New Castle County Property Taxes Increase July 1 2018

New Castle County Property Taxes Increase July 1, 2018

New Castle County Property Taxes are increasing July 1, 2018 after County Council passed a budget amendment to raise the county property taxes 15% to balance the budget. There was a budget standoff in the county council over what to cut or raise in order to balance the budget. In a 7-5 vote County Council passed a 15 percent property tax increase to end the budget standoff. The budget shortfall was balanced on the backs on homeowners and home buyers by increasing the property tax as well as an increase to the Sewer Bill last month by 12 percent. The passage of the bill funds County Executive Matt Meyer’s $325 Million operating and construction budget for the up coming fiscal year.

How Much are New Castle County Property Taxes Going Up?

New Castle County Property taxes were raised 15% with the passage of the revenue proposal. Effective July 1, 2018 there is an increase of 15% with a 7.5% credit back on the bill so effectively will only increase 7.5% the first year. The following year on July 1, 2019 the full 15% is in effect as the 7.5% credit will be removed. The county gave an example for average taxpayer that does not live inside of a municipality as paying about $476 on average a year for the county portion of the property taxes. Effective July 1, 2018 their tax bill will increase by 15% which is $71.40. They will only pay $35.70 more the first year as county will be giving back a $35.70 credit. The second year the average tax payer would pay the full $71.40 increase.

The 12% increase on the county sewer fees for homeowners will cost the average new castle county homeowners about $36 more per year based on a current average sewer bill of $263. So the total yearly increase to a average New Castle County homeowner or home buyer is $107.40.

What were the justifications for New Castle County Property Taxes increasing?

New Castle County justified the increase to the property taxes based on the following:

- The county said that increasing the property taxes and sewer fees would allow the county to have a balanced budget without touching the county’s current reserves to make up a $21 million shortfall in the proposed budget.

- No cuts to current county jobs for all counties employees including police and emergency service personnel.

- No cuts to services for parks and libraries or other community services.

- Even with the increased property taxes, New Castle County still remains very competitive with neighboring states such as Pennsylvania.

The last point could be contended in that to get the same level of education as the Pennsylvania counties, you would have to pay for private school in Delaware so the money would be offset if not higher for the private school education versus the public school education on Pennsylvania.

What will the effect be for homeowners and home buyers moving forward?

The increase in property taxes and sewer fees will make cost of owning a home and buying a home more as the increase will increase closing costs and yearly out of pocket money to own a home. The yearly average increase would be about $107.40 and this comes after the big school districts increasing their property taxes last year and on the heels of the State of Delaware raising their transfer tax to 4% which is the highest in the nation. Mortgage interest rates are increasing and the price of homes are increasing across the board as Delaware deals with the lowest inventory of homes for sale since it has been tracked. All of these factors are affect affordable housing in Delaware and make it less affordable.

Homeowners that escrow for property taxes should expect to see a bill from their mortgage lenders at the end of 2018 for an escrow shortage. The lenders will have to pay the increased property tax bill that comes out July 1, 2018 and will collect the shortage from homeowners at the end of the year and in turn raise the current mortgage payment for the following year to account for the increased property taxes. This same scenario will repeat itself in 2019 as the second half of the property tax increase takes affect.

For home buyers in Delaware, you could potentially off set some of the increase by applying for the First Time Home Buyer Tax Credit program through the state of Delaware which allows for a Federal Tax Credit of up to $2,000 per year every year that you have the mortgage. The official name of the program is Mortgage Credit Certificate Program. Primary Residential Mortgage is one of the preferred providers of the tax credit program. You can call 302-703-0727 for more information or APPLY ONLINE.

If you are looking for information on first time home buyer programs in Delaware you can visit this website: Delaware First Time Home Buyers

How do you calculate your own new castle county property tax increase for the upcoming year?

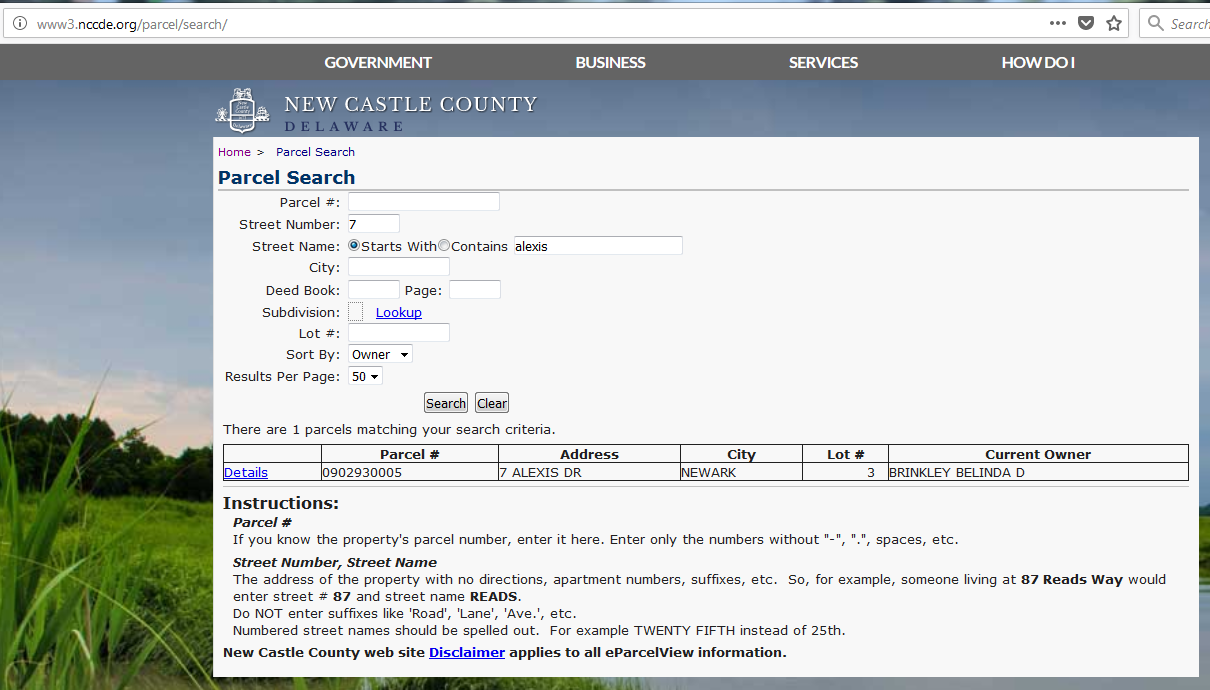

You can calculate what your own increase would be July 1, 2018 by going to the New Castle County Parcel Search website and looking up your property:

Below is screen shot of New Castle County Parcel Search:

Step 1: Put in your street number and street name and hit “search”

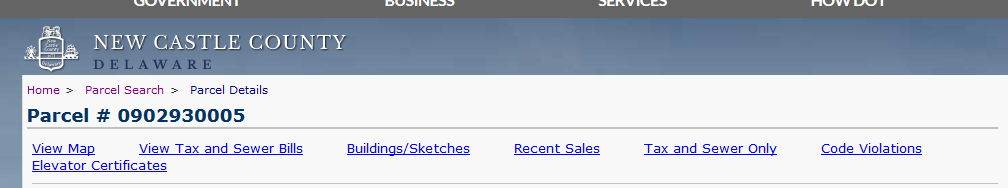

Sep 2: Click on your property that should come up and then hit the “View Tax and Sewer Bills” tab at the top seen below:

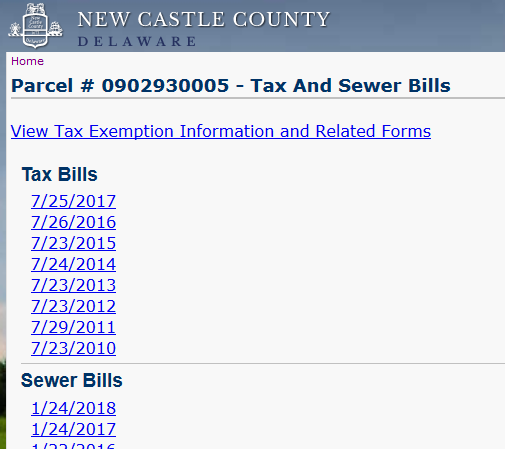

Step 3: Click on the 7/25/2017 link under Tax Bills

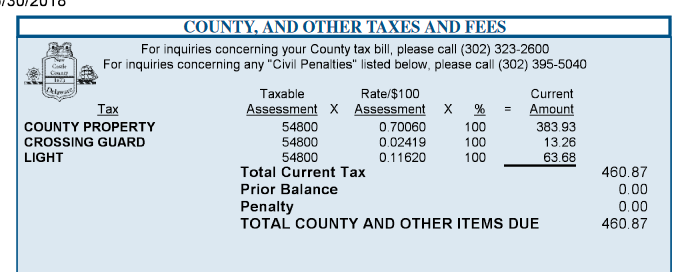

Step 4: Look at the top of the tax bill for County, and other taxes and fees seen below. Take the first line for “County Property” tax and multiple it by 0.15%. This will be your total tax increase. Cut it in half for the amount going up in 2018 and then the full amount will be in 2019.

How Do You Get Started on Purchasing or Refinancing a home in New Castle County?

If you have questions about purchasing a home or refinancing your home, please feel free to call us at 302-703-0727 or you can APPLY ONLINE to get started today.

John R. Thomas NMLS 38783

Primary Residential Mortgage, Inc.

248 E Chestnut Hill Rd

Newark, DE 19713

302-703-0727 Office