Mortgage Rates Weekly Update [September 3 2018]

Mortgage Rates Weekly Update for September 3, 2018

Mortgage Rates Update for September 3, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

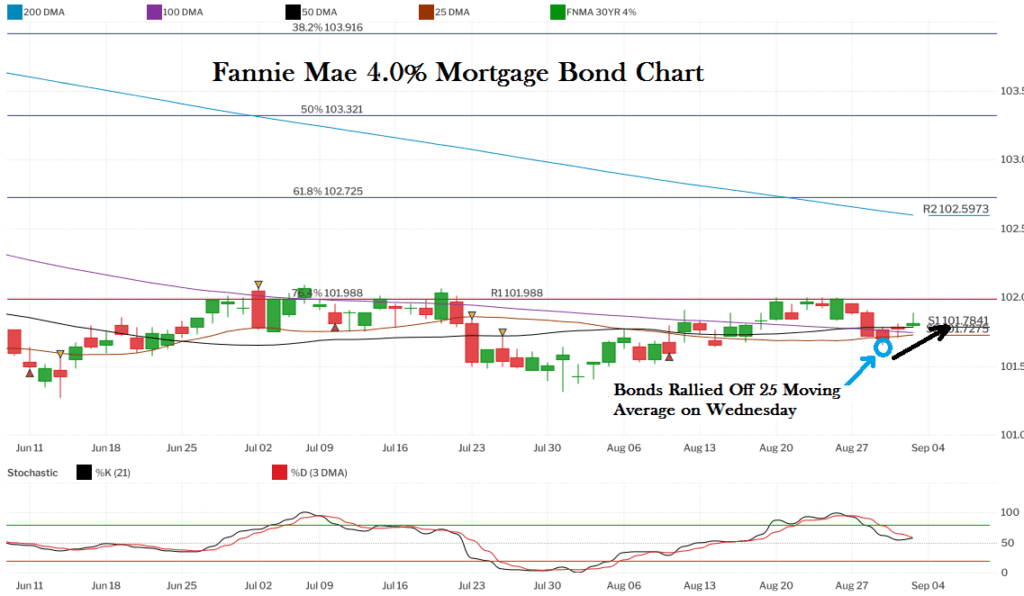

Mortgage Rates moved higher last week as mortgage bonds were turned lower by a tough ceiling of resistance. If you look at the Fannie Mae 4.0% mortgage bond chart below you can see mortgage bonds started the week on Monday with a red candle which meant mortgage bonds sold off. Bonds fell to a low on Wednesday when they were able to find a floor of support at the 25 moving average. Bonds were able to rally higher on Thursday and Friday and ended the week just above support at the 50 day moving average. We are recommending FLOATING Your mortgage rates to start the week to see if mortgage bonds can make a run at the tough overhead resistance at 101.988 on the chart.

In Economic News

The US, Mexico, and Canada are discussing new trade terms but US and Canada missed the deadline Friday to work out a deal. The goal is to get a revamped North American Free Trade Agreement (NAFTA). The US wants to sign a deal with Mexico before their is a new president and everything would have to be renegotiated. The President Trump notified Congress that he will sign the trade deal with Mexico and Canada (if willing) in 90 days. So there is a 90 day window to still work out a deal with Canada. Canada is one of the few major economies that buys more goods and services from the US than it sells so it would be in the US’ best interest to work out a deal with Canada.

The second look at the Second Quarter Gross Domestic Product (GDP) showed that the US economy grew by 4.2% which was higher than the first reading of 4.1%. This was also the highest GDP reading in 4 years. GDP is on track to average 3.2% for 2018.

