Mortgage Rates Weekly Update for June 29, 2015

Mortgage Rates weekly market update for the Week of June 29, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates Continued to move higher last week as mortgage bonds sold off on news of a bailout being reach for Greece. If you look at the mortgage bond chart below you can see mortgage bonds continued their downward spiral as investors dumped mortgage bonds in favor of stocks as the European Union seems to have reached a deal to keep Greece from defaulting on its debt. We have been recommending LOCKING Your Mortgage Rate as the bonds continue to sell off. Bonds were able to hold a line of support on Friday so you can start the week carefully FLOATING if you didn’t take our advice and LOCK last week. If bonds break below support, we would again quickly switch to a LOCKING stance.

The Big Picture for Mortgage Bonds is shown below in the bond chart for the last quarter. It shows bonds have been on Staircase step down pattern of making lower lows and lower highs moving mortgage interest rates higher. Anybody “hoping” rates will again move lower in the short term is being unrealistic in the face of the facts that we have. There is nothing coming out that would move mortgage bonds higher other than a reversal on the Greece bailout. So the long term outlook right now is for the path of least resistance for mortgage bonds which is to move lower and move mortgage interest rates higher.

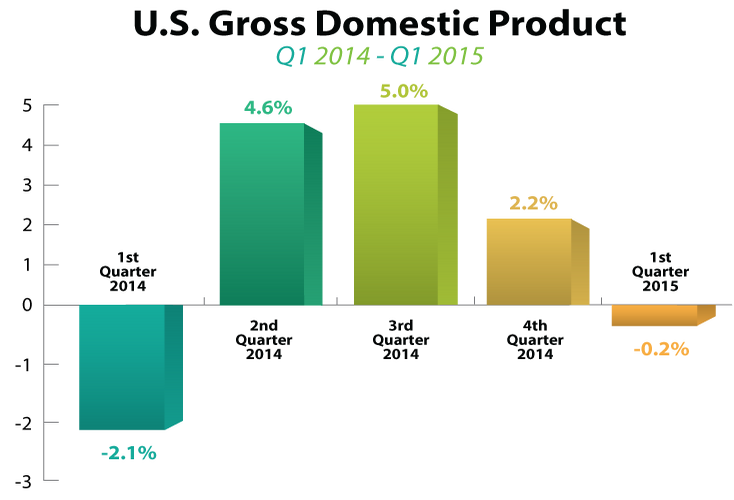

In Economic News, the Final Reading of the Gross Domestic Product (GDP) for the First Quarter of 2015 came in at a-0.2% which is the fifth time we have had a negative GDP in the 6 year recovery since the Great Recession. The negative GDP reading is being blamed on a negative trade balance due to a much stronger Dollar, Harsh winter weather, and the closing of the West Coast Port. GDP needs to be closer to 3% positive in order to have a healthy growing economy.

Federal Reserve Decides Against Rate Hike – The Feds decided not to raise short term interest rates at their June 2015 meeting. The Feds Funds Rate has been near zero since 2008. They hinted that the short term interest rates could be raised at the next meeting in September 2015. Feds also lowered their forecast for economic growth for 2015 from a range of 2.3 to 2.7 percent down to a range of 1.8 to 2 percent.

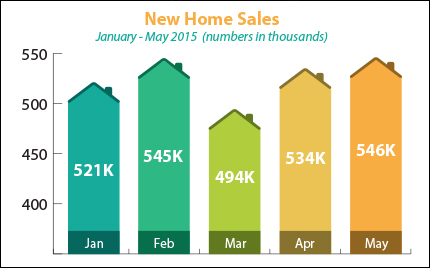

In Housing News, New Home Sales for May 2015 hit their highest level in seven years as sales rose by 2.2% in May from April to an annualized rate of 546,000 new homes sold. This is nearly 20% higher than May 2014.

TRID Start Date Delayed – The CFPB issued a statement that will delay the implementation of the new TILA-RESPA Integrated Disclosures (TRID) from August 1, 2015, to October 3, 2015. This gives the industry more time to implement the new rules and work out some kinks but this was not the reason for the extension. The extension was because the CFPB didn’t follow the rules in disclosing to Congress the time frame for implementation.

USDA Rural Housing Announced it will increase the Guarantee Fee on new commitments issued on or after October 1, 2015, from the current 2% fee to 2.75% fee. So on a $200,000 purchase price, the current guarantee fee would be $4,000 and on October 1, 2015, that will go to $5,500.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 6/26/2015 they are working on reviewing files that have been submitted on 6/18/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, July 18, 2015, in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713