A Gift Fund or Gift of Equity Can Be Your Best Gift Ever

Did you know? Nearly 25% of first-time home buyers use cash gifts as

Yes, it’s true.

Many people find it difficult to purchase their first home when cost meets financial constraints (like having to pay off student loans despite good-paying jobs).

Here’s where caring friends and family may step in and help out—by offering a gift fund or a gift of equity.

What Is a Gift Fund and What Is a Gift of Equity?

When you’re looking to buy a house and you’re getting a loan, any money that your relative wants to contribute toward the purchase of your home is called a gift fund. Gift funds are common when a person buying a home doesn’t have all the liquid money to purchase it and a relative is willing and able to help supplement their financing needs.

Let’s say you’re buying a house and one of your parents wants to give you $30,000. That amount is their gift fund, provided that it is acceptable to the lender, which we will discuss later.

On the other hand, a gift of equity is when you’re buying the home of a relative and instead of them offering you the full market value of that home, they offer it to you at a price below the current market value. The difference between the actual sales price and the home’s market value is called the gift of equity and may serve as a downpayment on the home.

Important Things Worth Knowing

1. Gift funds can be used as full or partial down payment, closing costs or to fulfill a reserve requirement.

2. Gift funds involve a paper trail. Money that is gifted to you by a relative must be verifiable and sourced. This means cash cannot be counted as a gift fund because you can’t prove where cash came from. It has to be in form of written check or wired so that your lender can confirm the source of the money.

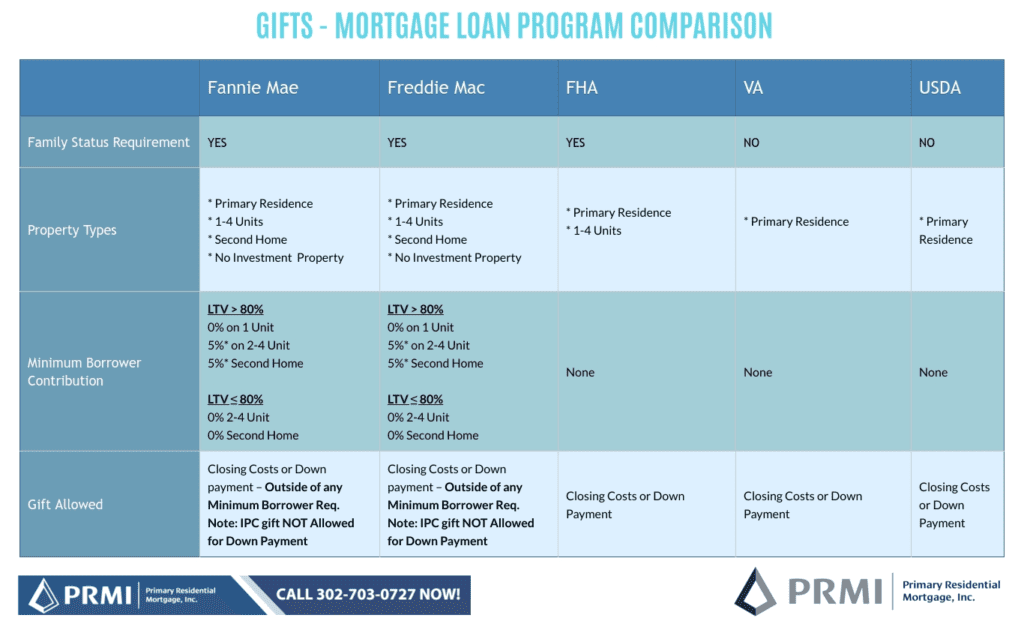

3. Gift funds cannot come from people who aren’t family members. It has to come from a parent, grandparent or sibling. It is also generally acceptable to receive gift funds from your spouse, domestic partner or fiancee/fiance.

4. The gift giver should make a “gift letter” stating the address of the property being purchased, the amount of the gift, the source of their funds and the relationship between you both. It should also state that the funds will be applied to your home purchase, the money wasn’t obtained behind the scenes from people associated with the transaction and that you are not expected to repay the gift. Other details include the date the funds were transferred and their signature. Your lender may request copies of withdrawal and deposit slips or something similar.

5. You may dread this last one, but yes, it could involve paying income tax on gifts above $10,000. The income taxes do not affect the mortgage process in anyway and is totally a separate issue between you and the IRS that would be dealt with at tax time. The donor of the gift money has no tax obligations, it would only be the borrower that is receiving the gift funds that could have a tax liability. Seek the advice of a tax professional. Gift of equity would not fall under this category and would only be taxable on the sale of the property as capital gains.

If you need help in determining which funds you can use to purchase your home, give us a call at 302-703-0727 and we’ll find the best option that works for you or APPLY ONLINE

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713