P&L Mortgage Loan

P&L Mortgage Loan for Self Employed Borrowers Looking for an alternative to qualifying for a mortgage versus using the traditional tax returns. The Profit & Loss Loan (P&L) allows self employed borrowers to qualify on an accountant prepared P&L, bypassing traditional income verification. The P&L mortgage loans significantly reduces the complexity of the loan application process by eliminating the need for exhaustive tax returns, 4506-C forms, or extensive bank statements. Avoid the hassle of providing Tax Returns to qualify for a mortgage and call the John Thomas Team today at 302-703-0727 to get started or APPLY ONLINE.

What is a P&L Mortgage Loan for Self Employed Borrowers?

P&L mortgage Loans, also known as Profit and Loss Loans, are a type of mortgage financing designed for individuals who may not meet the strict income verification requirements of traditional mortgage products. Unlike conventional loans that rely solely on Tax Returns and/or W-2 documentation, P&L Loans take into account a borrower’s entire financial picture, including both personal and business income, to determine their eligibility. A licensed tax preparer or CPA provide a 12 month or 24 month profit and loss statement for the business and we use the net profit as the qualifying income.

What are the Guidelines for P&L Mortgage Loans?

P&L Mortgage Loans allow self employed borrowers to qualify based on the following guidelines:

- LTV up to 90% on Purchase, depending on borrower Credit Score

- LTV up to 80% on Refinance

- Loan Amounts up to $4,000,000

- Minimum FICO Score is 600

- No Bank Statements Required below 80% LTV

- Available for Primary Residence, Second Home, & Investment Properties

- CPA or Tax Preparer P&L Covering 12 or 24 Consecutive Months

- Minimum Loan Amount is $100,000

- Available for First Time Home Buyers

- Only 1 Year Self Employed required

What Property Types are Eligible for Profit & Loss Loan?

Below is a list of eligible property types for financing with a P&L Mortgage Loan:

- Single Family Residence (SFR)

- Townhomes

- 1-4 Unit Properties

- Warrantable & Non-Warrantable Condos

What is a Profit & Loss Statement?

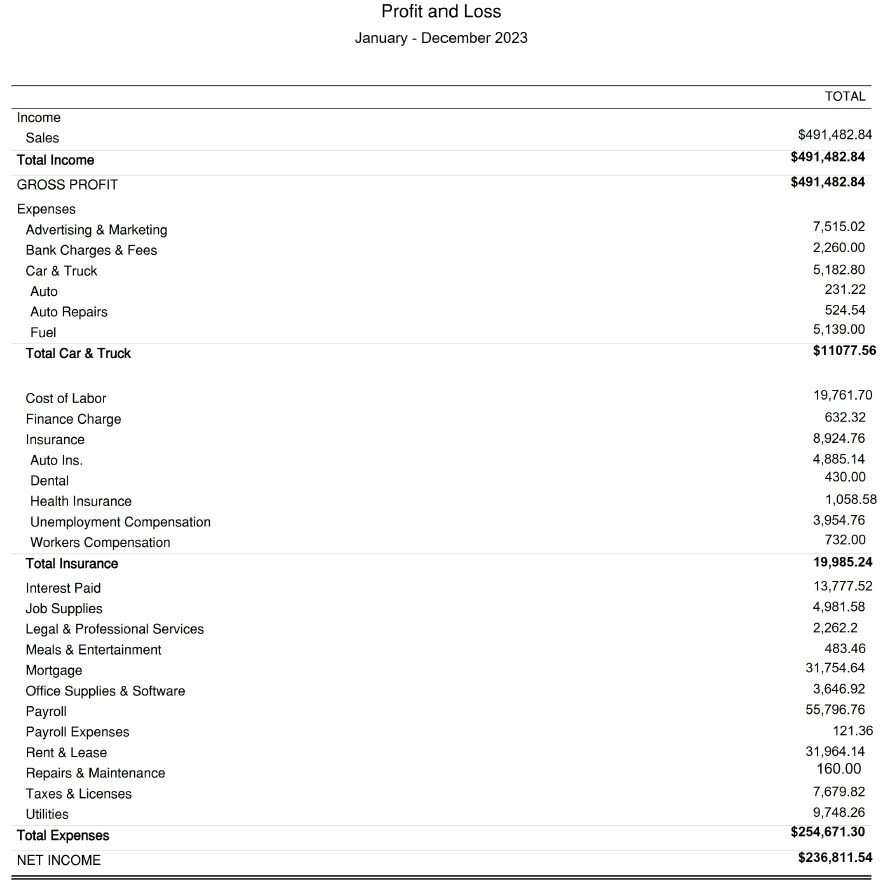

A Profit & Loss Statement shows all the income and expenses for a business on one ledger. It uses the gross income and all expenses to calculate the business’s Net Operating Income. This is the income that will be used for the P&L Loan. Below is sample Profit & Loss for a Business:

Are There Other Loan Options for Self Employed Borrowers?

YES! We have Four Different mortgage loan options for Self Employed borrowers seeking a mortgage for purchase or refinance. Below are the options for Self Employed:

- Conventional Loans – Fannie & Freddie

- Bank Statement Loans (Personal or Business)

- 1099 Only Loans

- P&L Mortgage Loans

How Do You Apply for a P&L Loan?

If you want to find out more information about a Profit & Loss Loan or would like to apply to be approved for a P&L mortgage loan then you can call the John Thomas Team at 302-703-0727 or APPLY ONLINE