being performed)

- Name and Principal residence / home address that will be signing the Personal Guaranty if multiple members with greater than 20% interest

What about Pre-Payment Penalty?

Investor Cash Flow Loans have a standard pre-payment penalty of 3 years. The pre-payment penalty is 6 months of interest on excess of 20% of the original principle balance unless otherwise restricted by law.

You can Buy-Out the Pre-payment Penalty:

Rate Buyout – 2 year PPP .125% adjustment to rate, 1 year PPP .375% adjustment to rate, No PPP .500% adjustment to rate

Cost Buyout – .25% fee for 2 years; .75% fee for 1 year; 1.00% fee for No PPP;

What are the credit requirements for a DSCR Loan?

Your credit score will determine your maximum loan to value which impacts your required down payment. You can do as little as 15% down but must have a minimum 680 credit score. Below is list of minimum credit scores by loan to value (LTV)

85% LTV – Minimum Score 680

80% LTV – Minimum Score 660

75% LTV – Minimum Score 640

70% LTV – Minimum Score 620

60% LTV – Minimum Score 600

How Do You Apply for an Investor Cash Flow Loan?

If you are interested in getting more information or would like to apply for an Investor Cash Flow Mortgage Loan, You can APPLY ONLINE HERE, or you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713