Mortgage Rates Weekly Update [May 20 2019]

Mortgage Rates Weekly Update for May 20, 2019

Mortgage Rates Update for May 20, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

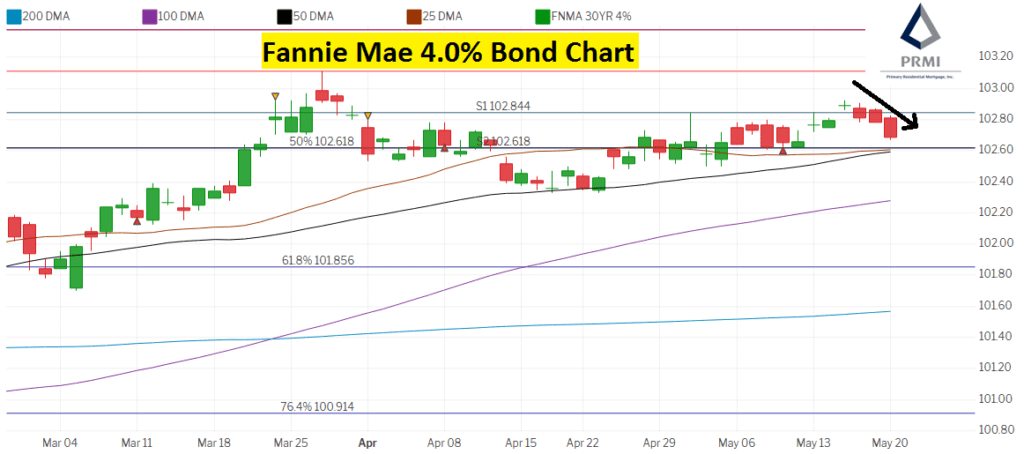

Mortgage Rates ended the week last week where they started but move higher to start this week as mortgage bonds failed to close above resistance. If you look at the mortgage bond chart below you can see mortgage bonds lost momentum last Thursday after mortgage bonds fell back below resistance. Then mortgage bonds sold off again on Friday after failing to move above resistance. Monday mortgage bonds fell through to the downside and mortgage rates moved higher. We recommend LOCKING your mortgage rate since bonds are selling off in the short term.

In Economic News

The biggest story in the financial markets and around the globe is the ongoing US/China trade negotiations.

At the moment, there is no resolution and it appears there will be no resolution for at least several weeks as the US and China are not expected to talk again until the G-20 Summit June 28-29.

The US, China and the entire globe would benefit from a deal and should it happen, Stocks will likely recover all of their recent losses and then some. At the same time, should the story drag on and escalate as higher tariffs are instituted — it would have a negative effect on global economies and Stocks may suffer as home loan rates improve further.

Looking at the US economy, it continues to do very well. Walmart posted incredibly strong corporate earnings this past week. Seeing they have $500B in annual sales — if Walmart is doing well, the US economy is doing well.

Weekly Initial Jobless Claims were released on Thursday showed 212,000 jobless claims which was a drop of 16,000 claims. This was 7,000 claims better than expectations of 219,000 claims. This is the first time claims have dropped in 3 weeks. We will have to see if claims are reversing course and moving lower.

In Housing News

Housing Starts for April 2019 rose 5.7% to 1.235 Million units on an annualized basis. Last Month’s housing starts were revised higher so starts were really up almost 8% and mostly in single family home construction which bodes really well for housing. We also saw Building Permits for April 2019 were 0.6% to 1.296 million units on an annualized basis which is a sign of future construction.

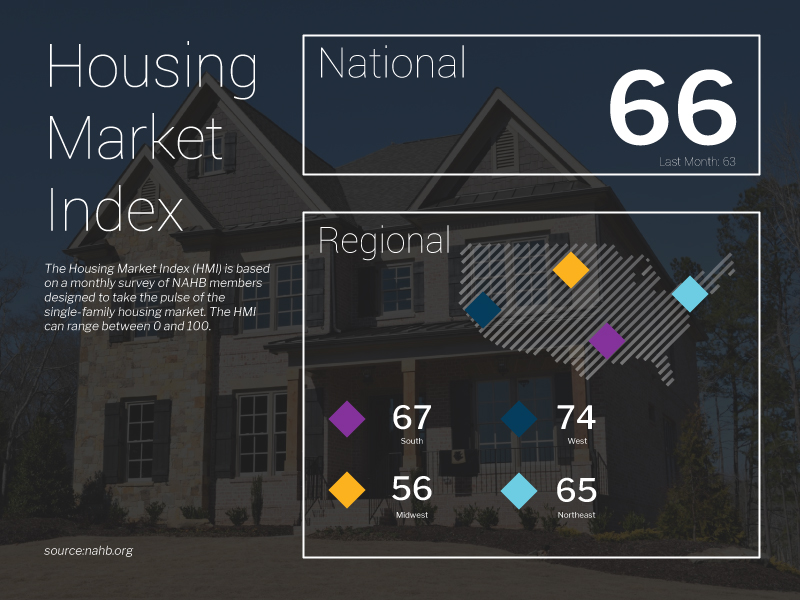

The National Association of Home Builders (NAHB) released their Housing Market Index for May 2019 and it was 66 which was much higher than April’s 63. This is a real time reading on Home Builder confidence. The reading is a 7 month high. There are three components to the NAHB market index report: Current Sales increased 3 points to 72 and Future Sales increased 1 point to 72. Buyer Traffic jumped 2 points to 49. Any reading over 50 signals expansion, so buyer traffic is the only one that is slightly weak, but is making strides.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday June 15, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday May 22, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday June 22, 2019 in Largo, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam