Mortgage Rates Weekly Update [November 19 2018]

Mortgage Rates Weekly Update for November 19, 2018

Mortgage Rates Update for November 19, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

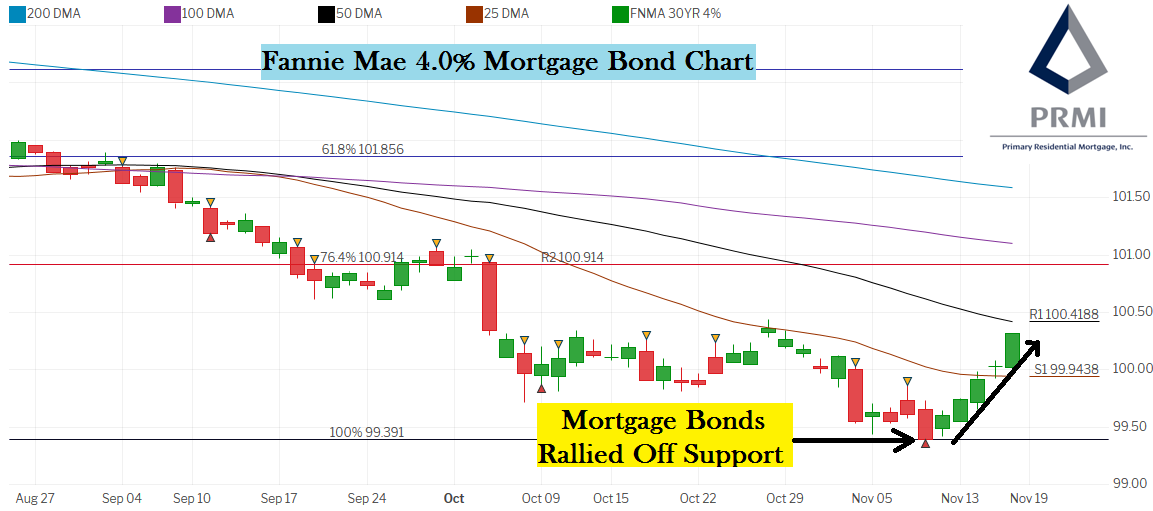

Mortgage Rates have hit a 7 year high on the week of November 8th but have since been able to move lower as mortgage bonds have rallied. If you look at the mortgage bond chart below you can see mortgage bond were able to rally off support the previous Friday with the green candle. Mortgage bonds have followed through all week closing up everyday but Thursday and ending the week with a green candle in the face of a stock market that traded higher on Friday as well. Mortgage bonds have broken through a ceiling of resistance and are just below the 50 day moving average. If they can break above the 50 day moving average we could see mortgage rates move lower. Because of all this, we are recommending FLOATING your mortgage rate to start the week to see if mortgage bonds can continue to rally higher.

What is the Long Term Outlook for Mortgage Rates?

The longer term outlook for rates could be switching as the dollar gets stronger against other currencies. There are distinct effects with the rising price of the dollar:

- A strong US Dollar tamps down inflation as it lowers commodity prices like oil. Have you noticed the recent price decline of gas at the pump?

- It Makes US imports cheaper. This along with lower oil keeps inflation down, which is good for long-term rates like mortgage rates

- If the US dollar strengthens further, the Fed may not raise rates as expected in 2019 because more hikes would further suppress inflation, which is already tame, again this is good for mortgage rates.

In Economic News

The stock market has started to become fearful of the potential for a recession. The beginning of October saw a sell off in the stock market that didn’t stop till about October 30th. Stocks rebounded from the lows and looked to start a recovery rally but then switched and started selling off at the beginning of this week. Stocks were able to stabilize on Thursday and post some gains on Friday. Recessions happen when the Unemployment rate is low, every time the Unemployment rate has dipped below 4.5% a recession has followed about 3 years later. Currently the Unemployment rate dipped below 4.5% about a year ago and if history repeats itself, we will see a recession around the summer of 2020.

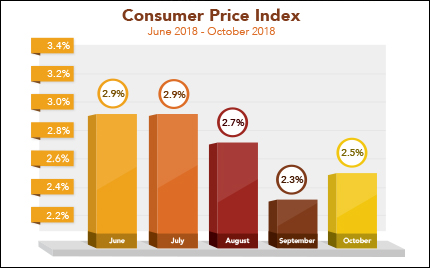

The Consumer Price Index (CPI) for October 2018 increased by 0.3% from September to October and the year over year rose from 2.3% to 2.5%. The CPI measures inflation at the consumer level. The Core CPI strips out food and energy prices and it only rose by 0.2% and year over year actually fell 0.1% from 2.2% to 2.1%. The CPI also includes a measure of rents and it showed rents were up 0.2% from the previous month and year over year are at 3.6%.

Weekly Initial Jobless Claims were released on Thursday and claims increased 2,000 claims to 216,000 claims for the week. Jobless claims remained stable as the employers continue to hold onto good employees. Jobless claims continue to remain near multi-decade lows.

In Housing News

CoreLogic Loan Performance Insights for August 2018 was released and showed that loans 30 days or more past due decreased from 4.1% to 4.0%. Seriously delinquent loans which are 90 days or more past due decreased from 1.6% to 1.5%. Homes in Foreclosure remained stable at only 0.5% of all mortgage loans. The housing market continues to remain healthy as delinquencies drop and homes are still appreciating.

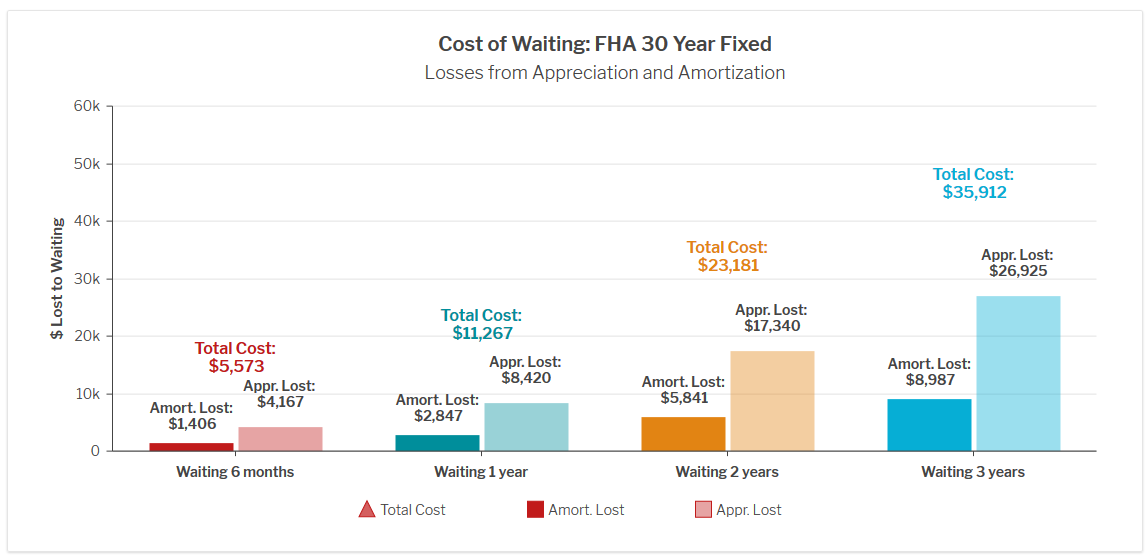

Should You Buy Now or Wait?

If you wait to purchase a home, you will pay something called the cost of waiting. Below is an example of someone that could buy a $200,000 house right now with 3.5% down payment on a FHA loan with a 5.0% Mortgage Rate (5.577% APR) and compares how much it will cost if you wait 6 months, 1 year, 2 years, and even 3 years. You will have a cost in increased monthly payment because of rising mortgage interest rates (Amortization Loss) and you will also pay more for the home because home prices are moving up each month (Appreciation Loss) in Delaware. 6 months = $5,573, 1 year = $11,267, 2 years = $23,181 and 3 years = $35,912

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday December 15, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday November 28, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday November 17, 2018 in Edgewood, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam