Mortgage Rates Weekly Update [April 2 2018]

Mortgage Rates Weekly Update for April 2, 2018

Mortgage Rates Update for April 2, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates finally moved lower last week as mortgage bonds were able to break above the 25 moving average. If you look at the mortgage bond chart below you can see mortgage bonds are now moving higher in the short term after breaking above the 25 moving average last Tuesday and followed through on Wednesday and Thursday. We are recommending FLOATING your mortgage rate to start the week to see if mortgage bonds can continue to rally now that we have broken above the 25 day moving average which had been a tough ceiling of resistance since the beginning of January.

In Economic News

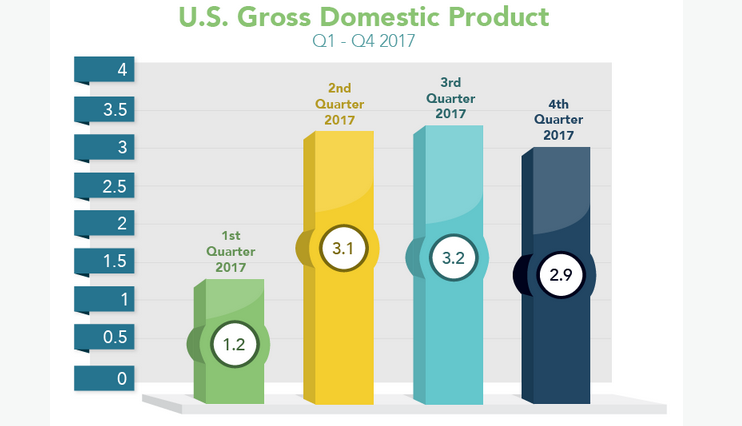

Gross Domestic Product (GDP) for fourth quarter of 2017 came out at 2.9% which is down from the third quarter reading of 3.2%. However, the report showed that consumer spending rose 0.4% in the fourth quarter which is the strongest pace since 2014. Consumer spending is the major driver of the U.S. economy by making up two thirds of the economy so that is very encouraging.

Consumer Inflation remained low in February as measured by the Personal Consumption Expediture (PCE). The Core PCE for February 2018 rose 0.2% from January which was in line with estimates. The year over year reading of the Core PCE came in at 1.6% which is still well below the Federal Reserves target of 2.0%. Low inflation helps mortgage rates.

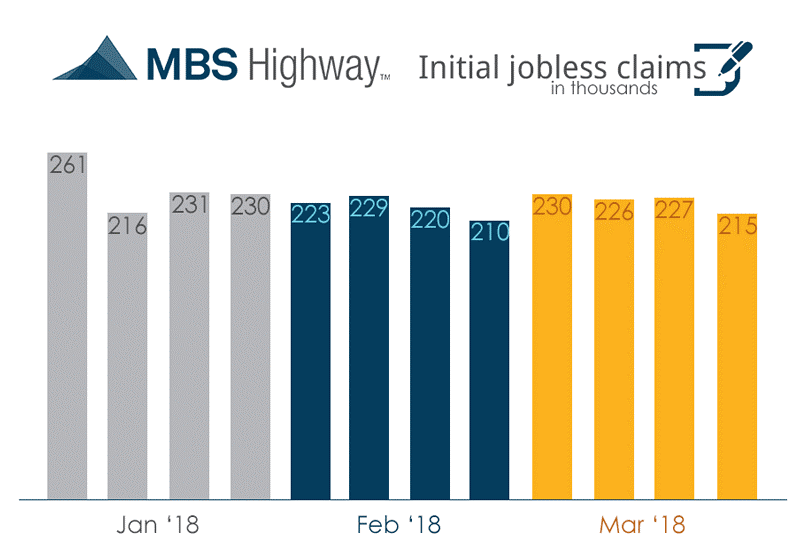

Weekly Initial Jobless Claims dropped 13,000 claims to 215,000 claims for the week. The previous week was revised lower from 230,000 to 227,000 claims and is the week to be used in the Jobs Report for March 2018 which is being released this Friday. This predicts the Jobs Report should be very strong.

In Housing News

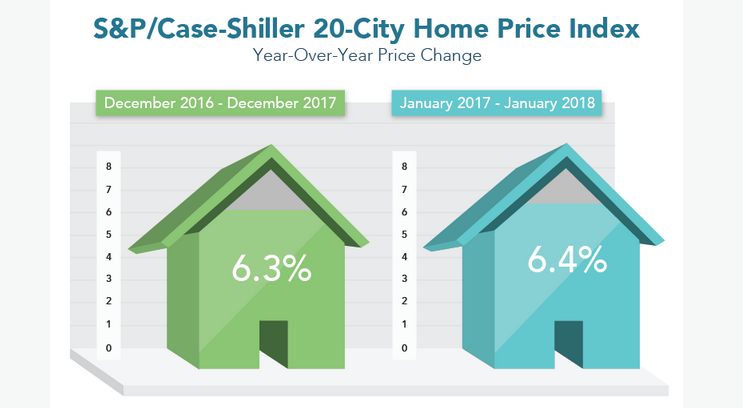

The Case Shiller 20 City Home Price Index showed home prices continued to rise in January 2018. Homes Prices rose 6.4% from January 2017 to January 2018 on the 20 City Index as low inventory continues to push home prices up. Home Prices were up 0.8% from December 2017 to January 2018. Inventory of homes for sale is at all time record low at 3-4 month supply of homes for sale.

National Flood Insurance Program Announces Rate Increases effective April 1, 2018. The average premium for Flood Insurance is increasing by 6.9% which increases the average premium rate for standard flood insurance policies from $994 to $1,062.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Saturday April 7, 2018 in Dover, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday April 18, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday April 21, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates