VA loan Eligibility Requirements in Delaware

VA Loan Eligibility Requirements in Delaware

What Veterans and Active-Duty Service Members Need to Qualify

To qualify for a VA loan in Delaware, veterans and active-duty service members must meet VA service requirements, lender credit and income standards, debt-to-income guidelines, VA residual income guidelines and purchase a primary residence that meets VA minimum property requirements. Veterans with full VA entitlement can finance 100% of the purchase price with no loan limit, while partial entitlement may require a down payment based on remaining entitlement.

John Thomas is a Delaware-based VA loan officer helping veterans qualify for VA home loans statewide.

Simple Summary: Straightforward Answer

Veterans and active-duty members looking to get a VA loan in Delaware need to meet VA service qualifications, lender income and credit standards comply with debt-to-income ratios, and agree to buy an approved primary home. Those with full VA entitlement can borrow the full amount of the home’s cost without limits, while having partial entitlement might mean putting a down payment depending on what entitlement remains. Need a VA Loan to purchase or refinance a home in Delaware? Then call Loan Officer and VA Home Loan Expert John Thomas at 302-703-0727 or APPLY ONLINE

Quick Answer: To qualify for a VA loan in Delaware, veterans must meet VA service requirements, lender credit and income standards, debt-to-income guidelines, VA residual income guidelines and buy an approved primary residence. Full VA entitlement allows 100% financing with no loan limit.

Explaining VA Loans

A VA loan is a type of mortgage supported by the government issued by private lenders and backed by the U.S. Department of Veterans Affairs. This program helps qualified veterans and military members buy homes with benefits like:

- No need for a down payment unless have partial entitlement

- No monthly mortgage insurance ever!

- Easier credit requirements with no minimum credit score

- Lower interest rates

Military families in Delaware often find VA loans to be one of the best ways to purchase a home.

Who Can Qualify for a VA Loan in Delaware?

Military service is key to qualify for a VA loan, though final approval also hinges on the lender’s requirements. In order to qualify for a VA Home Loan in Delaware will you have to qualify to obtain a Certificate of Eligibility from the Department of Veteran Affairs.

Basic VA Loan Eligibility (Service Criteria)

You might qualify if your military service meets certain conditions.

- Someone serving in the military

- A veteran who has completed the required service period

- A National Guard or Reserves member

- A surviving spouse who qualifies

You’ll need a Certificate of Eligibility (COE) from the VA to prove you qualify.

VA Loan Credit Rules in Delaware

The VA doesn’t have a strict credit score requirement, but lenders do.

Common Credit Guidelines for VA Loans in Delaware

VA minimum Guidelines

- VA has no minimum credit score requirement (BEWARE of Lenders that do!)

- No recent bankruptcies or foreclosures unless enough time has passed

- A good record of making payments on housing and other debts

Even with lower credit scores, you might still qualify if:

- You have enough extra income left over each month (VA Residual Income)

- Other strong financial factors work in your favor

- The overall loan stands as a good risk

Income Criteria to Qualify for VA Loans in Delaware

VA Home Loans do not have any income limits. As long as you have a Certificate of Eligibility from the VA, you can apply for a VA Home Loan not matter how much you make.

Lenders instead focus on:

- Reliable documented income sources

- A steady job record

- Whether you can handle the planned housing payment

What Type of Income Is Acceptable?

- Income from W-2 employment

- Military pay along with allowances

- Profits from self-employment

- Pensions or retirement earnings

- Income from VA disability benefits or Social Security

Guidelines for Debt-to-Income Ratio (DTI)

The VA does not enforce a strict limit for DTI.

- Recommended 41% DTI or lower is Standard but can go much higher if meet residual income

- Approval for higher DTI if residual income is strong

Explaining Residual Income

Residual income refers to the money left at the end of the month once you have settled these payments:

- Housing costs

- Loan or credit payments

- Taxes owed

- Insurance premiums

The VA places strong importance on residual income in areas of Delaware with higher living expenses.

