Mortgage Rates Weekly Update [March 26 2018]

Mortgage Rates Weekly Update for March 26, 2018

Mortgage Rates Update for March 26, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

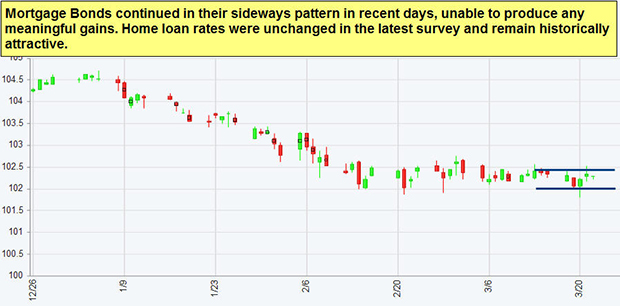

Mortgage Rates failed to move lower after a stock market drop of over 400 points on Friday. If you look at the mortgage bond chart below you can see that mortgage bonds failed to break out of the channel they have been caught in for the past couple of weeks even in the face of a big stock market sell off. Failing to break above the 25 moving average is a bad technical signal for mortgage bonds so we are recommending LOCKING your Mortgage Rate to start the week.

In Economic News

The Federal Reserve raised its Fed Funds Rate last week 0.25% which brings the new target range between 1.5% to 1.75%. The Feds acknowledged that inflation still remains low but they expect it to rise in the short term. The Feds would not answer whether they plan to raise the Fed Funds Rate 3 or 4 times in 2018.

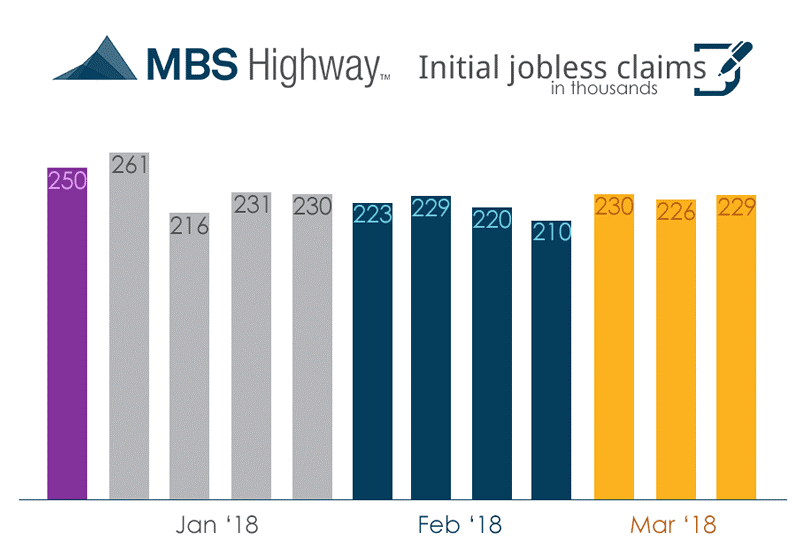

Weekly Initial Jobless Claims moved up 3,000 claims last week to 229,000 claims for the week. This is the “sample week” to be used in the March Jobs Report which points to a very good jobs report and will be released the first Friday in April.

In Housing News

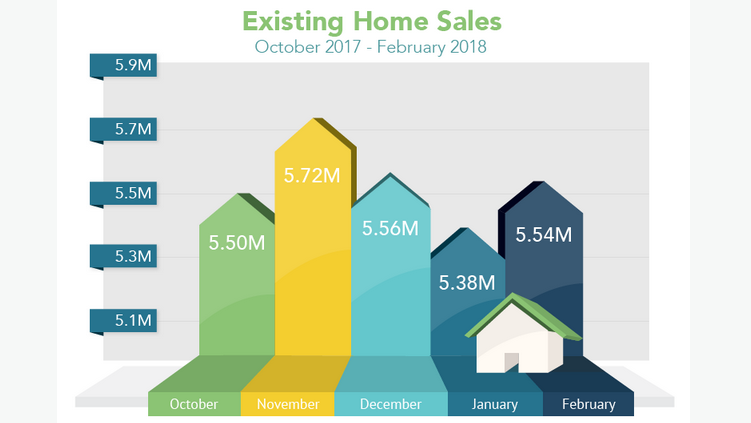

Existing Home Sales for February 2018 moved up 3 percent from January 2018 to an annual rate of 5.54 million units. Sales bounced back after 2 straight months of decline in spite of low inventories and home price growth. Existing home sales were up 1.1 percent from February 2018. The median home price of an existing home moved up to $241,000 an increase of 5.9 percent from February 2017.

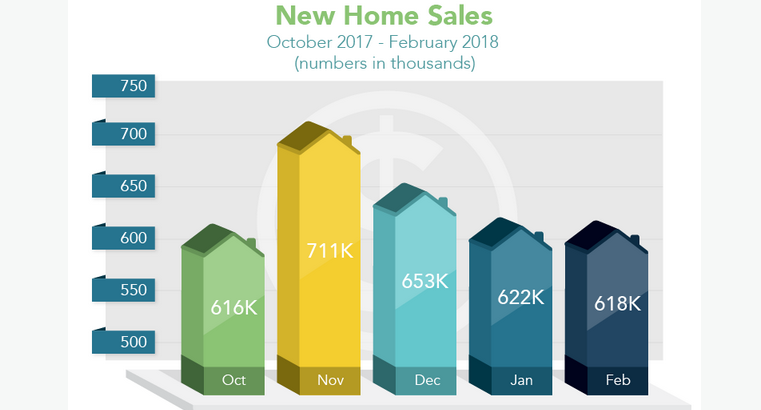

New Homes Sales for February 2018 edged lower by 0.6% to 618,000 units on an annualized basis. This was the third straight month of declines in new home sales; however, new homes were up 0.5% from February 2017 so new home construction is doing well. The median sales price of a new home was 326,800 for February 2018.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Saturday March 24, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday March 28, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday April 7, 2018 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates