Mortgage Rates Weekly Update for July 6, 2015

Mortgage Rates weekly market update for the Week of July 6, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

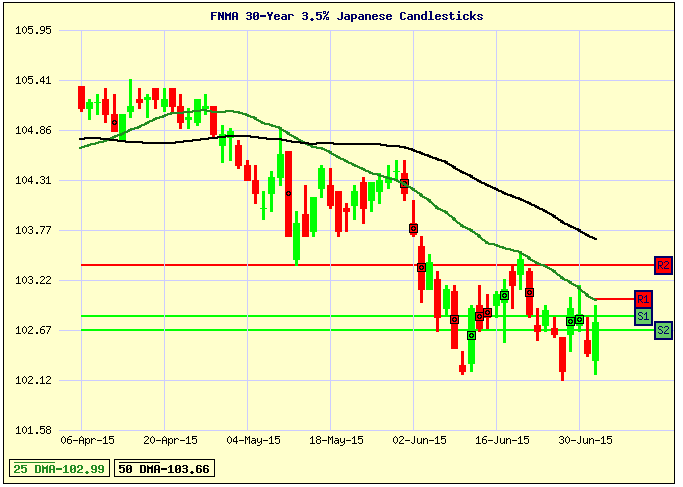

Mortgage Rates have been on a long term trend of moving higher since the middle of April 2015. Last week mortgage bonds were able to bounce off the lows of 2015 but still remain below the 25 days moving average which is capping bonds from moving higher. The bonds did a rally on Friday after the Jobs Report was released. The crisis in Greece is helping the bond markets and the “No” vote on Sunday is going to help boost the bond market as the stock market should sell off on the news. We are recommending FLOATING Your Mortgage Rate to start the week to see if mortgage bonds can rally off the news from Greece and move above the 25 Day Moving Average.

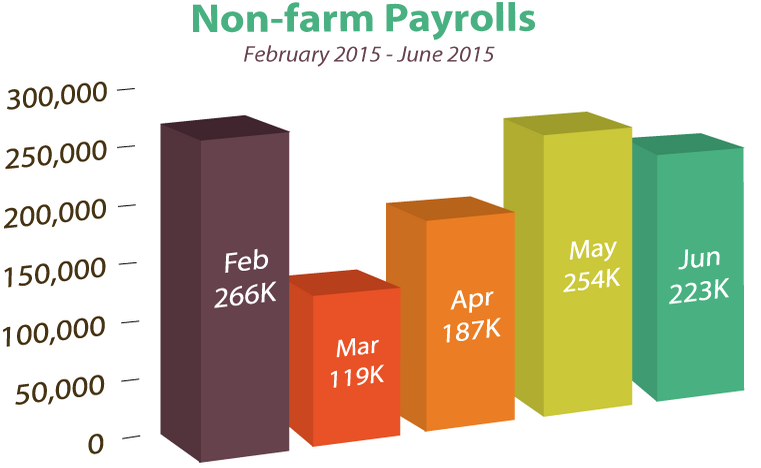

In Economic News, the Jobs Report for June 2015 was released on Thursday morning which showed 223,000 jobs were created in June 2015 which was just below the 230,000 jobs expected. The Unemployment Rate Dropped to 5.3% from 5.5% but this was NOT good news because the reason for the drop was because people dropped out of the workforce not because people went back to work. This can be proved by looking at the Labor Force Participation Rate which dropped to a 38 year low at 62.6%.

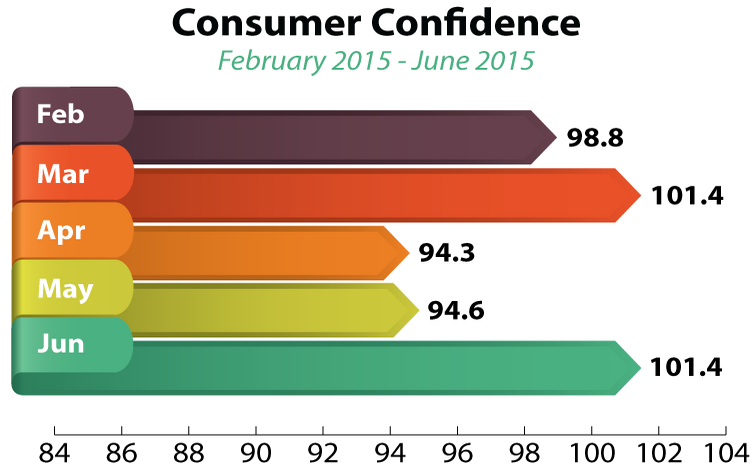

In Other Economic News, the Consumer Confidence for June 2015 surged to 101.4 which was above expectations and a big jump from May’s reading of 94.6. Consumer Confidence is up because of the improving job market.

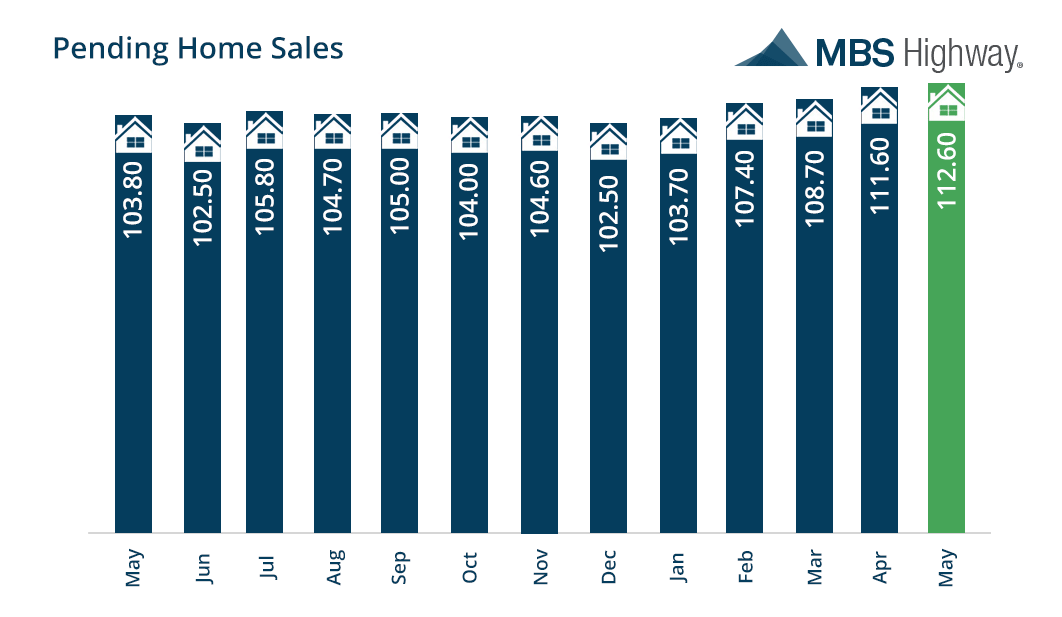

In Housing News, Pending Home Sales for May 2015 were up 0.9% from April but are up a whopping 10.4% from May 2014. This is the best number in 9 years. Pending Homes Sales is a measure of the number of Existing Homes that went under contract for that month.

In other Housing News, Congress has a bill that will help put private money back into the Flood Insurance Market with the Flood Insurance Market Parity and Modernization Act. The legislation addresses two of the primary impediments to the development of a private flood insurance market: lack of clarity as to what constitutes acceptable private flood insurance and uncertainty about the effect of private insurance on the continuous coverage requirement

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 7/3/2015 they are working on reviewing files that have been submitted on 6/23/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, July 18, 2015, n Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713