Mortgage Rates Weekly Update for October 16 2017

Mortgage Rates Weekly Update for October 16, 2017

Mortgage Rates Update for October 16, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

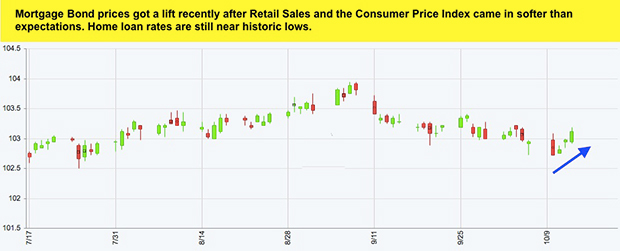

Mortgage Rates were able to rebound last week and end the week lower than they started as mortgage bonds rebounded after weaker than expectations of Retail Sales & Consumer Price Index. If you look at the mortgage bond chart below you can see mortgage bonds were able to rally off support and moved higher to break above the previous ceiling of resistance. Mortgage bonds closed just below 25 day moving average and US Treasuries broke below 200 day moving averages and technicals favor the bonds continuing to rally so we are recommending FLOATING Your mortgage rate to start the week.

In Economic News

Consumer Price Index for September 2017 jumped 0.5% from August as reported by the Bureau of Labor Statistics but was less than expectations. The Core CPI which strips out food and energy only was up 0.1% and was only up 1.7% year over year which is below the Feds target of 2.0%. Low inflation is good news for mortgage bonds and low interest rates.

Wholesale inflation was as measured by the Producer Price Index (PPI) was up 0.4% in September 2017 as the price of gasoline jumping after the hurricanes. Wholesale inflation doesn’t always translate directly to the consumer as measured by the CPI but in this case the price of gasoline spiking up has affected both the CPI and the PPI.

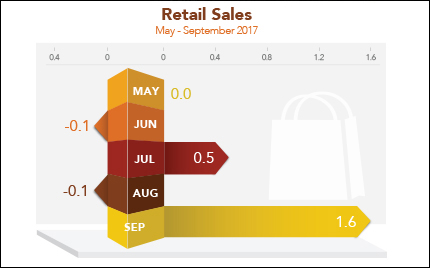

Retail Sales for September 2017 were up 1.6% from August and up 4.4% from September 2016. Retail Sales is a measure of consumer spending which makes up two thirds of our economy so that is good news.

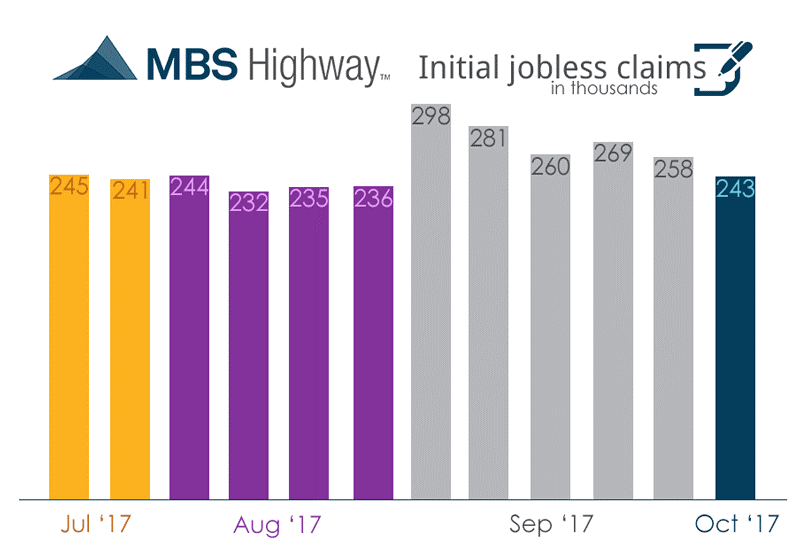

Weekly Initial Jobless Reports were released on Thursday and claims dropped 15,000 claims to 243,000 jobless claims for the week. This was a nice snap back since the hurricanes moved jobless claims considerably higher of the last several weeks. This shows things are starting to return to normal post hurricanes in Florida and Texas.

In Housing News

New Loan Program to help home buyers and home owners:

PRMI FHA Loans down to 500 FICO Score. Primary Residential Mortgage, Inc. will lend to borrowers with credit scores down to 500 on its FHA loan product as long as the borrower receives an approved Eligible response from the automated underwriting system, the debt to income ratio is not over 45% and the credit profile meets FHA guidelines. If you or a client have been turned down for a loan because of your credit score, give us a call at 302-703-0727 or APPLY ONLINE

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 21, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE