Delaware VA Loans for Veterans

Delaware VA Loans for Veterans provides one of the best mortgage loan options available with great low rates and 0% down payment to purchase or refinance a home in Delaware. Delaware Veteran Loans provide 100% financing so eligible military veterans need no down payment when purchasing a home. Most Delaware vets can purchase a home with as little as a $1,000 when they negotiate for the seller to pay their closing costs on a Delaware VA Loan with a Delaware VA Lender. If you served your country in the Navy, Army, Marines, Air Force, Coast Guard, Reserves or National Guard then Call 302-703-0727 to Apply for a VA Home Loan today or APPLY ONLINE

Delaware VA Loans – Benefits

- 100% Financing Available up to $1,500,000

- No Down Payment Required

- Seller Can Pay ALL Your Closing Costs

- Great Low Interest Rates!

- No Monthly Mortgage Insurance

- Guaranteed by Department of Veteran Affairs

- Minimum 580 Credit Score to Apply

- Active Duty, Reserves, National Guard, & Retired Veterans Can Apply

The VA Home Loan Guaranty Program was created by the U.S. Congress in 1944 and since its creation has helped more than 20 million women and men who served in the U.S. Military become homeowners or refinance their home loan. The military home loan program was created to reward eligible veterans and active duty service members for their service to their country.

Delaware Veteran Loan – Are You Eligible?

Our team of VA Loan Specialists can help you determine if you are eligible for a VA mortgage loan and assist you in obtaining a Certificate of Eligibility from the VA. The John Thomas Team is a Delaware VA Lender who has the knowledge and experience to help every Veteran use their VA Benefits.

In order to be eligible to qualify for a VA Mortgage Loan you must meet the following criteria:

- Served 2 years on Active Duty

- Served 181 Days during peacetime (Called up under U.S.C. Title 10)

- Served 90 Days during wartime (Called up Under U.S.C. Title 10)

- Served 6 Years in the Reserves or National Guard

- You are the spouse of a service member who was killed in the line of duty

- You are the spouse of a service member who died from a service related disability

You can get more details on VA Home Loan eligibility at the following link:

What are the 2022 Loan Limits for a Delaware VA Loan?

VA Loan Limits for 2022 with Full Entitlement:

There are No VA Loan Limits for Veterans or Service Members with Full or 100% Entitlement.

VA Loan Limits for 2022 with Partial Entitlement:

Delaware Veteran Loans with Partial Entitlement have a maximum loan limit of $510,400 as of January 1, 2020 which is the maximum a veteran can borrower for a 100% financing. The Vet with Partial Entitlement can borrower more than $510,400 but must put down 25% of the amount above the maximum loan limit. So if a Delaware Veteran wanted to purchase a home for $1,000,000 he would be able to borrower 100% of $510,400 and then must put down 25% of the difference between the $1,000,000 purchase price and the maximum VA loan limit of $510,400. Below is example calculation for Veteran with Partial Entitlement:

VA Purchase Price – $1,000,000

Maximum Delaware VA Loan Limit for 100% – $510,400

Difference – $489,600

25% of the Difference – $122,400

VA Loan amount – $877,600

A Veteran or Service member with Full Entitlement would be able to borrower the whole $1,000,000 in the example above because there is no VA Loan Limit for Full Entitlement.

What are the Different Types of VA Loans?

Veterans can apply for several different types of VA Loans depending on what their needs are at the time of requesting a VA Loan. Below is a list of the different types of Veteran loans available for Veterans:

- Purchase VA Loan for purchasing a primary residence

- Cash-Out VA Loan for up to 100% Financing

- VA IRRRL Streamline Refinance Loan

- VA One Time Close Construction Loan

- VA Renovation Loan

How Do You Obtain Your Certificate of Eligibility (COE) for a VA Loan?

In order to be able to use a VA Loan to purchase or refinance a home, a Veteran must obtain a Certificate of Eligibility or COE for short. Without the COE, the Veteran is NOT eligible for a VA Loan. The lender cannot even order a VA Appraisal without having the COE for the Veteran.

Below is a list of Documents that are needed for your lender to obtain your Certificate of Eligibility:

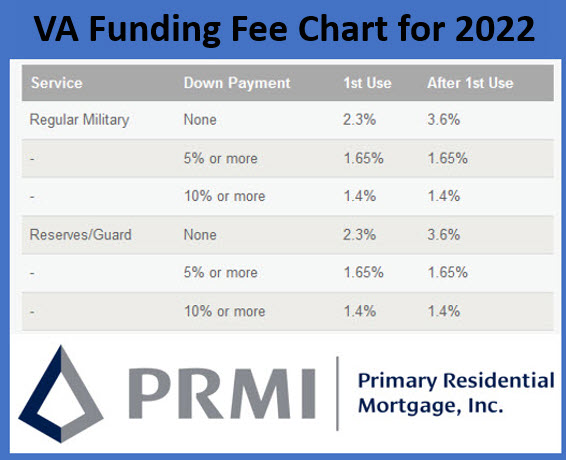

What is a VA Funding Fee?

Delaware Veteran Loans require that the Veteran or Service Member pay a funding fee in order to get a VA Loan. There is no mortgage insurance on a VA loan even when borrowering 100% financing. In order to offset this, the Department of Veteran Affairs requires that VA Mortgage lenders charge a one funding fee that can be financed into the loan.

The VA Funding Fee for 2022 is in the table below:

Apply for a Delaware VA Loan for the purchase or refinance of a home today

Speak to VA Loan Specialist on the John Thomas Team with Primary Residential Mortgage a VA Lender today by calling 302-703-0727 or APPLY ONLINE

#DelawareVALoans

#DelawareVeteranLoans

#VALoans

#VeteranLoans

#100%financing

#NoMoneyDownLoans