Mortgage Rates Weekly Update [June 11 2018]

Mortgage Rates Weekly Update for June 11, 2018

Mortgage Rates Update for June 11, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates have moved up from the lows of 2018 as geopolitical and trade war uncertainty have eased as well as the release of some solid economic data. If you look at the mortgage bond chart below you can see mortgage bonds have been trending lower since hitting the high of 2018 at near the end of May. Mortgage bonds closed just at the 25 moving average and the technical signals are not good for mortgage bonds so we recommend LOCKING your mortgage rate.

In Economic News

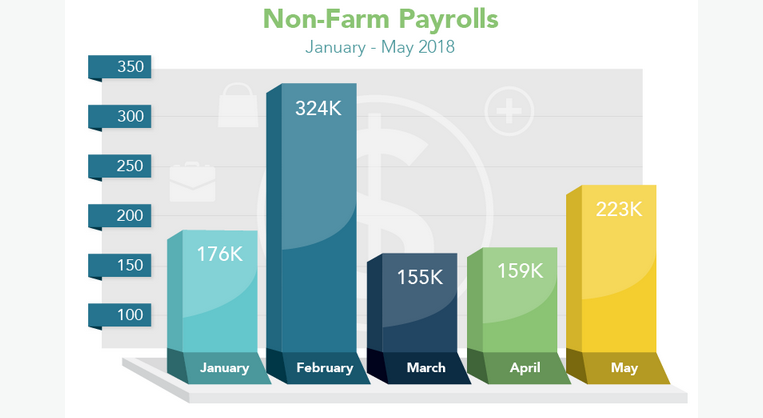

The Jobs Report for May 2018 showed 223,000 jobs were created which is a strong number and above expectations of 190,000 jobs. The averaged number jobs created over the last 3 months was 179,000. The Unemployment Rate for May 2018 fell to 3.8% which is the lowest since April of 2000. May 2018 Average Hourly Earnings increased by 0.3%. The total unemployment rate of U6 fell to 7.6% in May which was the lowest in 17 years.

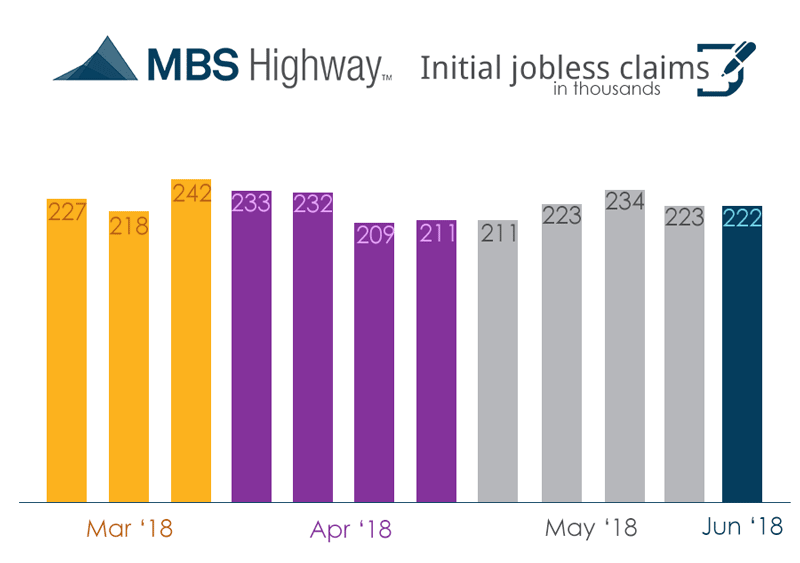

Weekly Initial Jobless Claims were released on Thursday and showed 222,000 claims which was down 1,000 claims from the previous week. Initial claims measures the number of first time filers for unemployment benefits and the low numbers shows that the labor market is still doing very well and businesses are holding onto their employees.

In Housing News

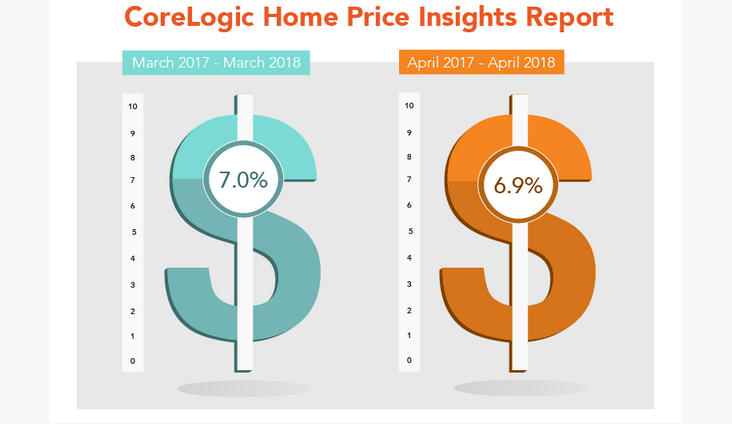

Corelogic Home Price Index for April 2018 showed home prices were up 6.9% from April 2017 and were up 1.8% from March 2018. Limited inventory of homes for sale continue to push home prices higher. CoreLogic is predicting home prices to increase 5.3% from April 2018 to April 2019 and sees a slight improvement in inventory levels.

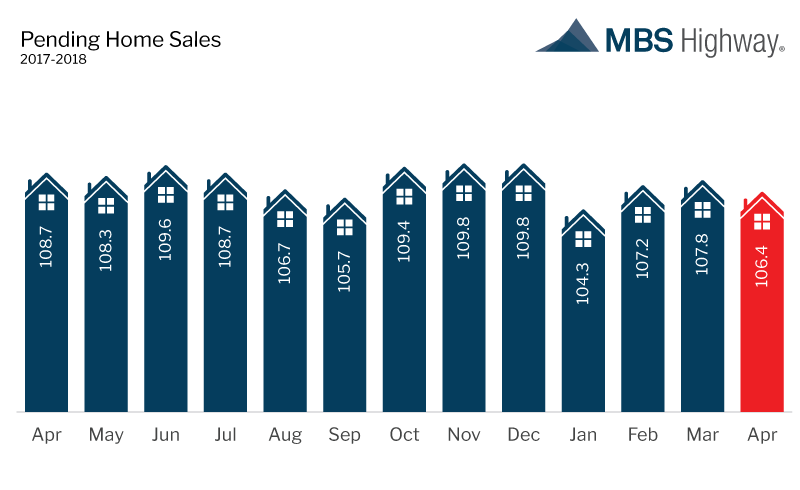

Pending Home Sales for April 2018 were down 1.3% on the index to 106.4 from 107.8 in March. Limited inventory levels continues to affect pending home sales. There are home buyers looking to purchase but are being held back by not enough homes for sale to support the demand. Pending home sales are down 2.3% from April of 2017.

Department of Veteran Affairs is cracking down on predatory mortgage lenders targeting veterans applying for VA Loans. Lenders will no longer to be able to solicit a Veteran for a refinance after obtaining a VA loan until 7 months have passed and 6 payments have been made effective June 1, 2018. The point of the new VA Loan guidelines is to protect veterans from lenders trying to “churn” VA loans and increase costs to veterans.

Department of Veteran Affairs is cracking down on predatory mortgage lenders targeting veterans applying for VA Loans. Lenders will no longer to be able to solicit a Veteran for a refinance after obtaining a VA loan until 7 months have passed and 6 payments have been made effective June 1, 2018. The point of the new VA Loan guidelines is to protect veterans from lenders trying to “churn” VA loans and increase costs to veterans.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Saturday June 16, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday June 27, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates