Mortgage Rates Weekly Update [August 4 2019]

Mortgage Rates Weekly Update for August 4, 2019

Mortgage Rates Update for August 4, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved lower last week as mortgage bonds rallied after the Federal Reserve announced 0.25% reduction in Feds Funds Rate. If you look at the mortgage bond chart below you can mortgage bonds were able to break through tough ceiling of resistance last week and rally much higher moving mortgage interest rates to the lowest seen in 2.5 years. Mortgage bonds are sitting just below next ceiling of resistance and with US Treasuries making a run at lower yields, we are recommending carefully FLOATING Your mortgage rate to start the week to see if mortgage bonds can make a run at the resistance level.

In Economic News

Federal Reserve announced cutting Fed Funds Rate by 0.25% on Thursday July 31, 2019. The Feds Funds Rate doesn’t directly move mortgage rates 0.25% lower. The Fed Rate affects short term interest rates like the Prime Rate. So Home Equity Lines of Credit (HELOC) did go down because they are tied to the Prime Rate. Feds cut their rates because of weak global growth and softening inflation. Feds are trying to ensure we don’t have an economic slow down in the US economy.

What Does The Fed Rate Cut Mean to You?

The Fed Rate Cut of 0.25% has helped mortgage interest rates move to 2.5 year lows so now is the best time to have a mortgage review to see if you could take advantage of one of the following:

- Lower Your Interest Rate & Monthly Payment to save Thousands!

- Cut Your Term from 30 year fixed to 15 year fixed

- Cash-Out Refinance to pay off consumer debt at high interest rate and increase your over-all cash flow

- Purchase investment property, second home or new primary residence

Call John Thomas Now to take advantage of these low rates at 302-703-0727 or get started online at APPLY ONLINE

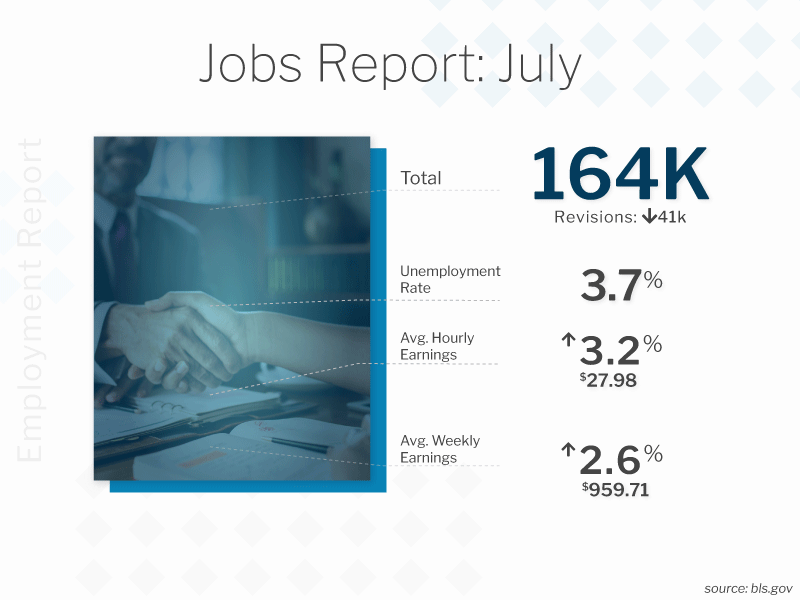

Jobs report for July 2019 showed 164,000 jobs created which was in line with expectations but the previous two months was revised lower by combined 41,000 jobs. The Unemployment Rate remained the same at 3.7%. The Labor Force Participation Rate (LFPR) increased from 62.9% to 63% which shows more people eligible to work are working. Average hourly earnings rose 3.2% year over year, which was slightly higher than the 3.1% from the previous report. Weekly Earnings, which is a better reading on wage pressure inflation, dropped from 2.8% to 2.6% year over year. The reason for the drop is hours worked dropped.

Personal Consumption Expenditures (PCE) for June 2019 showed inflation remained the same at 1.4% which is well below the Fed’s target of 2.0%. This shows there is not much inflation which is mortgage bond friendly news.

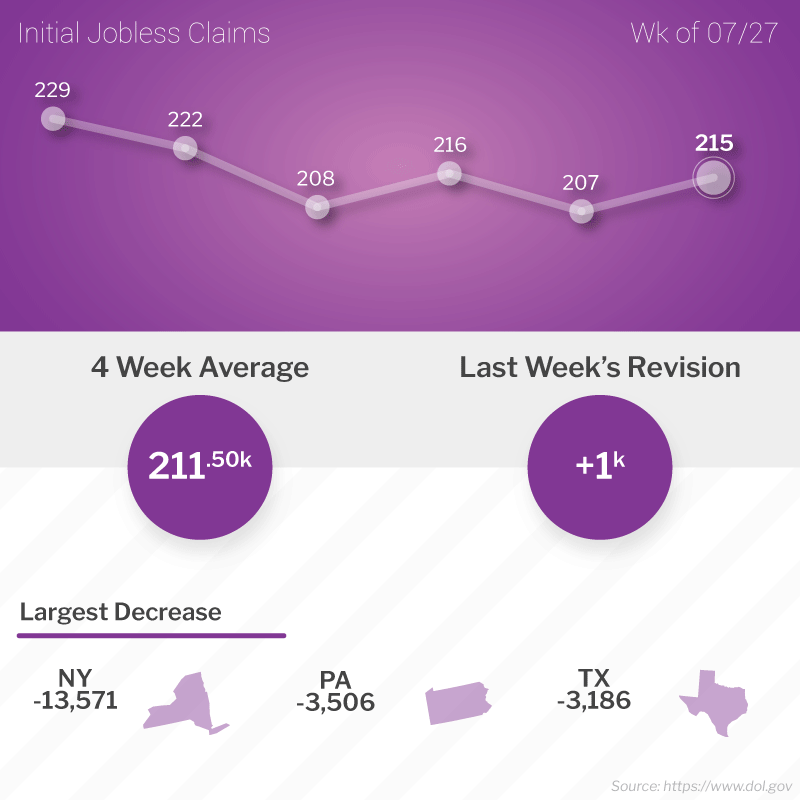

Weekly Initial Jobless Claims were released on Thursday and claims moved up 8,000 to 215,000 claims for the week. Even though claims moved up, 215k claims is still very low and supports the low unemployment rate seen in the jobs report of 3.7%.

In Housing News

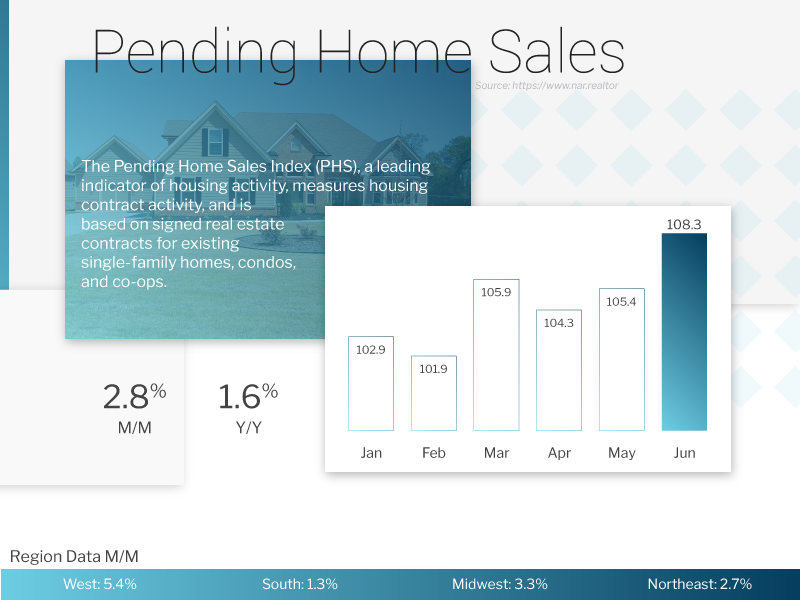

Pending Home Sales for June 2019 were up 2.8% to 108.3 on the index. This was much stronger than expectations of 0.5% gain. Pending home sales measures signed contracts on existing homes for sale and is a leading indicator of Existing home sales.

New Home Sales for June 2019 were up 7% to 646,000 units on an annualized basis. New home sales are up 4.5% from June of 2018. The Median Home Price of New Home Sale is $310,400 which is unchanged from last year.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday August 10, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday August 14, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday August 24, 2019 in Largo, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates and just dropped to a 2.5 year low, so it is the perfect time to purchase or refinance a home. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam