Mortgage Rates Weekly Update [November 12 2018]

Mortgage Rates Weekly Update for November 12, 2018

Mortgage Rates Update for November 12, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

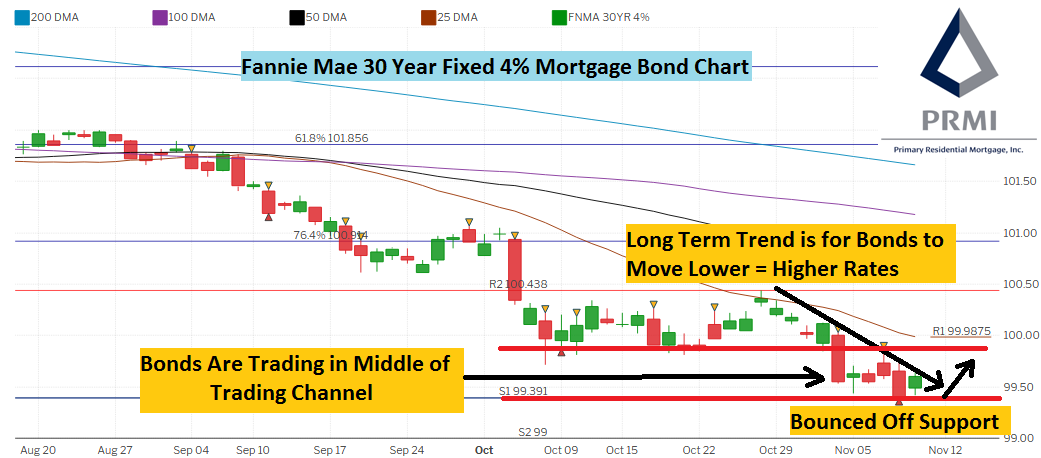

Mortgage Rates have been moving higher since end of August and had big sell off after Jobs Report for October 2018 and have followed through on that sell off until finding support on Thursday. If you look at the Fannie Mae 4% Mortgage Bond Chart below you can see mortgage bonds have sold until until Thursday when Red Candle stopped right at support at 99.391. Mortgage bonds were able to rally higher off this support on Friday as you can see with the green candle. Mortgage ended the week about where they started and are in the middle of a wide trading channel. Mortgage bonds have been following the lead of the 10 year US Treasury so we predict it will continue to do so this week absent any unexpected economic news. The 10 Year stopped right at support at 3.19% yield and if it can break below this, mortgage bonds could continue to move higher and move mortgage interest rates lower so we are recommending carefully FLOATING Your mortgage rate to start the week but we have to watch the 10 year, if it doesn’t break lower and moves back up toward the 3.25% level, we would quickly switch to a locking stance.

In Economic News

The Results of the 2018 Election are in and the Democrats have taken control of the House and the Republicans have kept control of the Senate. No matter what side you land on, the market has viewed this result as a good thing as the DOW was up 200 points on Wednesday.

The Producer Price Index for October 2018 was released on Friday and showed wholesale inflation increased from 2.6% to 2.9% year over year. We will get a read on Consumer inflation with the Consumer Price Index released this week. The CPI will show us if any of the wholesale inflation is being passed onto consumers.

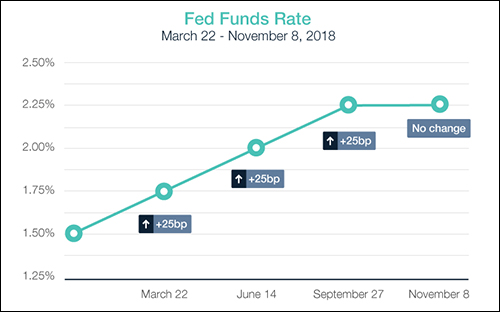

The Federal Open Market Committee released their statement on Thursday that they were not raising the Fed Funds Rate in November but the language in their press release leads most people to believe that they will raise the Fed Funds Rate again in December 0.25%.

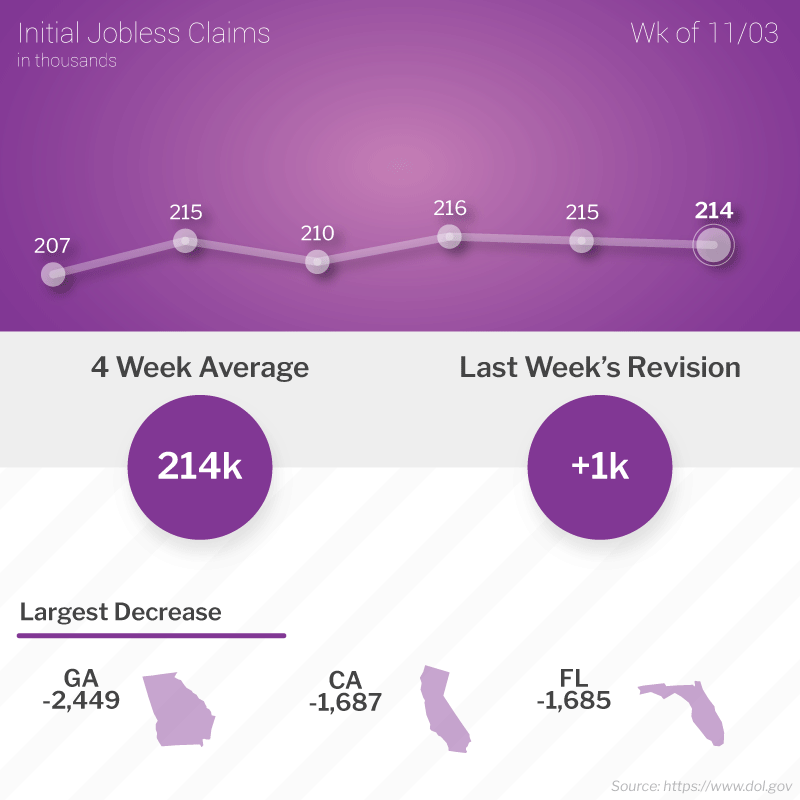

Weekly Initial Jobless Claims were released on Thursday and claims dropped 1,000 claims to 214,000 claims for the week from a revised 215,000 claims the previous week. Jobless claims remained stable as the employers continue to hold onto good employees.

In Housing News

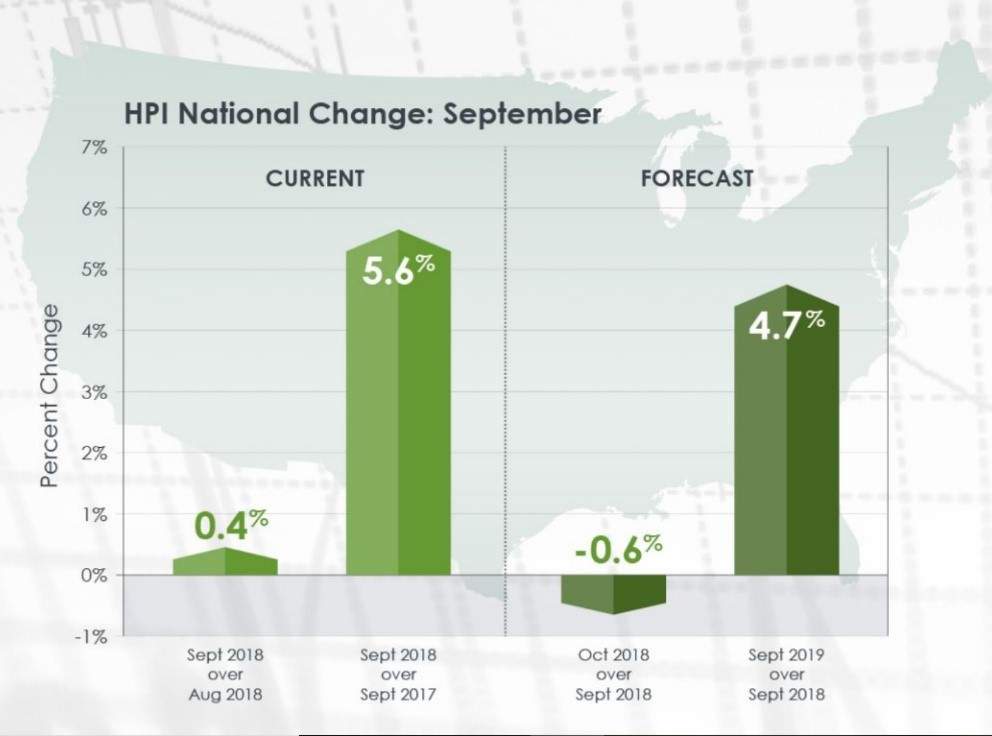

CoreLogic Home Price Index for September 2018 was released and showed that home prices were up 0.4% from August 2018 and were up 5.6% from September 2017. This was an increase from August’s 5.5% year over year appreciation and 0.4% increase from August 2018 is very good. The forecast for next year is a 4.7% year over year increase which is very solid and will create a lot of wealth for homeowners. If your home is worth $250,000 today and it appreciates 4.7% next year, you will have gained $11,750 in equity increase.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday November 17, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday November 26, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday November 17, 2018 in Edgewood, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam