Mortgage Rate Weekly Update for January 30, 2017

Mortgage Rate Weekly Update for January 30, 2017

Mortgage Rate Weekly Update for January 30, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week slightly higher as stock markets hit record levels. If you look at the mortgage bond chart below you can see the trend is for mortgage bonds to sell off but bonds were ale to find a floor of support on Thursday and ended the week with a green candle so we are recommending FLOATING your mortgage rate to start the week to see if mortgage bonds can recover.

In Economic News

The Bureau of Economic Analysis reported the fourth quarter Gross Domestic Product (GDP) for 2016 grew by 1.9% which was below expectations of 2.2% and down from 3.5% reported in the third quarter of 2016. GDP for all of 2016 grew only at a very modest pace of 1.9% which was a drop from 2.6% in 2015 which was the worst reading since 2011.

The DOW Jones Industrial Average broke 20,000 for the first time in history last week which has highlighted a huge stock market rally since election day in November 2016. This has pulled money out of bonds and other fixed income investments and caused mortgage interest rates to move higher since the election as mortgage bonds have sold off.

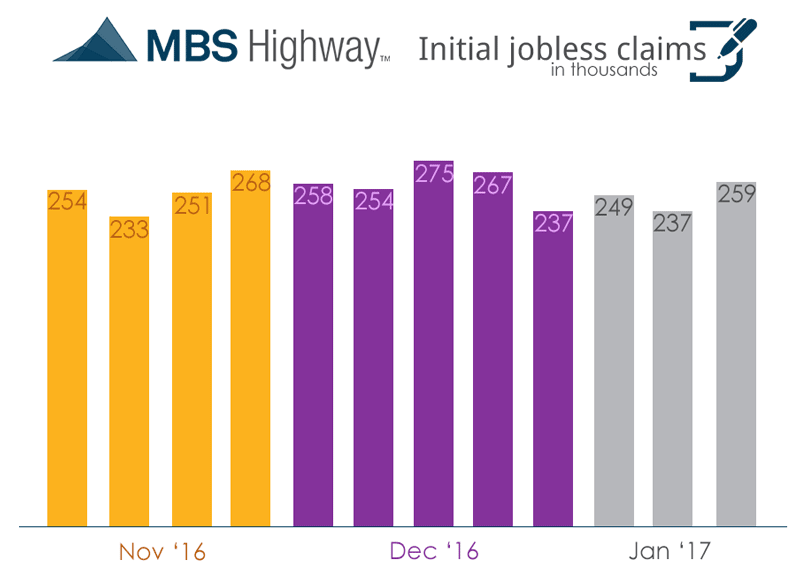

Weekly Initial Jobless Claims were released on Thursday and jumped 22,000 claims higher to 259,000 claims for the week. This report was worse than expectations of 246,000 by 13,000 claims to the upside.

In Housing News

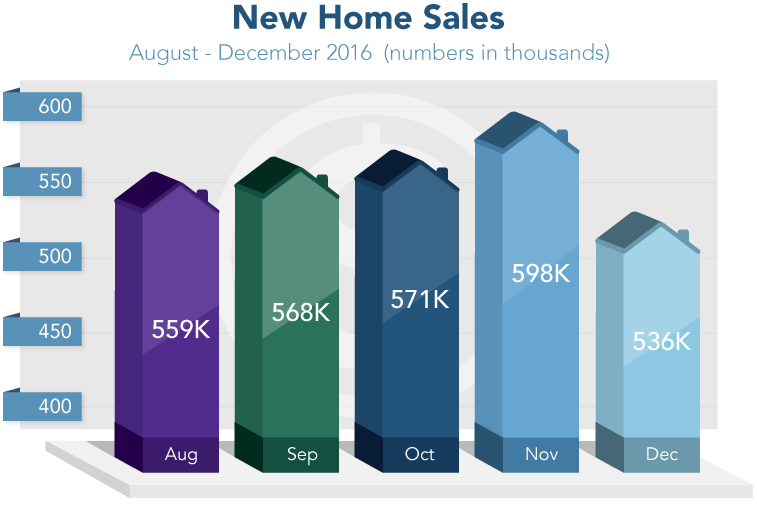

New Homes Sales for December 2016 which measure the number of signed contracts to purchase new construction homes were released on Thursday and dropped b 10.4% from November 2016 to 536,000 units on an annualized basis. December New Home Sales was a miss but sales of New Homes in 2016 was up 12.2% over 2015 and was the highest year for new home sales since 2007. Median Home Price for a New Construction home was $322,500 which was up 7.9% from 2015. New Home Sales only contribute to about 10% of the market.

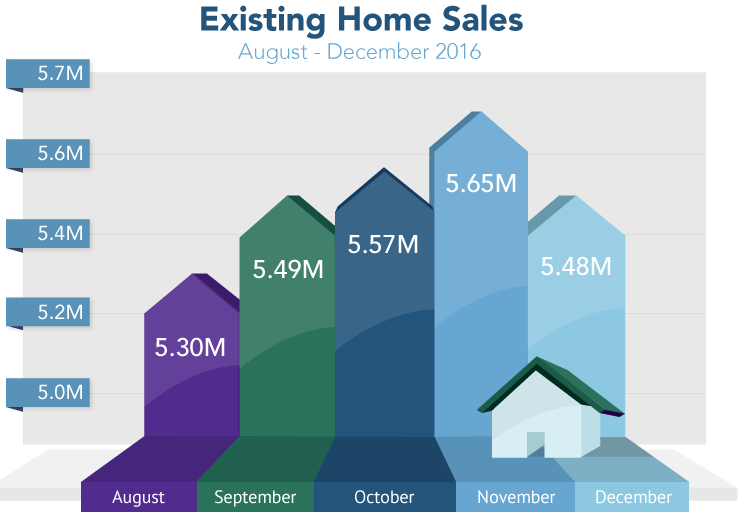

Existing Home Sales for December 2016 were released on Tuesday and showed 5.48 Million units were sold on an annualized basis which was a 2.8 percent drop from November 2016 but 2016 Existing Home Sales closed at as the best year in a decade. The total Sales for Existing homes in 2016 were 5.45 Million units which was above the 5.25 Million units sold in 2015 and the highest yearly sale of existing homes since 2006.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday February 18, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday March 25 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate