Mortgage Rates Weekly Update for August 3, 2015

Mortgage Rates weekly market update for the Week of August 3, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

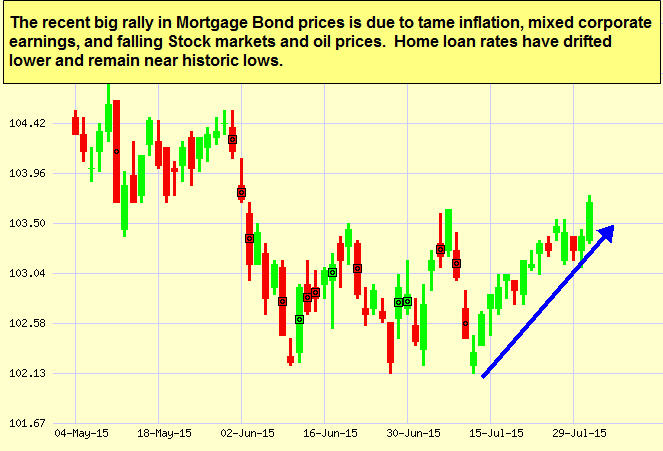

Mortgage Rates were finally able to reverse the trend and move lower last week as mortgage bonds broke through a tough ceiling of resistance. If you look at the mortgage bond chart below, you can see the blue arrow shows the short term trend is now for bonds to move higher which moves mortgage interest rates lower. The big green candle on Friday shows bonds closing above a huge resistance that has turned bonds lower in the past which had created a “triple top” at 103.68 which is a technical signal for bonds to sell off and move lower if don’t break through this top. Since we broke through the triple top and closed above it at 103.84, it is a good sign for mortgage bonds to now use this previous resistance as support. We are recommending FLOATING your Mortgage Rate to start the week but be cautious as we get close to Friday as the Jobs Report for July could be a market mover.

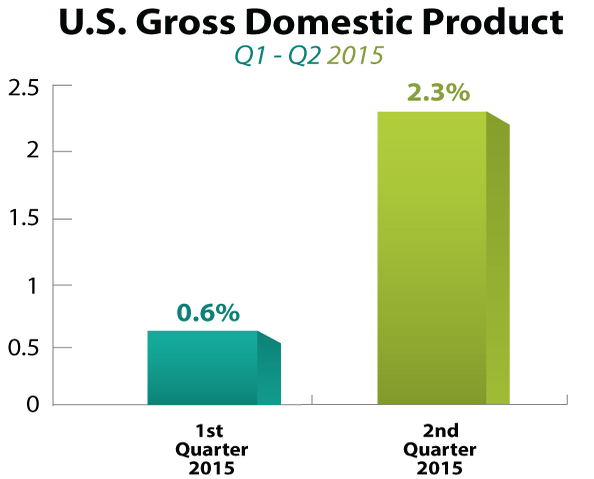

In Economic News, the first reading of Gross Domestic Product (GDP) for the 2nd quarter of 2015 was released last week and it rebounded higher to 2.3% from a very anemic 0.6% reading for Q1 of 2015. The rebound was seen from a rise in Consumer Spending by nearly 3% and an increase in U.S. exports overseas.

In other Economic News, the price of Oil continued to drop and closed on Friday the price of a barrel of West Texas Intermediate was $48.21. This drop on Friday was after OPEC announced it would not cut production even with a glut of oil on the world market. The lower price of oil is one of the reasons the price of Stocks has moved lower.

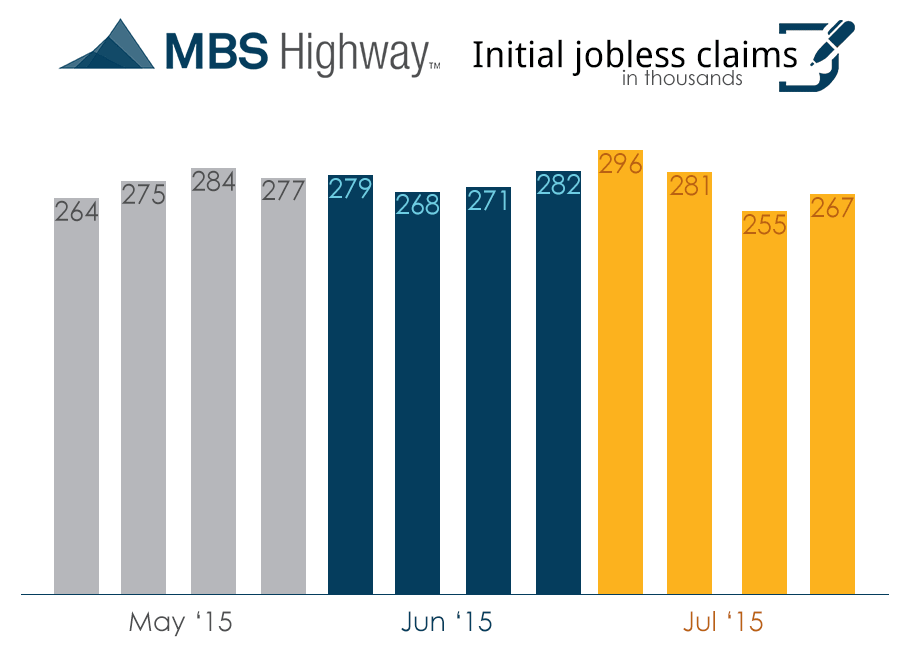

Weekly Initial Jobless Claims came out at 267,000 claims which were below expectations of 272,000 but still an uptick of 12,000 from the previous week of 255,000 claims. Previous weeks was a 42 year low for weekly jobless claims and are also the sample week to be used in the July Jobs Report to be released on Friday. This could signal a very strong Jobs Report which could negatively impact the mortgage rate.

In Housing News, the National Rate of Homeownership was at a 22 year low at only 63.7% of people owning homes at end of 1st quarter of 2015 compared to 69.2% at the peak in 2004. It hasn’t been 63.7% since 1993. The drop in homeownership can be attributed to low inventory and the millennial generation delaying purchasing homes.

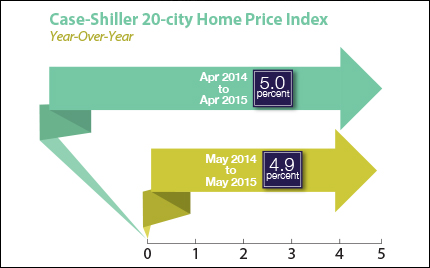

The Case-Shiller 20 City Home Price Index for May 2015 was up 4.9% from May 2015. This shows that the housing sector remains stable and continues to show about a 5% year over year gain on home prices.

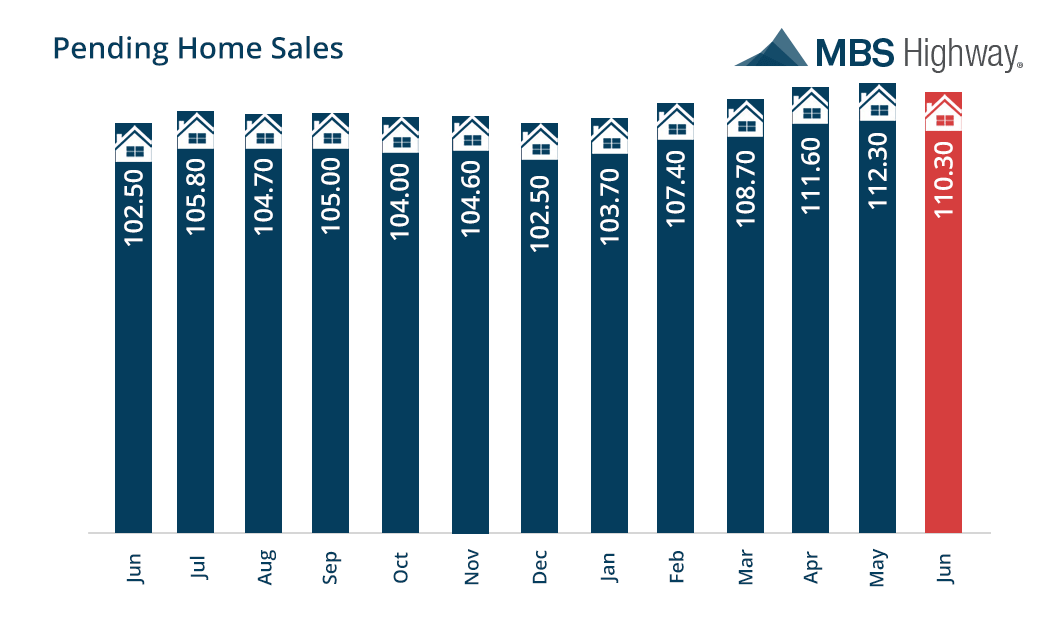

Pending Home Sales for June 2015 were down 1.8% from May but May 2015 was the best level in 9 years. Pending Home Sales are still up 8.2% on a year over year basis so report was still a very good report on housing. Pending Home Sales measures the number of new contracts on existing homes for sale.

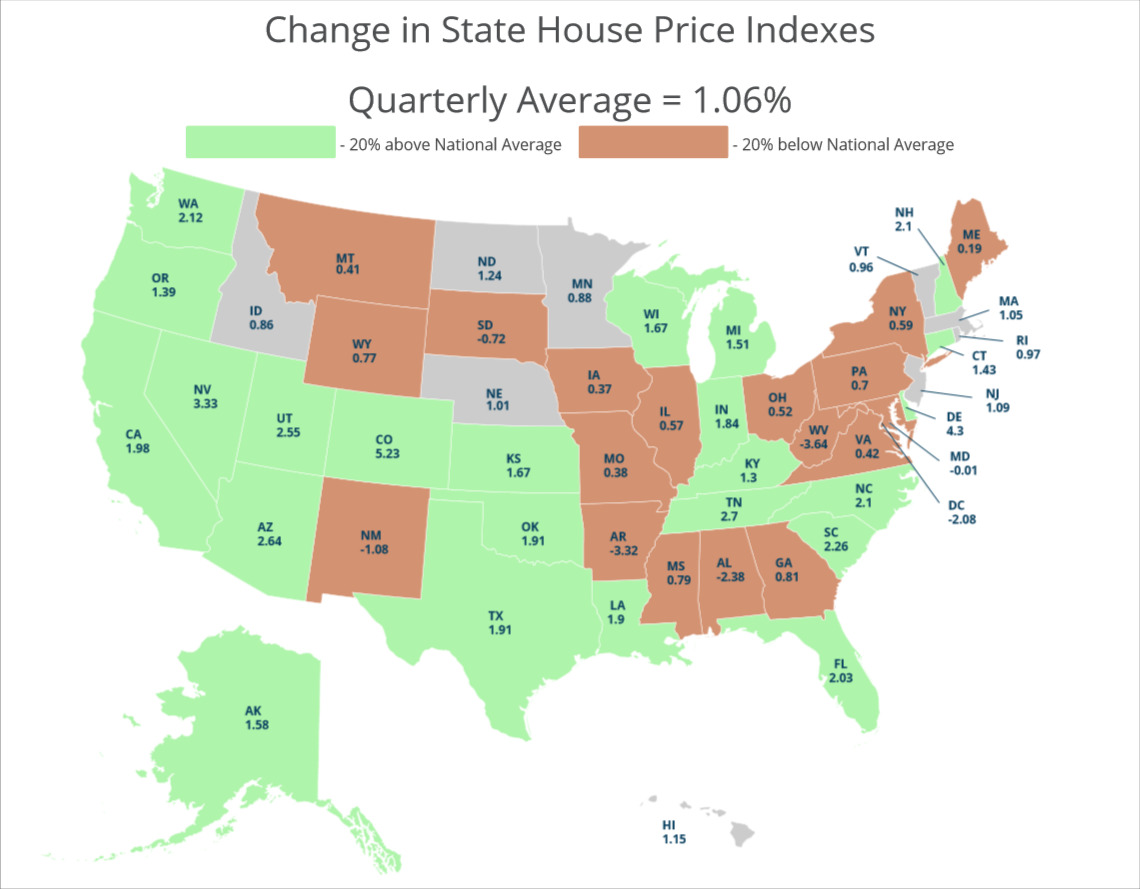

The chart below shows the Change in State House Price Index for the 1st Quarter of 2015. Delaware had an increase of 4.3% in home price which is more than 20% above the national average which is only 1.06%. So Delaware is seeing a nice increase in home prices to start in 2015.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 7/31/2015 they are working on reviewing files that have been submitted on 7/21/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

FYI – USDA is Increasing the upfront Guarantee Fee from 2% to 2.75% on October 1, 2015.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, August 29, 2015, in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713