Mortgage Rates Weekly Update [October 9 2017]

Mortgage Rates Weekly Update for October 9, 2017

Mortgage Rates Update for October 9, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates increased this week after the Jobs Report for September was released on Friday. If you look at the mortgage bond chart below you can mortgage bonds had been trading above the line of support that had held for the last 2 weeks but bonds broke through support on Friday. Mortgage bonds fell to the next level of support and were able to rally back higher end the day just below the previous level of support. We are recommending starting the week FLOATING your mortgage rate as the damage has already been done and we are looking to see if mortgage bonds can rally back now that the jobs report is behind us.

In Economic News

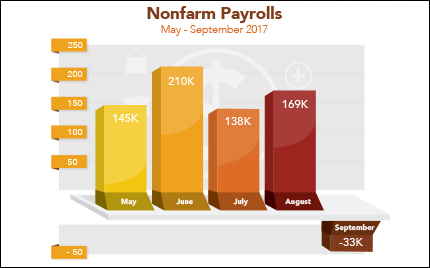

The September 2017 Jobs Report was released on Friday and showed that 33,000 jobs were lost versus expectations of 75,000 jobs being created. This was the first negative reading on job growth in 7 years. There were also revisions to the previous two months job reports: July was revised lower by 51,000 jobs to 138,000 jobs and August was revised higher by 13,000 jobs to 169,000 jobs.

The big news in the report was Wage Growth with hourly earnings moving up 0.5% above the expected 0.2% and bringing the yearly total to 2.9% which was the highest in 8 years. Wage growth is the same was wage pressure inflation which is bad for mortgage bonds and that is why we saw mortgage bonds sell off at the end of the week moving mortgage interest rates higher.

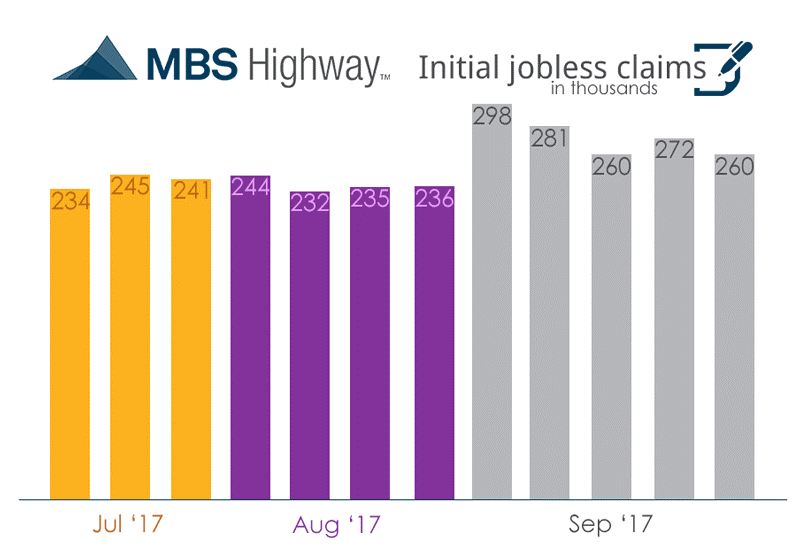

Weekly Initial Jobless Reports were released on Thursday and dropped 12,000 claims to 260,000 claims. This number is still being skewed higher from the hurricanes that hit Florida and Texas. It will take a couple of months before jobless claims normalize.

In Housing News

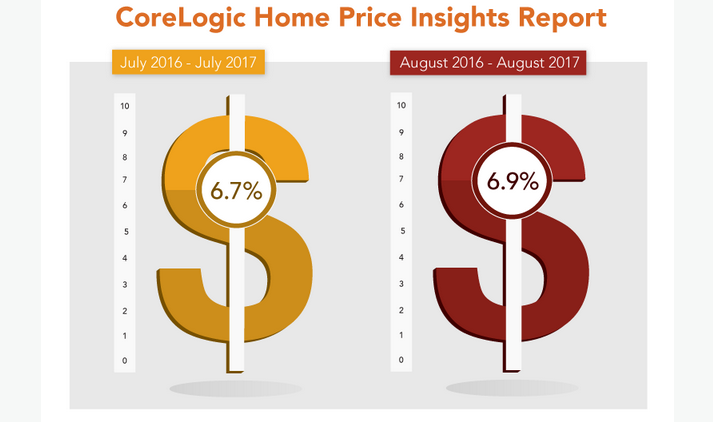

The CoreLogic Home Price Index for August 2017 showed home prices were up 6.9% from August 2016 and were up 0.9% from July 2017 as limited inventory of homes continues to put upward price pressure on homes for sale. CoreLogic is predicting home prices to rise 4.7 percent from August 2017 to August 2018.

New Down Payment Assistance Program

PRMI Dream Maker Down Payment Program provides 100% financing for borrowers using a FHA loan by providing a second mortgage loan for the required 3.5% down payment on FHA loans. There are no income restrictions and borrowers only need a 620 minimum FICO credit score. You can apply for the Dream Maker Program by calling 302-703-0727 or APPLY ONLINE

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 21, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage