Mortgage Rates Weekly Update for October 30, 2017

Mortgage Rates Weekly Update for October 30, 2017

Mortgage Rates Update for October 30, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week higher than they started last week as mortgage bonds continued the downward trend but were able to hammer out a floor of support. If you look at the mortgage bond chart below you can mortgage bonds have been selling off since back on September 8th and have broken through several floors of support but last were able to find support and ended the week with a rally off of support. The green candle on Friday is a good signal that bonds may recover in the short term so we are recommending FLOATING your mortgage rate to start the week.

In Economic News

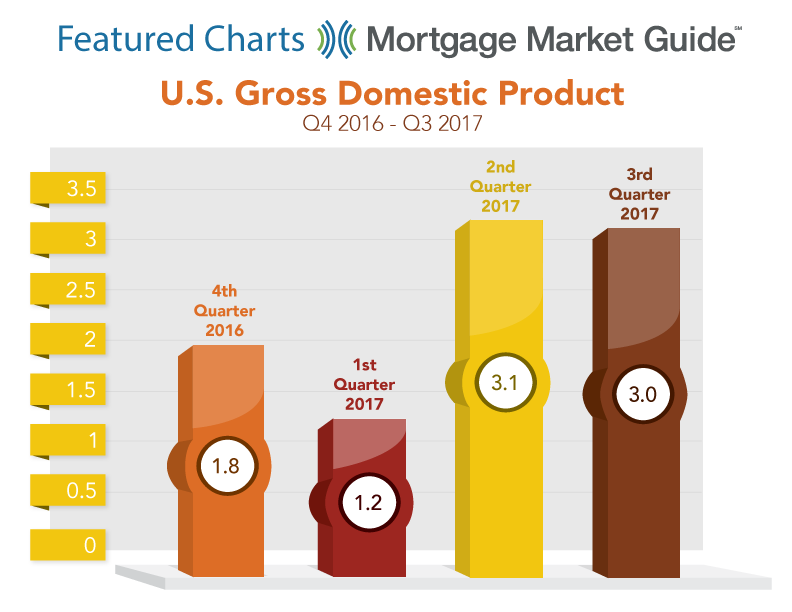

Gross Domestic Product for the third quarter of 2017 grew by a solid 3.0 percent in the first reading which comes after a 3.1 percent reading of GDP in the second quarter. Consumer spending was up 2.4 percent in the third quarter which follows a 3.3 percent in the 2nd quarter. Consumer spending makes up two thirds of the US economy so a trending increase favors a good outlook for the economy. GDP is the monetary value of all finished goods and services produced within a country’s borders in a specific time period. It is considered the broadest measure of economic activity.

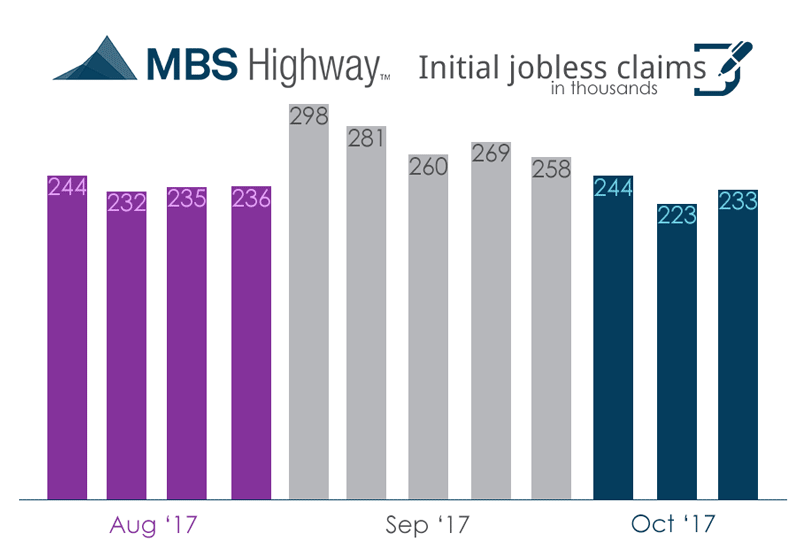

Weekly Initial Jobless Claims were released on Thursday and moved up 10,000 claims to 233,000 claims for the week which is still very low and will also be the sample week for the October Jobs Report.

In Housing News

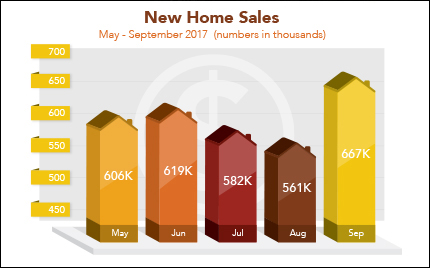

The US Commerce Department reported New Homes Sales for September 2017 surged higher by 18.9 percent from August 2017 to 667,000 units on an annualized basis. New Home Sales measures the number of new construction homes that were sold in a particular month so this shows new construction is doing very well as we move into the end of the year. New Home Sales were 17 percent higher than September 2016.

Existing Home Sales for September 2017 were reported by NAR to have only risen 0.7% from August 2017 as low inventory coupled with rising prices have capped existing home sales. The median existing-home price for all housing types in September was up 4.2 percent from September 2016. Inventories were running at a 4.2 months’ pace, below the 6 month pace that is seen as healthy.

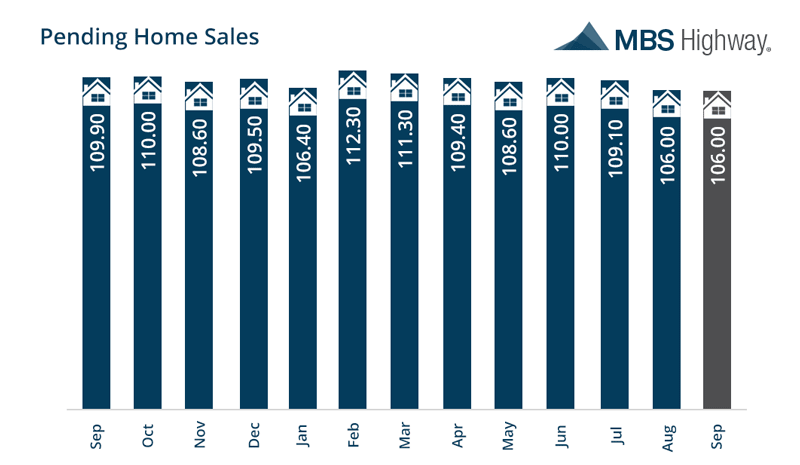

Pending Home Sales for September 2017 was unchanged from August 2017 at the index of 106.0. Pending home sales measures the number of contracts on existing homes for the month. Pending home sales are suffering from low inventory and rising prices.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Wednesday November 15, 2017 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday November 18, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage