Mortgage Rates Weekly Update May 22 2017

Mortgage Rates Weekly Update May 22, 2017

Mortgage Rates Weekly Update May 22, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

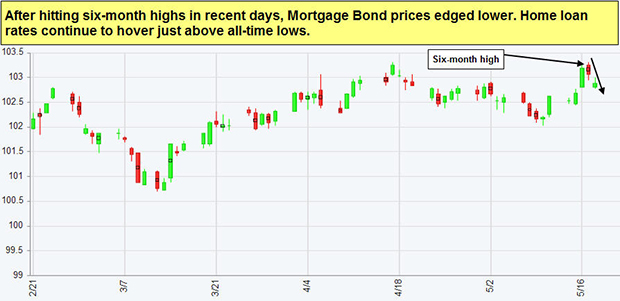

Mortgage Rates ended the week slightly higher than where they started after mortgage rates hit the lows for the last 6 months. If you look at the mortgage bond chart below you can see mortgage bonds rallied last week until hitting ceiling of resistance on Thursday and being turned lower which moved rates higher after hitting 6 month lows. We are recommending LOCKING Your mortgage rate to start the week to take advantage of record low rates for 2017.

In Economic News

The US Stock Market posted the biggest one day drop last week since September 2016 after questions arose about Trump Administration’s ability to push through its pro-growth agenda. This helped mortgage bond markets rally and move mortgage interest rates lower.

US Households now have as much consumer debt as they did in 2008. The New York Federal Reserve released report showing US households now have debt balance of $12.73 Trillion in March of 2017 which is above the peak in 2008 of $12.68 Trillion.

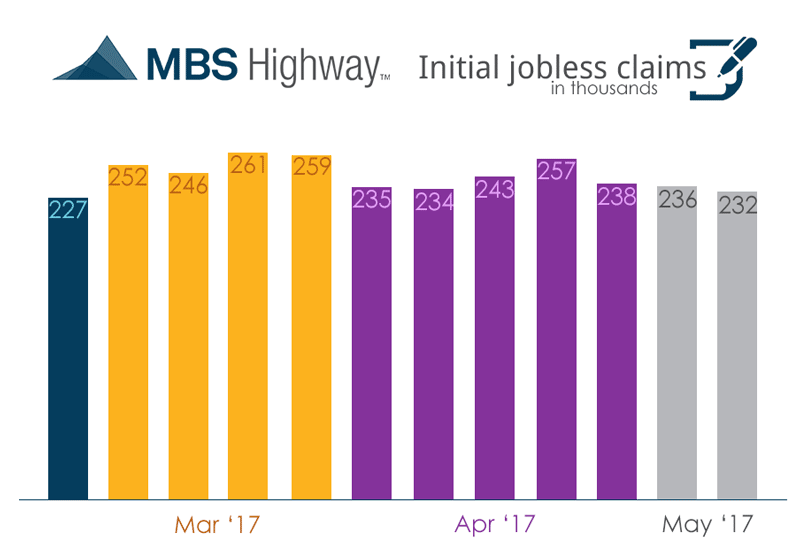

Weekly Initial Jobless Claims were released on Thursday and dropped 4,000 claims to 232,000 claims for the week. Continuing Jobless Claims, which measures the number of people that are currently collecting unemployment benefits dropped 22,000 to 1.9 million. This is the lowest level in 29 years for continuing jobless claims. This is also the sample week used in the jobs report so we are looking for a strong May Jobs Report.

In Housing News

Housing Starts for April 2017 were down 2.6% from March to 1.172 million units on an annualized basis but in the report Single Family Housing starts were up 0.5% from March and up 7.6% year over year so this report shows new construction is still doing well. Building Permits which are sign of future construction were down 2.5% from March to 1.229 million units. However, building permits are still up 5.7% year over year.

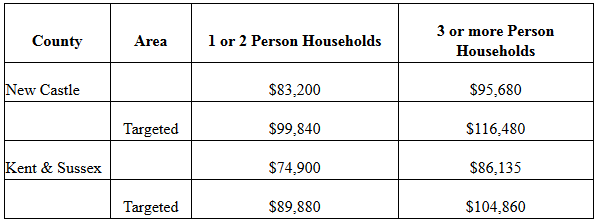

Delaware State Housing Authority announced changes to the DSHA SMAL mortgage loan program and First time home buyer tax credit (MCC) program effective May 15, 2017. The maximum purchase price and maximum household income are increasing for both programs. Below is the household income limits table for all three counties of Delaware:

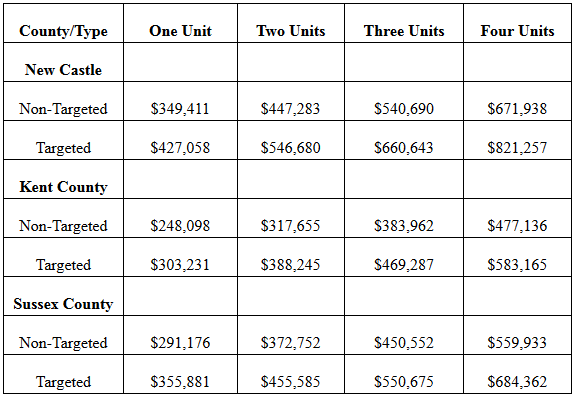

Below is the new maximum purchase prices for all three counties of Delaware for DSHA SMAL and DSHA Mortgage Credit Certificate (MCC):

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday June 17, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday June 24 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate