Mortgage Rates Weekly Update for April 10 2017

Mortgage Rates Weekly Update for April 10, 2017

Mortgage Rates Weekly Update for April 10, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

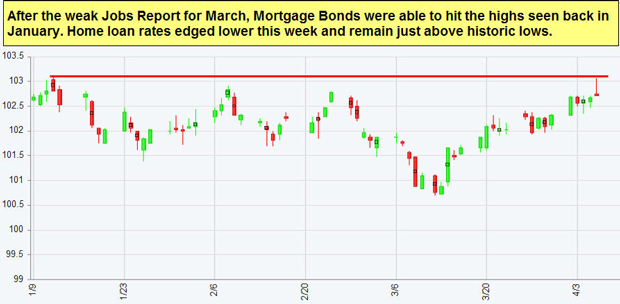

Mortgage Rates ended the week slightly higher after failing to move lower on Friday. If you look at the mortgage bond chart below you can see mortgage bonds moved higher on Monday and then traded sideways until Friday. Bonds made a run at tough overhead resistance on Friday but were turned lower and ended the week down with the red candle on Friday. We are recommending very carefully FLOATING your mortgage rate to start the week to see if bonds can make another run at tough overhead ceiling of resistance but be on guard because last time failed to break above resistance bonds switch trading pattern to selling off and moving interest rates higher.

In Economic News

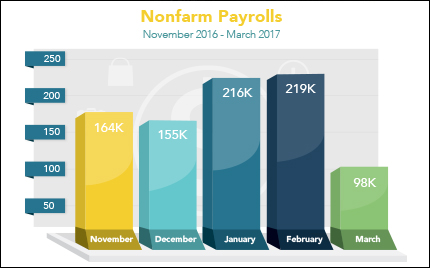

The U.S. Labor Department released the March 2017 Jobs Report on Friday which showed a very disappointing 98,000 jobs created for March which was a huge drop from February’s 219,000 jobs. This was a surprise that showed a huge stumble for the labor force. The Unemployment Rate dropped from 4.7% in February to only 4.5% in March which was the lowest reading in 10 years.

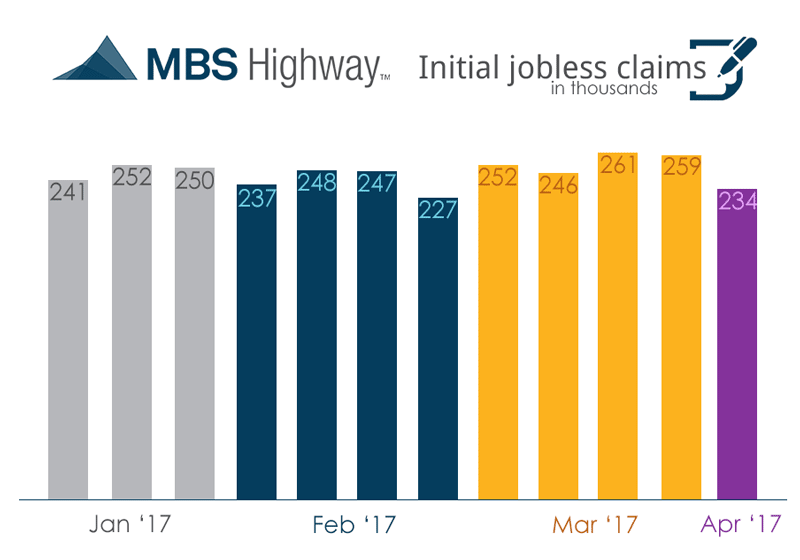

Weekly Initial Jobless Claims were released on Thursday and dropped 25,000 claims to only 234,000 claims for the week which shows the labor market is doing well for people out of work. This concedes with a low unemployment rate of 4.5%. The employment scene remains the same – Employers are hopeful for faster growth and are holding onto their employees, while at the same time it is getting tougher to add more qualified workers.

In Housing News

CoreLogic released it Home Price Index for February 2017 which showed home prices jumped 7 percent from February 2016. Home prices rose 1 percent from January 2017 to February 2017. High demand and low inventory seem to be pushing home prices upward.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday April 15, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday April 15 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate