DSHA Welcome Home Mortgage Loan

DSHA Welcome Home Mortgage Loan Program provides Delaware first time home buyers with below market interest rates home loans to make purchasing your first home affordable. If you are looking to purchase your first home in Delaware and have not owned a home in the past 3 years then this first time home buyer loan program may be the perfect solution to get you into your first home. Get started today by calling 302-702-0727 or APPLY ONLINE

What are the Guidelines for the DSHA Welcome Home Mortgage?

In order to qualify for the Welcome Home Mortgage Program, potential Delaware home buyers must meet the following guidelines:

- Must purchase a home in the state of Delaware as your Primary Residence.

- Minimum Credit Score of 620 for All Borrowers.

- Must be a First Time Home Buyer (Not owned a home or been on a deed in the last 3 years) unless borrower is a Qualified Veteran or purchasing a property in a Targeted Area.

- Must be under the Household Income Limits for the County the property is located.

- Must Qualify for a DSHA Conventional Loan, DSHA FHA Loan, DSHA USDA Loan or a DSHA VA Loan

- Must complete 8 hours of HUD approved Home Buyer Counseling if Your Credit Score is below a 660.

- Cannot use the Delaware Mortgage Credit Certificate Program from DSHA with this Program.

- Mortgage Interest Rates for the program Set Daily by DSHA at https://kissyourlandlordgoodbye.com/loan-products/

What are the Eligible Property Types for a Welcome Home Mortgage Loan?

In order to use the Welcome Home First Mortgage Loan Program from DSHA, you must be purchasing an eligible property type. Below is a list of the eligible property types:

- Single Family Home

- Town House / Row Home

- 2-4 Unit Property (FHA, USDA & VA Only)

- Manufactured Home (Must have 660 Score or Higher & Only FHA Loans)

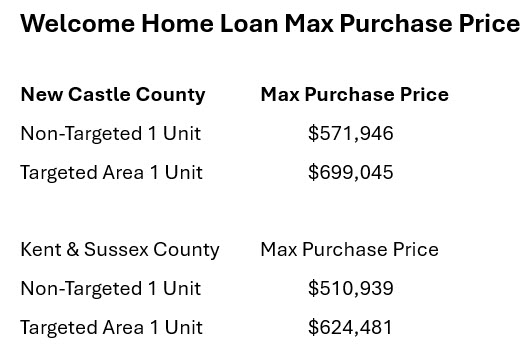

The DSHA Welcome Home Mortgage Program has a maximum purchase price for each county listed below:

What are the Household Income Limits for the Program?

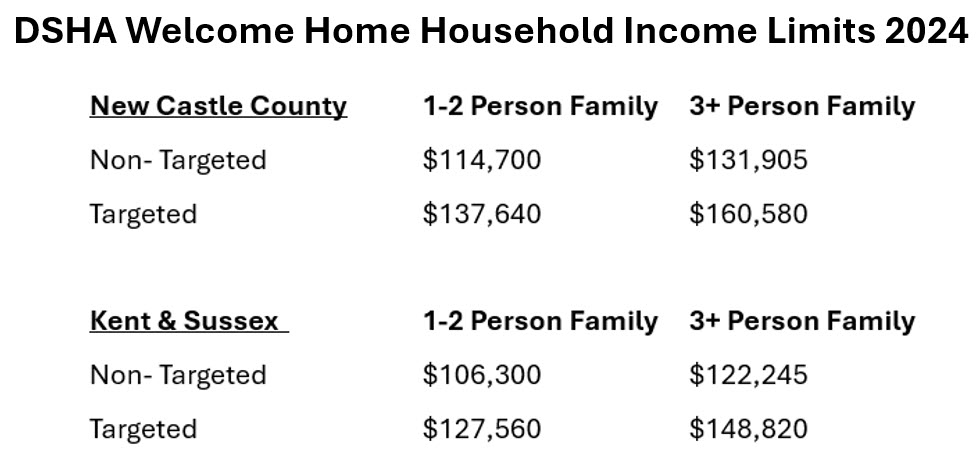

In order to qualify for the Welcome Home Loan Program, the household must be under the household income limits set by DSHA for the county the home is located. All members of the household are REQUIRED to provide income documents to calculate the total household income regardless if person is going on the mortgage loan or not. So if Wife is purchasing a home by herself, we still must get husband income documents to calculate household income for qualifying purposes.

Below are the household income limits by County for DSHA Welcome Home Program:

If you are over the income limits for the Welcome Home Program then you may qualify for the DSHA Home Again Loan Program as income limits are higher. If you are over the income limits for all the programs then you may want to consider the PRMI Welcome Home DPA Program which has no income limits and can use in all the states.

What are the Down Payment Assistance Programs Available?

When choosing to use the DSHA Welcome Home Loan Program to purchase your first home you can choose to use the Smart Start Loan which gives the lowest interest rate or you can pair the Welcome Home with one of the four Down Payment Assistance Programs offered by DSHA which are as follows:

- DSHA Home Sweet Home DPA

- DSHA Delaware Diamonds DPA

- DSHA First State Home Loan DPA

- DSHA Diamond in the Rough 5% DPA (Min 660 Credit Score)

You May only use one of the Down Payment Assistance Programs(DPA) so may not combine them. Each DPA program has its own guidelines and qualifications so may qualify for Welcome Home buy may not qualify for a certain DPA.

How Do I Apply for the DSHA Welcome Home Loan Program?

IF you would like to apply for the DSHA Welcome Home Loan Program, you must apply with a DSHA approved lending partner. The John Thomas Team with Primary Residential Mortgage specializes in the DSHA Programs so give us a call at 302-703-0727 or APPLY ONLINE Today!