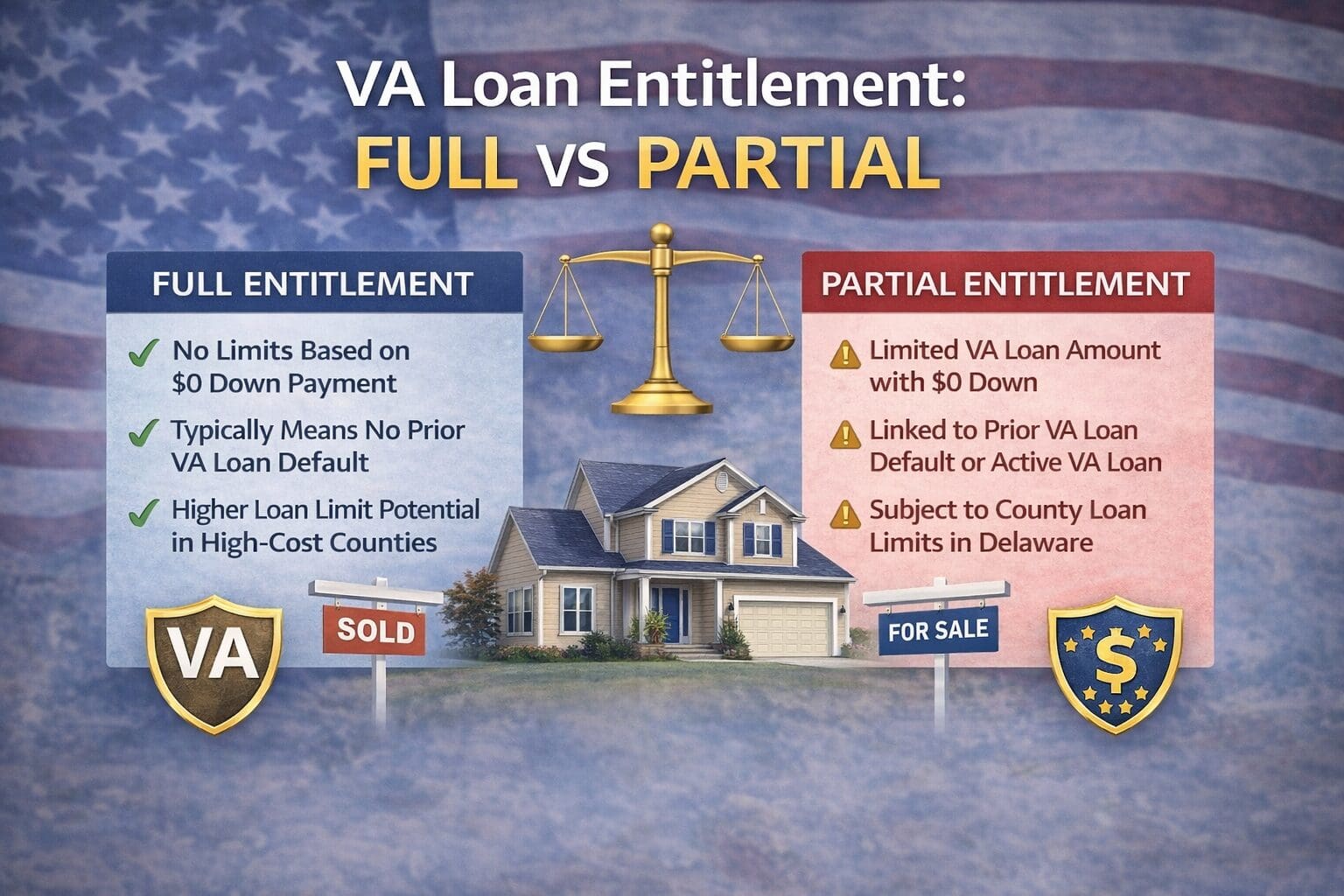

VA Loan Entitlement: Full vs. Partial in Delaware

Your VA entitlement determines the amount you can borrow.

Full VA Entitlement

- Delaware has no VA loan limit

- You can get 100% financing

- No down payment needed if you qualify

Partial VA Entitlement

- Delaware’s VA loan limits will apply

- You might need to make a down payment depending on what entitlement is left

- This often applies if you already have an existing VA loan

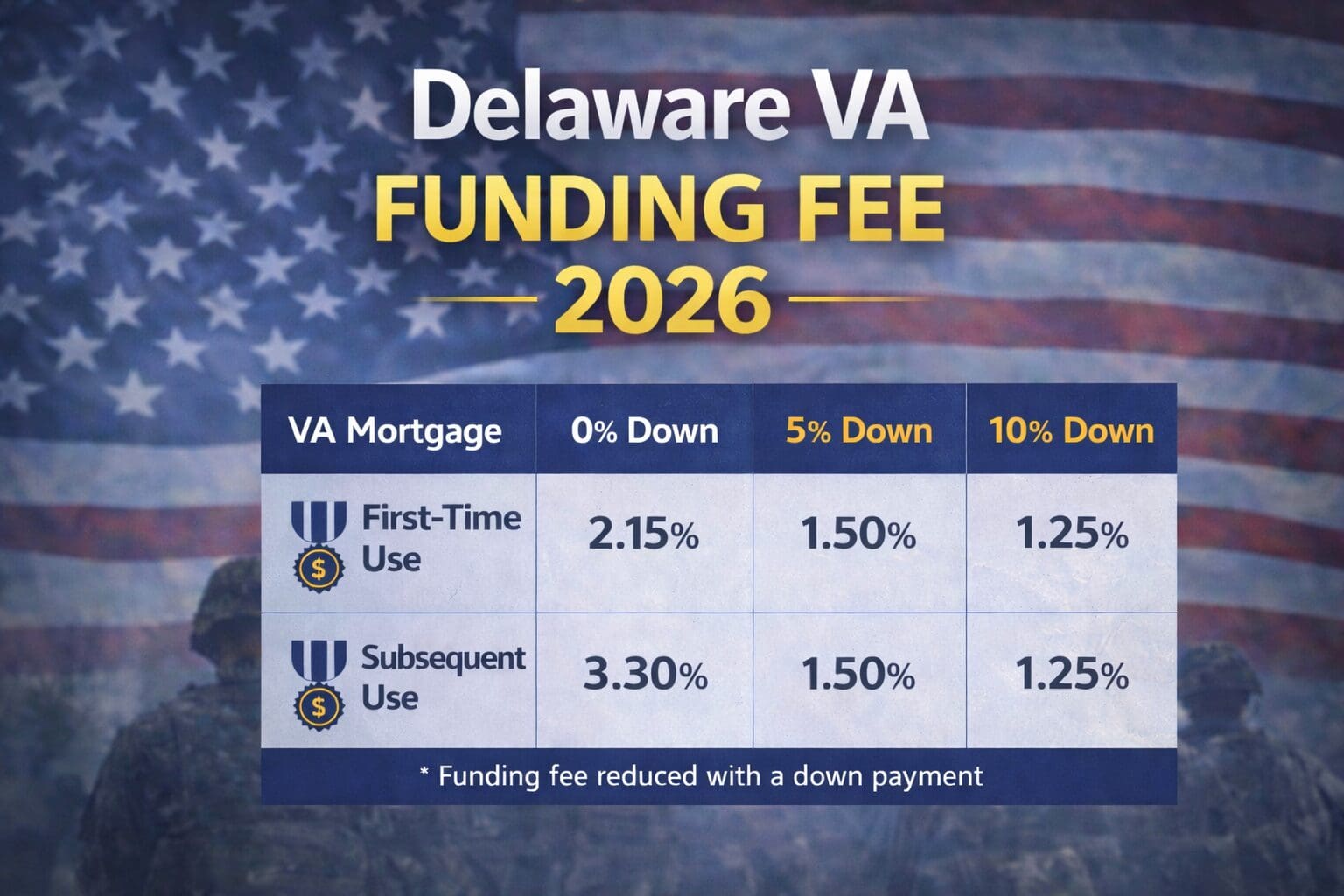

Understanding the VA Funding Fee

The VA funding fee is a one-time fee charged on most VA loans. It helps keep the VA loan program available for future veterans and replaces the need for monthly mortgage insurance. The funding fee is not paid out of pocket in most cases and can be financed into the loan.

Who Is Exempt from the VA Funding Fee?

Some veterans do not have to pay the VA funding fee at all. You may be exempt if you are:

- Receiving VA disability compensation

- Eligible for VA disability compensation but receiving retirement pay instead

- An eligible surviving spouse

If you are exempt, your total loan amount equals your base loan amount, with no added funding fee.

How the VA Funding Fee Is Determined

For veterans who are not exempt, the funding fee is based on three factors:

- Whether this is your first-time or subsequent use of a VA loan

- The down payment amount, if any

- The loan type (purchase, refinance, or cash-out)

VA Funding Fee Percentages (Purchase Loans)

- 0% down: 2.15% (first-time use) / 3.30% (subsequent use)

- 5%–9.99% down: 1.50% (first-time and subsequent use)

- 10% or more down: 1.25% (first-time and subsequent use)

Can the VA Funding Fee Be Financed?

Yes. In most cases, the VA funding fee is rolled into the loan amount instead of being paid upfront. This allows eligible veterans to purchase or refinance a home with minimal cash due at closing.

Because the funding fee affects your total loan amount and monthly payment, it’s important to review how it applies to your specific situation before making an offer or refinancing.

How Delaware VA Loan Limits Affect Your Eligibility in 2026

Understanding VA loan eligibility also means understanding how VA loan limits work in Delaware. For 2026, Delaware VA loan limits only apply if you are using partial VA entitlement. Veterans and active-duty service members with full VA entitlement have no loan limit and can finance 100% of the purchase price, as long as they qualify based on income, credit, and the VA appraisal.

If you are using partial entitlement, Delaware follows a statewide VA loan limit of $832,570 across all three counties. When a home price exceeds what your remaining entitlement allows for 100% financing, VA guidelines require a 25% down payment on the difference.

To see how VA loan limits work by county, how down payments are calculated with partial entitlement, and real-world examples for Delaware veterans, read our full guide on

Delaware VA Loan Limits 2026

VA Loan Types Available in Delaware

Most people think a VA loan is only for buying a standard home. In reality, the VA program includes several loan types that can help you buy, build, improve, or refinance a home in Delaware. The right option depends on your goal, your property type, and how you plan to use the home.

VA Renovation Loans

A VA renovation loan allows eligible veterans to buy a home and finance certain repairs or improvements into one VA mortgage. This option can be useful when a property needs updates to meet VA minimum property standards or personal needs. Renovation guidelines and repair limits vary, so lender experience matters.

VA One-Time Close Construction Loans

A VA one-time close construction loan is designed for veterans who want to build a new home. It combines construction financing and the permanent VA mortgage into one loan with one closing. This structure helps reduce complexity, closing costs, and timing issues compared to traditional construction loans.

VA Manufactured Home Loans

A VA manufactured home loan may be available for veterans purchasing an approved manufactured home in Delaware. The home must meet VA guidelines, including permanent foundation requirements and classification as real property. Not all lenders offer this option, so proper lender selection is critical.

VA IRRRL Refinance (VA Streamline Refinance)

The VA IRRRL refinance, also known as the VA streamline refinance, is designed for homeowners who already have a VA loan and want to reduce their interest rate or monthly payment. Documentation requirements are lighter than a full refinance, and in many cases closing costs can be rolled into the loan.

VA Cash-Out Refinance

A VA cash-out refinance allows eligible homeowners to refinance their existing mortgage and access equity from their home. This option is commonly used for debt consolidation, home improvements, or other major expenses. Because it increases the loan balance, it’s important to review long-term affordability before proceeding.

If you’re unsure which VA loan type fits your situation in Delaware, the next step is reviewing your goals, entitlement status, and the property you want to finance with an experienced VA loan specialist.

Types of Properties You Can Use a VA Loan for in Delaware

VA loans work if you’re buying a primary home.

Properties VA Approves

- Houses for single families

- Townhouses

- Condos approved by VA

- Owner-occupied buildings with 2 to 4 units

- Manufactured Homes (Single-Wide & Multi-Wide)

Properties You Can’t Use VA Loans For

- Houses for investment

- Vacation or holiday homes

- Mobile Homes on Leased Land

- Houses that don’t pass VA appraisal rules unless you use a VA Renovation Loan

What VA Appraisals Look For

When doing an appraisal, VA checks these:

- If the property is safe

- If the building is sturdy

- If the home can be lived in

- If the price matches its real worth

What Is the VA Tidewater Process?

The VA Tidewater process is a built-in protection for veterans when a VA appraisal comes in lower than the contract price. If the VA appraiser believes the home may not support the agreed-upon value, Tidewater gives the lender a chance to provide additional comparable sales before the appraisal is finalized.

When Tidewater is triggered, the lender has two business days to submit relevant comparable sales that support the purchase price. These comps are reviewed by the VA appraiser before issuing the final value.

Why Tidewater Matters for Veterans

Tidewater helps prevent veterans from being caught off guard by a low appraisal. It creates an opportunity to support the contract price without immediately forcing a price reduction or renegotiation.

However, Tidewater does not guarantee the value will come in at the purchase price. If the additional data does not support the value, the appraisal may still come in low.

What Happens If the VA Appraisal Comes in Low?

If the final VA appraisal is below the purchase price, veterans generally have several options:

- Renegotiate the purchase price with the seller

- Bring the difference in cash (if allowed and affordable)

- Request a Reconsideration of Value (ROV)

- Cancel the contract if permitted under the VA appraisal contingency

Understanding Tidewater before making an offer helps veterans structure competitive offers while still protecting themselves during the appraisal process.

The house must stick to VA’s Minimum Property Requirements (MPRs).

False Beliefs About Using VA Loans in Delaware

- Myth: You must have flawless credit

- Fact: VA loans come with flexible credit requirements

- Myth: It takes longer to finalize VA loans

- Fact: With the right paperwork, VA loans close as as other financing options

- Myth: You can get one VA loan in your lifetime

- Fact: You can use VA loans multiple times if your entitlement is restored

Why Veterans in Delaware Choose John Thomas

Handling VA loans takes accuracy and attention. Local Loan Officer John Thomas supports Delaware veterans by:

- Verifying eligibility and entitlement for VA benefits

- Checking credit reports and income ahead of time

- Setting up VA loans from the start

- Preventing last-minute hurdles with underwriting

This is crucial for those using partial entitlements or buying expensive homes in Delaware.

Questions People Often Ask (FAQ)

What kind of credit score is needed to get a VA loan in Delaware?

Lenders prefer credit scores between 580 and 620, but there can be some exceptions.

Does the VA have an income restriction for loans?

No income limits apply. The VA does not set any restrictions on earnings.

Are down payments mandatory for VA loans?

No, not if you have full entitlement. However partial entitlement might mean you need a down payment.

Can veterans who are self-employed still qualify?

Yes as long as they can provide proper income documents.

How can I figure out my VA eligibility?

You need a Certificate of Eligibility or COE to confirm if you qualify.

Want to Find Out if You’re Eligible for a VA Loan in Delaware?

If you’re a veteran or serving in the military and want to buy a home in Delaware, your first move should be to check if you’re eligible and see your entitlement.

John Thomas is here to help you out:

- Check if you qualify for a VA loan

- See how much of your entitlement you have

- Learn what you can afford to buy

Call 302-703-0727 or go to www.PRMILoanApplication.com

Get clear info. Trustworthy advice. Delaware VA loan expertise you can rely on.

Serving Veterans Across Delaware

John Thomas works with veterans and active-duty service members throughout Delaware, including New Castle County, Kent County, and Sussex County. Whether you are buying near Dover Air Force Base, relocating to northern Delaware, or purchasing in a coastal community, VA loan eligibility rules remain the same statewide.