Delaware Mortgage Rate Sept 5 2016

Delaware Mortgage Rate Update September 5, 2016

Delaware Mortgage Rate weekly update for the Week of September 5, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Delaware Mortgage Rates ended the week slightly Higher than they started as mortgage bonds ended the week down after a disappointing August 2016 Jobs Report. If you look at the mortgage bond chart below you can see the red candle on Friday that shows long upward thin line. The thin red line upward showed mortgage bonds had rallied initially after jobs report but quickly switched and sold off as the stock market rallied. Mortgage bonds have been caught between the converging 50 day moving average and the 25 day moving average and are looking to make a break out either up or down. We recommend FLOATING Your Delaware Mortgage Rate to start the week to see if mortgage bonds can break higher.

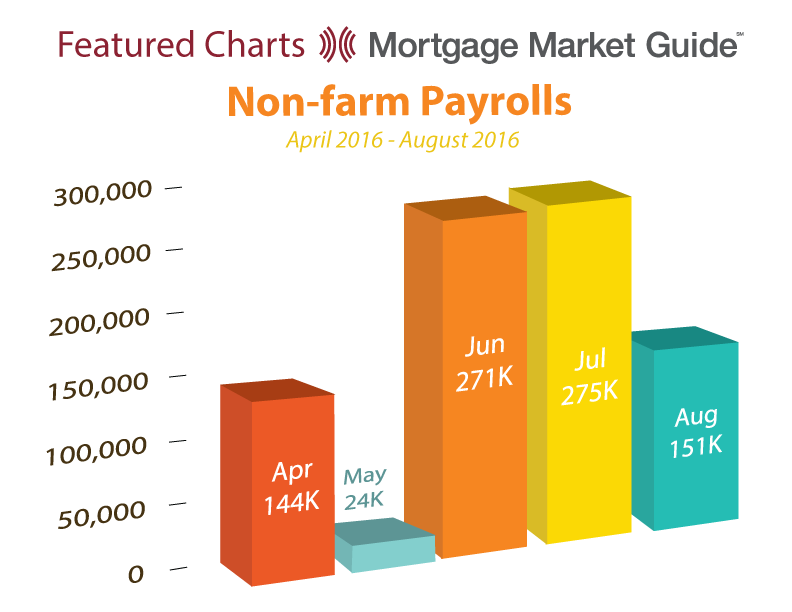

In Economic News, the August 2016 Jobs Report was released on Friday and showed a only 151,000 jobs created in August which was lower than the predicted 180,000 jobs. This ended up being bad for mortgage rates because stock market rallied betting the Feds will not be able to raise their short term funds rate at the September 2016 meeting. The Unemployment Rate was 4.9% which was also higher than the anticipated 4.8%.

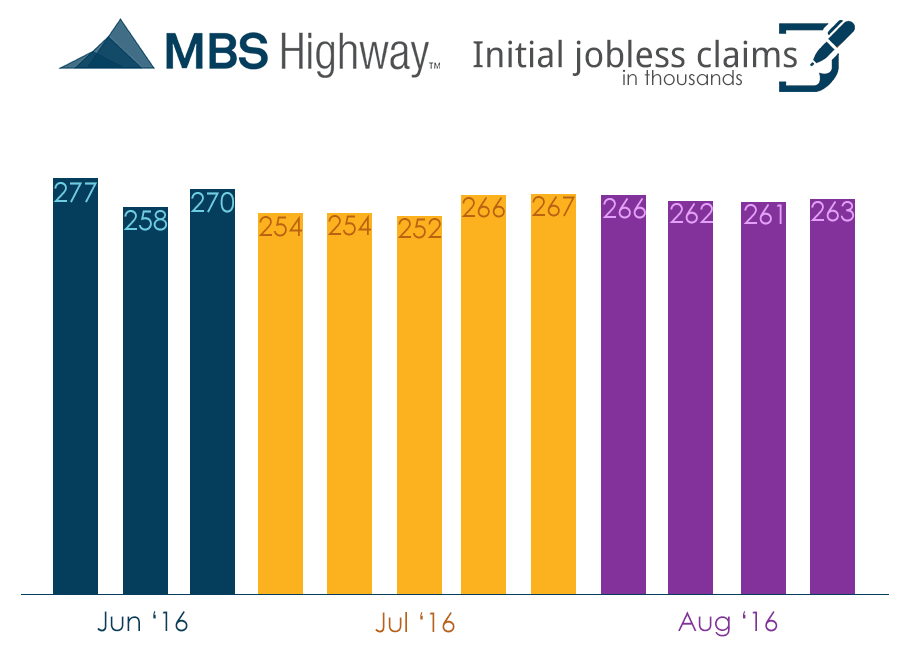

Weekly Initial Jobless Claims were reported on Thursday at 263,000 claims. This report measures the number of people filing for unemployment benefits for the first time. This is still a solid number and was below expectations of 265,000 claims. The story for the labor market is the same, companies are holding on to good employees and are firing less.

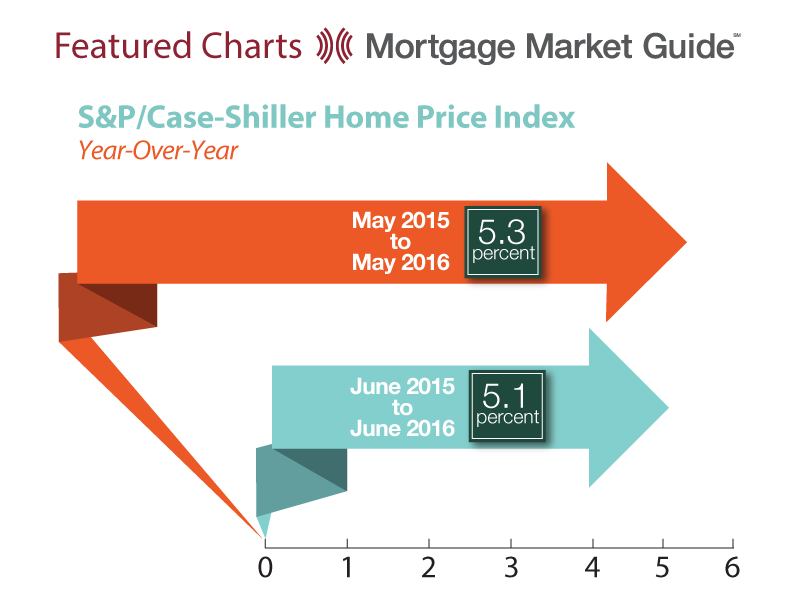

In Housing News, the Case-Shiller Home Price Index for June 2016 was released and showed a year over year increase in home prices by 5.1% from June 2015. The housing market remains steady and still a good investment for home buyers.

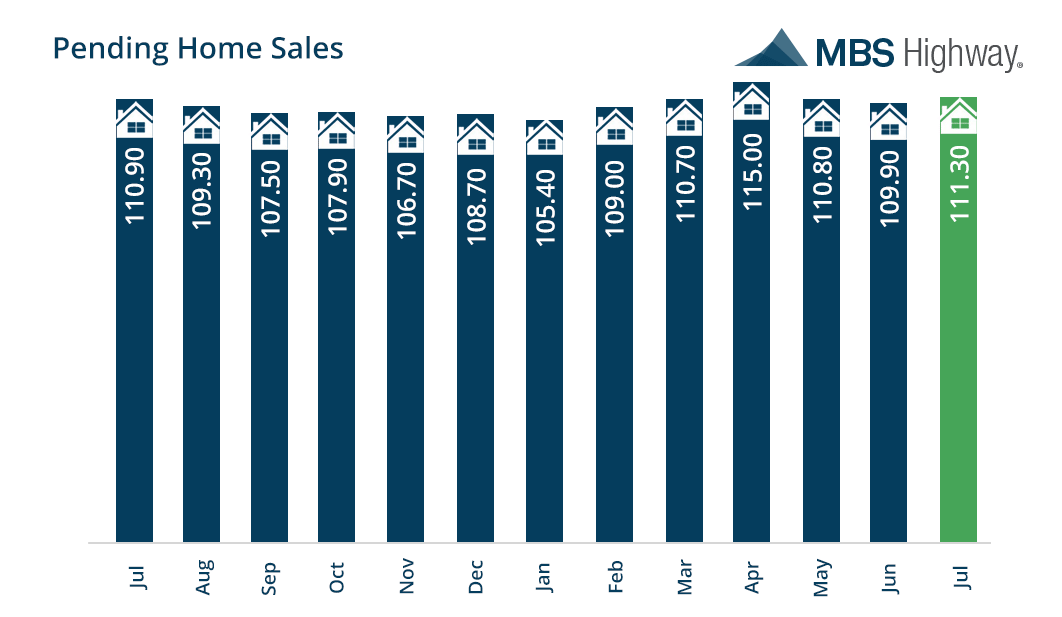

Pending Home Sales for July 2016 were released on Wednesday and showed a solid 1.3% increase from June to 111.30 Million units on annualized basis. Pending Home Sales measure the number of new contracts signed to purchase existing homes. This was the second highest reading for pending home sales in the past 12 months and is very good looking forward indicator of a good housing market for home sales in August and September.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday September 17, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Mortgage Interest Rates remain near all time record low rates, so it is the perfect time to purchase or refinance a home before rates move higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you.

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate