Mortgage Rates weekly market update for the Week of June 8, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

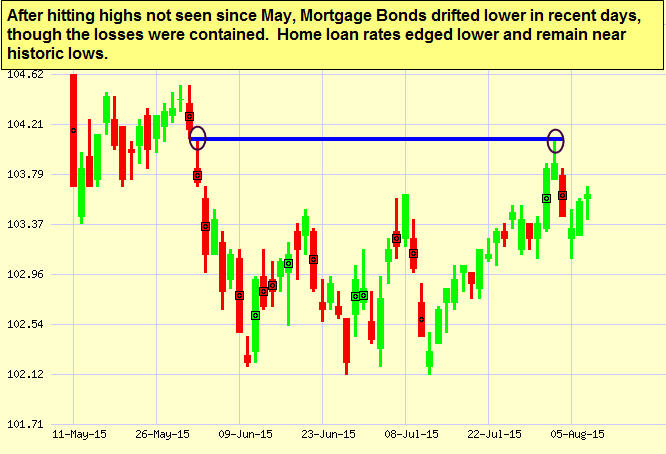

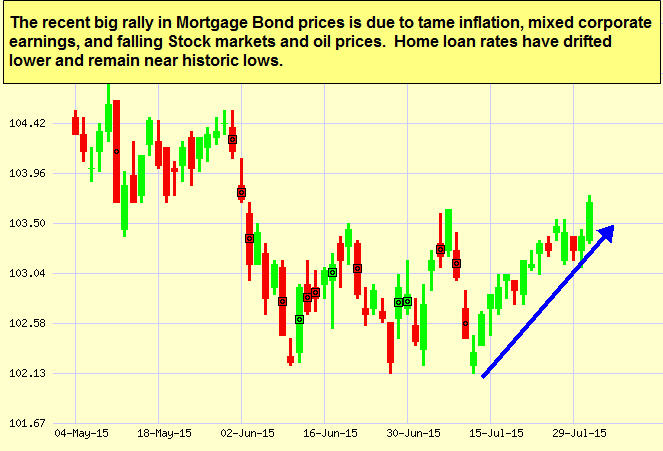

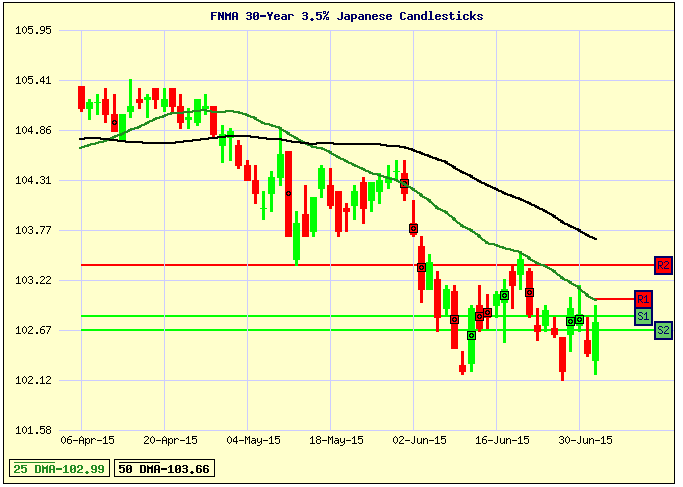

Mortgage Rates Moved Higher last week as the bond market reversed the trend from the previous week and sold off. If you look at the mortgage bond chart below, you can see the trend is now for mortgage bonds to sell off and move lower which will move mortgage interest rates higher. The big red candle down on Friday was after the better than expected jobs report was released. The bond closed below key technical levels which if the bond doesn’t recover this week could foretell higher interest rates in the near future. We are recommending LOCKING Your mortgage rate to start the week as the short term trend is for rates to move higher.

Mortgage Rates now face severe headwinds for the rest of 2015 as mortgage bonds have broken beneath a 2-year trend line and the 200-day moving average. This will cause extreme volatility and we can see big price swings in the bond market with still plenty of downside. This means the trend is now for higher mortgage rates unless the bond can close above this line.

In Economic News, The May 2015 Jobs Report was released on Friday by the Labor Department reported that 280,000 jobs were added in May which was well above the 225,000 expected. The Unemployment Rate ticked up from 5.4% to 5.5% as more Americans started looking for work again.

The Weekly Initial Jobless Claims were released on Thursday and dropped by 8,000 claims from the previous week to 276,000 claims.

In Housing News, CoreLogic reported that home prices for April 2015 were up 6.8% from April 2014 on their Home Price Index Report. This marked the 38th consecutive month of home price appreciation. Home prices were up 2.7% from March to April but Home Prices are still about 9% below the peak in 2006.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 6/5/2015 they are working on reviewing files that have been submitted on 5/22/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, June 13, 2015, in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday, June 27, 2015, in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783 Keep Reading...