Mortgage Rates Weekly Update for August 24, 2015

Mortgage Rates weekly market update for the Week of August 24, 2015 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to move lower in recent days as the Stock Market plunged after weak global economic news. If you take a look at the mortgage bond chart below you can see mortgage bonds were able to rally off support last week and move higher. BUT with the stock market plunging over 500 points on Friday and mortgage bonds only ending the day up 9 points we are recommending LOCKING Your Mortgage Rate to start the week. Mortgage bonds failed to move above the 200 day moving average even with the stock market sell off which is a bad sign for mortgage bonds.

In Economic News, the Dow Jones Industrial Average has lost 1,000 points since the high on Wednesday. The sell off in stocks started in China as it is clear they are experiencing an economic slow down. Falling Oil prices and the fear of a rate hike by the Federal Reserve have also added to the sell off in the stock market.

The Consumer Price Index (CPI) for July 2015 was released on Wednesday and it edged higher by 0.1% from June. This shows inflation remains very tame which is bond friendly.

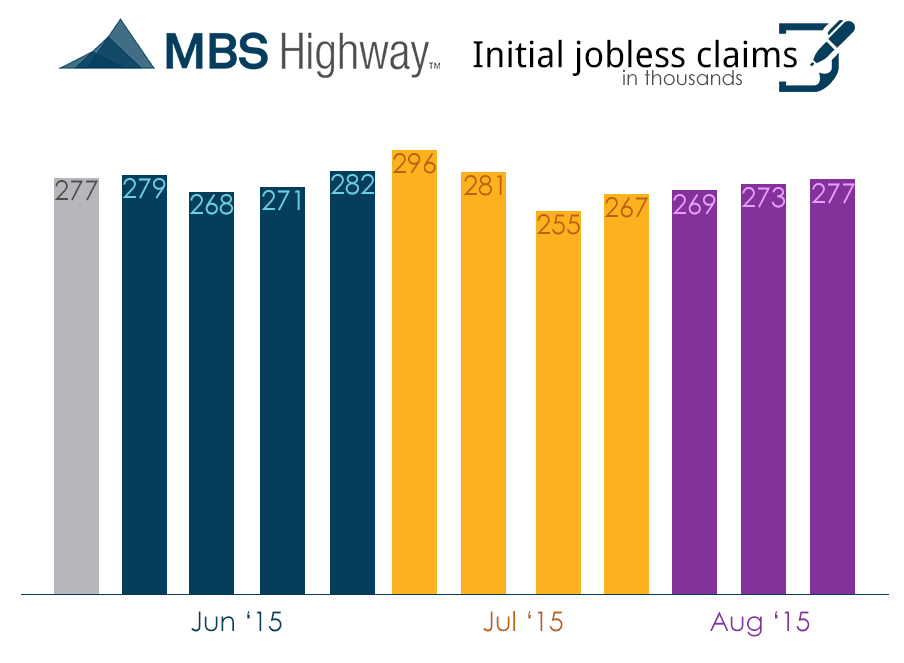

Thursday, we saw the release of the Weekly Initial Jobless Claims which came out at 277,000 claims. This was a jump of 4,000 claims from the previous week but still a very good number.

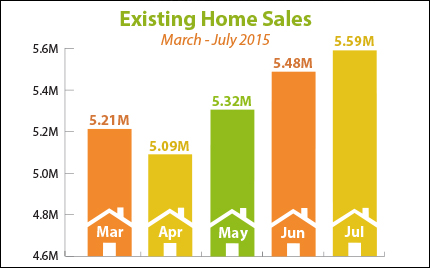

In Housing News, Existing Home Sales for July 2015 were up 2.0% from June to 5.59 million units on an annualized basis. Existing Home Sales are up 10.3% year over year from July 2014. This is the 3rd straight monthly gain and the best number in 8 years.

FHA is Updating its Underwriting Guidelines effective with FHA case numbers assigned on or after September 14, 2015. There are numerous changes the guidelines that lenders and borrowers must be aware of as you may qualify now for FHA loan but no longer qualify after September 14th. For example, you can currently qualify with deferred student loans not counted in your debt to income ratio but that will no longer be allowed as of September 14th

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 8/21/2015 they are working on reviewing files that have been submitted on 8/10/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

FYI – USDA is Increasing the upfront Guarantee Fee from 2% to 2.75% on October 1, 2015.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday August 29, 2015 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com