Delaware Mortgage Rates Weekly Update for February 17, 2014

Delaware Mortgage Rates weekly mortgage rate update for the Week of February 17, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

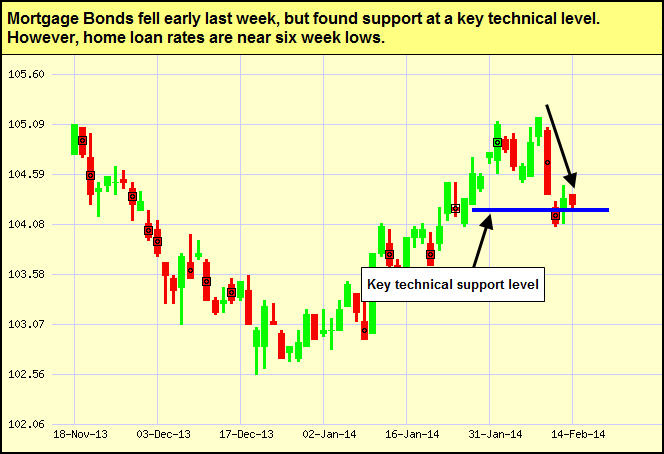

Delaware mortgage rates did end the week higher as the stock market rallied and pulled money out of the bond market. If you look at the mortgage bond chart below you can see that the bond hit a six week high on Monday but sold off on Tuesday as the stock market rallied. The bond was able to hold a key level of support. We are recommending LOCKING your Delaware mortgage rate if you are closing in the next 30 days as the short term risk for rates to continue to rise is very high but if you are closing in 45 days or longer than you can FLOAT your mortgage rate to see if bonds can bounce higher from the key level of support.

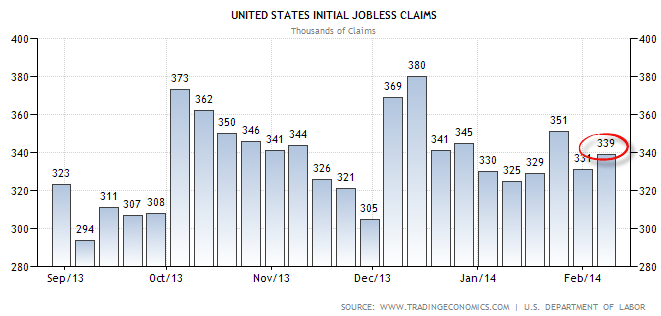

In Economic News, We had several reports show that the economy is still struggling along. The first report was the Initial Weekly Jobless Claims jumped higher by 8,000 claims on Thursday to 339,000 claims. Jobless claims increasing coupled with two months of poor Jobs Reports shows the labor market is continuing to muddle along.

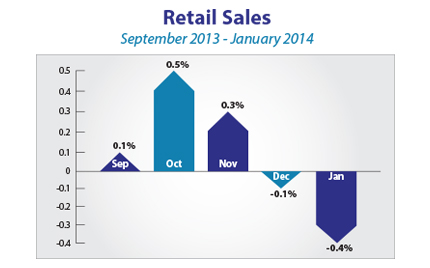

We saw the Retail Sales Report for January 2014 showed retails sales dropped by 0.4% versus the 0% expected. This is the second month of dropping Retail Sales. The harsh Winter weather is probably to blame for the drop in Retail spending by consumers.

We saw the Retail Sales Report for January 2014 showed retails sales dropped by 0.4% versus the 0% expected. This is the second month of dropping Retail Sales. The harsh Winter weather is probably to blame for the drop in Retail spending by consumers.

In Housing News, RealtyTrac reported that foreclosure filings declined by 18% from January 2013 to January 2014 which was the 40th straight month of year over year decline for foreclosure filings.

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, March 22, 2014, in Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, February 22, 2014, in Towson, Maryland or Maryland First Time Home Buyer Seminar Saturday, March 22, 2014, in Rockville, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713