DSHA Home Again Mortgage Loan

DSHA Home Again Mortgage Loan Program is for Delaware home buyers that do NOT meet the requirements for a DSHA Welcome Home Mortgage Loan. Delaware State Housing Authority Home Again Mortgage Program has a higher income limit and allows for non-first time home buyers to qualify for a home loan program. The program is available for anybody purchasing in the State of Delaware even out of state residents as long as purchasing in one of the three counties in Delaware. This program can be combined with any of the three down payment assistance programs offered by DSHA. Get Started today by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.

What are the Guidelines for the DSHA Home Again Mortgage Loan Program?

DSHA Home Again Mortgage Loan Program is available for anybody looking to purchase a primary residence in the state of Delaware that meets the following requirements:

- Minimum Credit Score of 620 for All Borrowers

- Minimum Credit Score of 660 for a Manufactured Home

- Must Purchase as Primary Residence

- Must be under the household Income Limits

- Must complete 8 hours of home buyer counseling if Less than 660 Credit Score

- Must Purchase a home in the State of Delaware

- Must use a DSHA Approved Lender Only

- Mortgage Interest Rates for the program Set Daily by DSHA at https://kissyourlandlordgoodbye.com/loan-products/

- Eligible to use the Delaware Mortgage Credit Certificate if Meet the Guidelines

- MUST qualify for a DSHA FHA Loan, DSHA VA Loan, DSHA USDA Loan, or a DSHA Conventional Loan.

What are the DSHA Eligible Down Payment Programs?

DSHA offers three different Down Payment Assistance Programs that can be combined with the Home Again Mortgage Loan Listed Below:

- DSHA First State Home Loan DPA Program

- DSHA Delaware Diamond DPA Program

- DSHA Home Sweet Home DPA Program

- DSHA Diamond in the Rough 5% DPA (Min 660 Credit Score)

What are the Eligible Property Types for Home Again Loan?

The DSHA Home Again Loan Program allows Delaware home buyers to purchase the following types of homes:

- Single Family Residence (SFR)

- Townhomes & Rowhomes

- 2-4 Unit Property with FHA, VA or USDA Only

- Warrantable Condo

- Manufactured Home (660 Score or Higher and FHA Loan Only)

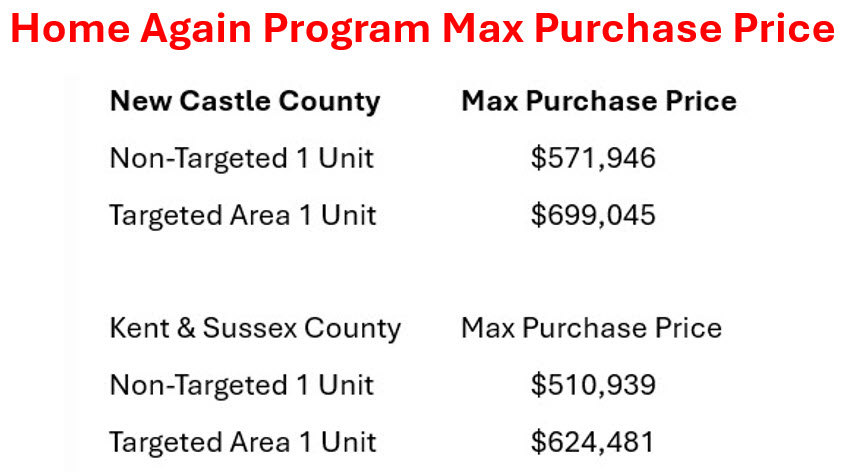

The DSHA Home Again Mortgage Loan Program has a maximum purchase price for each county listed below:

What are the Income Restrictions for Home Again Loan Program?

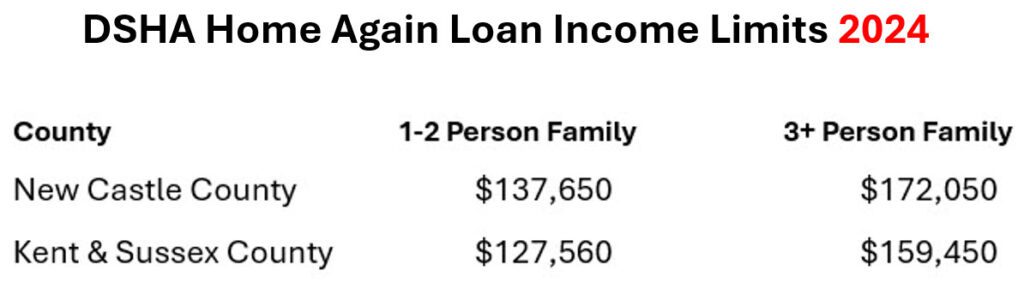

In order to qualify for the DSHA Home Again Mortgage Loan Program, you must be under the household income limit set by DSHA per county. All members of the household are REQUIRED to provide income documents to calculate the total household income regardless if person is going on the mortgage loan or not. So if Husband is purchasing a home by himself, we still must get the wife’s income documents to calculate household income for qualifying purposes.

Below are the household income limits by County for DSHA Home Again Mortgage Loan Program:

How Do You Apply for the DSHA Home Again Mortgage Loan Program?

If you would like to apply for a DSHA Home Again Loan then give the John Thomas Team with Primary Residential Mortgage a call at 302-703-0727 or APPLY ONLINE.