Does a 50-Year Mortgage Make Sense for VA Buyers? Break-Even Analysis

A Veteran using a VA loan with 100% financing can typically reach break-even in about 2–3 years,

even when the VA funding fee is financed into the loan. Using a $400,000 purchase price and a 4% annual appreciation rate, equity is built mostly through home price appreciation rather than early principal pay-down. Veterans who are exempt from the funding fee break even even faster, while subsequent-use Veterans with a 3.3% funding fee break even slightly later. VA loans require eligibility, a Certificate of Eligibility (COE), and meeting VA underwriting standards. If you are Veteran or active duty service member and want to get started today on a VA Home Loan, give VA Loan Officer John Thomas a call at 302-703-0727 or APPLY ONLINE.

Does a 50-Year Mortgage Make Sense for a Veteran Using a VA Loan?

The idea of a VA 50-year mortgage is getting national attention right now, especially as policymakers look for ways to address the housing affordability crisis. While a true 50-year mortgage is not available today,

Veterans are understandably asking how a longer-term mortgage would affect their equity – especially when they are using a 100% VA loan.

In this article, we walk through real numbers to answer one key question:

“If I borrow 100% with a VA loan and finance the funding fee, how long until I can sell without being underwater?”

We will compare three common VA situations on a $400,000 purchase:

- Veteran with a 2.15% VA funding fee (first-time use)

- Veteran exempt from the funding fee (0%)

- Veteran with a 3.3% VA funding fee (subsequent use)

For each, we compare a 30-year VA loan, a conceptual 40-year fully amortizing loan,

and a 50-year fully amortizing loan (for illustration only).

For a deeper explanation of the 50-year mortgage discussion, see our full guide:

50-Year Mortgage Explained

For a complete overview of VA home loans for Veterans, visit:

VA Loans for Veterans

Quick Overview of VA Loan Requirements

A VA loan is one of the best mortgage options available to eligible Veterans, active duty service members, and some surviving spouses.

At a high level, you need:

- Eligible service history (Veteran, active duty, Guard, or Reserve)

- A valid Certificate of Eligibility (COE)

- A home that will be your primary residence

- Acceptable credit and stable income

- Approval under VA and lender underwriting standards

One of the biggest benefits is that VA loans usually require no down payment.

Most buyers finance 100% of the purchase price, and many also finance a VA funding fee

(unless they are exempt due to service-connected disability).

Shared Assumptions for All Three Veteran Scenarios

- Purchase price: $400,000

- Interest rate: 6.25% fixed

- Annual appreciation: 4%

- Real estate commission: 5% of the sale price

- Break-even definition: Net sale proceeds ? Remaining loan balance

At 4% appreciation, the home value grows like this:

- Year 1: $416,000

- Year 2: $432,640

- Year 3: $449,946

- Year 4: $468,029

- Year 5: $486,661

After subtracting a 5% Realtor commission, estimated net sale proceeds are:

- Year 2 net: $411,008

- Year 3 net: $427,449

- Year 5 net: $462,328

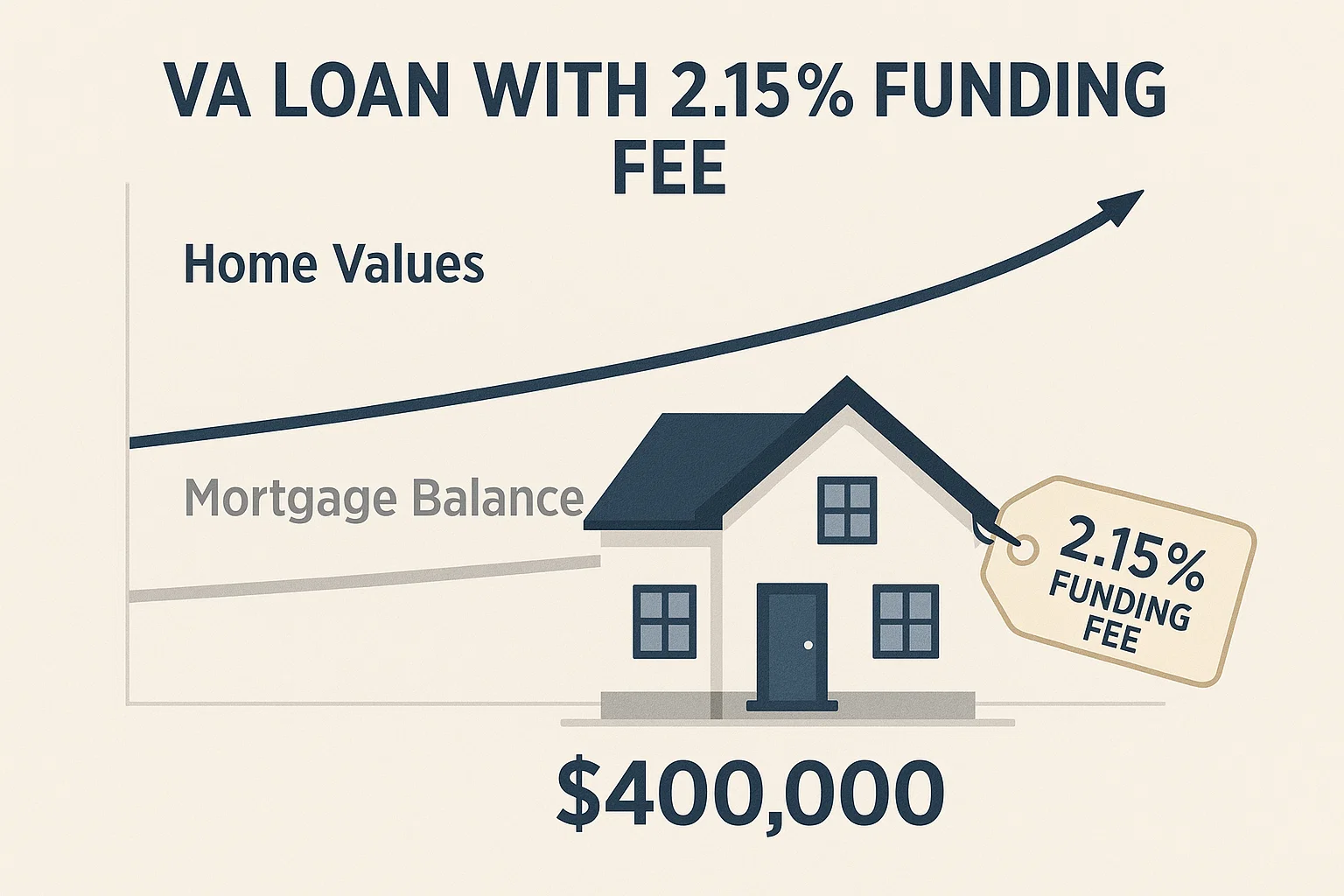

Scenario 1: Veteran With Standard 2.15% VA Funding Fee (First-Time Use)

Starting Loan Amount

- Purchase price: $400,000

- Funding fee (2.15%): $8,600 (financed)

- Beginning loan amount: $408,600

Loan Balances Over Time (6.25% Rate)

| Loan Term | Balance After 2 Years | Balance After 3 Years | Balance After 5 Years |

|---|---|---|---|

| 30-Year VA | $398,716 | $393,292 | $381,376 |

| 40-Year (Standard Amortizing) | $403,714 | $401,033 | $395,142 |

| 50-Year (Concept Only) | $406,085 | $404,706 | $401,674 |

Break-Even Timing

- Year 2 net sale proceeds: $411,008

Compared to the balances above:

- 30-year VA: Veteran typically breaks even in about 2 years.

- 40-year term: Break-even around 2.1–2.2 years.

- 50-year conceptual term: Break-even around 2.2 years.

Even with 100% financing and the funding fee rolled in, the Veteran usually reaches break-even

in roughly 2–3 years at a 4% appreciation rate.

Scenario 2: Veteran Exempt From the VA Funding Fee

Many Veterans with a qualifying service-connected disability are exempt from the VA funding fee.

That means they borrow only the purchase price, with no fee added to the loan.

Starting Loan Amount

- Purchase price: $400,000

- Funding fee: $0 (exempt)

- Beginning loan amount: $400,000

Loan Balances Over Time (6.25% Rate)

| Loan Term | Balance After 2 Years | Balance After 3 Years | Balance After 5 Years |

|---|---|---|---|

| 30-Year VA | $390,593 | $386,218 | $374,210 |

| 40-Year (Standard Amortizing) | $395,500 | $392,944 | $387,122 |

| 50-Year (Concept Only) | $397,816 | $395,545 | $392,440 |

Break-Even Timing

- Year 2 net sale proceeds: $411,008

Compared to these lower balances:

- 30-year VA: Veteran breaks even slightly before year 2.

- 40-year term: Break-even is around 2 years.

- 50-year conceptual term: Break-even just over 2 years.

Being exempt from the funding fee helps the Veteran build equity faster because the starting balance is lower.

Scenario 3: Subsequent-Use Veteran With 3.3% Funding Fee

If a Veteran has used the VA benefit before and does not qualify for a reduced fee,

a higher 3.3% funding fee may apply on a new purchase with no down payment.

Starting Loan Amount

- Purchase price: $400,000

- Funding fee (3.3%): $13,200 (financed)

- Beginning loan amount: $413,200

Loan Balances Over Time (6.25% Rate)

| Loan Term | Balance After 2 Years | Balance After 3 Years | Balance After 5 Years |

|---|---|---|---|

| 30-Year VA | $403,848 | $398,337 | $386,376 |

| 40-Year (Standard Amortizing) | $408,974 | $406,242 | $400,175 |

| 50-Year (Concept Only) | $411,379 | $409,030 | $406,197 |

Break-Even Timing

- Year 2 net sale proceeds: $411,008

With the higher funding fee:

- 30-year VA: Break-even is just after 2 years.

- 40-year term: Break-even around 2.3 years.

- 50-year conceptual term: Break-even around 2.4 years.

The higher funding fee pushes the starting balance up, but normal appreciation still allows a Veteran to

get out in roughly 2–3 years without being underwater.

What All Three Scenarios Have in Common

- Early equity for VA buyers comes mostly from home price appreciation, not rapid principal reduction.

- Across all funding fee levels and terms, the typical break-even point is about 2–3 years.

- Longer amortizations (40- or 50-year concepts) change the payment more than they change the short-term break-even.

This is why I tell Veterans: the real power of your VA benefit is the ability to become a homeowner

with little or no money down and still build equity as the market grows.

For more on how longer-term mortgages might be used as an affordability tool in the future,

read our article:

50-Year Mortgage Explained

Important Clarification on VA Loans and Longer Terms

- VA loans today are generally offered as 30-year fixed loans (and sometimes 15-year).

- A 50-year mortgage is not currently available for VA or conventional programs.

- Where 40-year mortgages exist, they are usually Non-QM portfolio loans, not VA loans.

These examples are education only. They show that, with normal appreciation and a reasonable holding period, VA borrowers are usually not “stuck” underwater even with 100% financing and a financed funding fee.

How the John Thomas Team Helps Veterans

My team and I work with Veterans every day to:

- Confirm VA eligibility and obtain your Certificate of Eligibility (COE)

- Estimate your break-even timeline based on your price range and market

- Compare VA versus other loan options if you are buying again

- Walk through funding fee scenarios and total cost options

If you are a Veteran thinking about buying, we can run these same numbers for your exact situation so you know where your break-even point really is. Give VA Loan Officer John Thomas a call at 302-703-0727 or APPLY ONLINE.

Start your VA loan review or pre-approval today scheduling an appointment:

https://schedule.johnthomasteam.com/30min