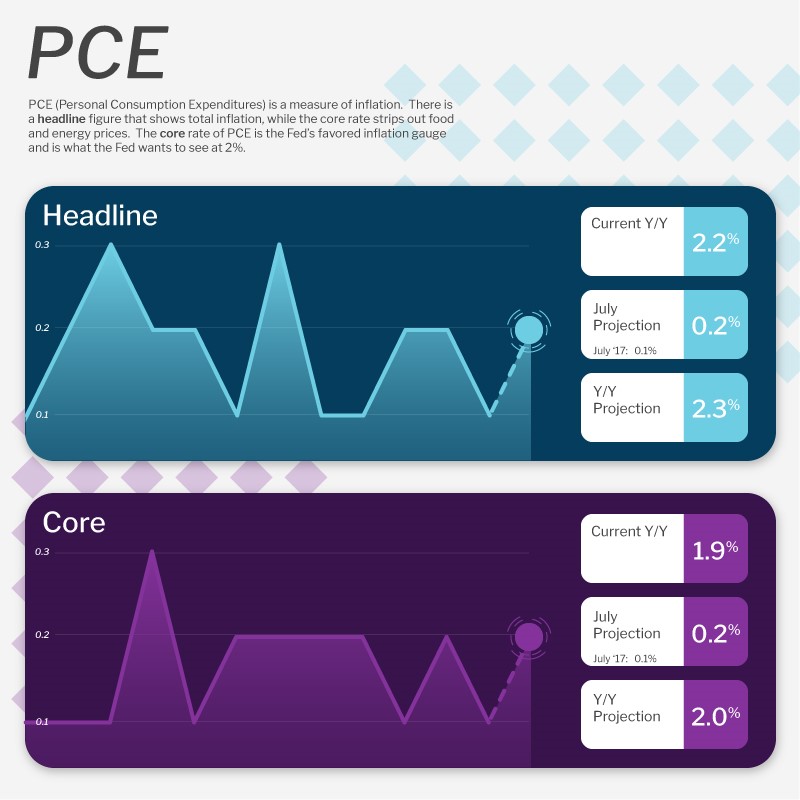

Personal Consumption Expenditures (PCE) Report for July 2018, which is the Fed’s favored measure of inflation, showed that inflation rose a bit by increasing 0.1% from June and rose to 2.2% year over year for the Headline reading. The Core rate which strips out food and energy prices rose from 1.9% to 2.0% . The core rate is the Fed’s primary inflation gauge and has now reached the Fed’s target of 2.0%.

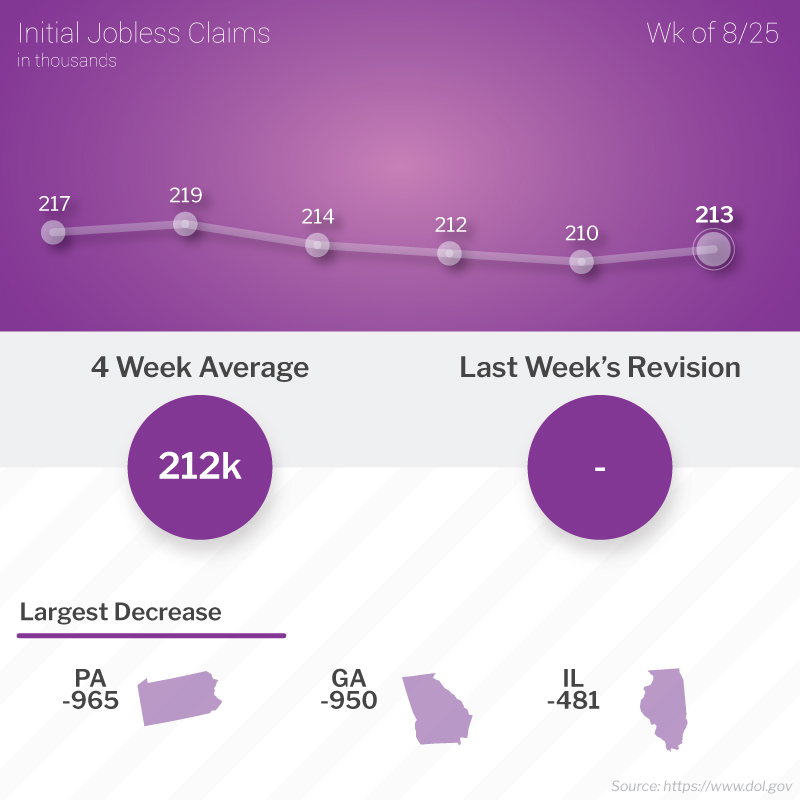

Weekly Initial Jobless Claims were released on Thursday and increased 3,000 claims to 213,000 claims for the week. Last week’s initial claims were un-revised at 210,000 and will be the sample week used in the August Jobs report which will be released this Friday. The US labor market remains extremely tight and employers are holding onto their workers. We will have to see if this finally translates into higher wages on Friday with the Jobs Report.

The Week Ahead in Mortgage Rates

For the Week of September 3, 2018 thru September 7, 2018

Weekly Initial Jobless Claims on Thursday

ADP National Employment Report on Thursday

August 2018 Jobs Report on Friday

In Housing News

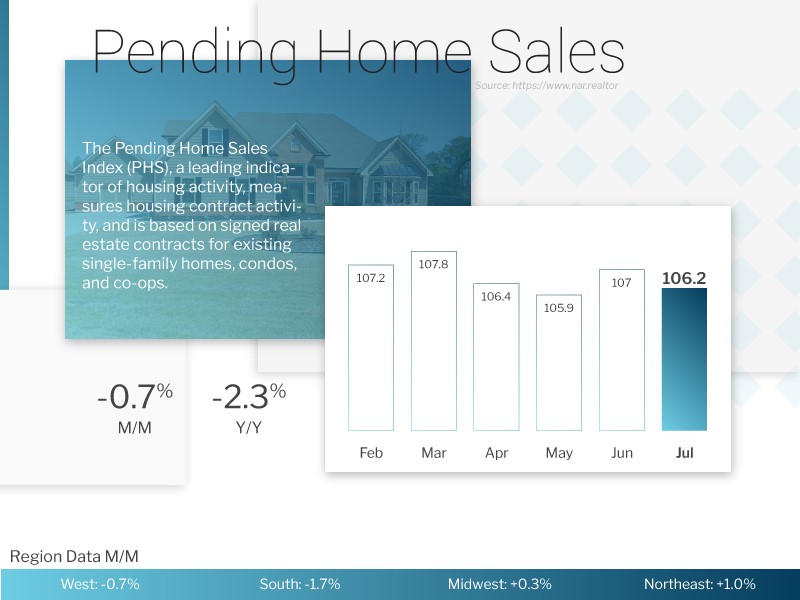

Pending Home Sales for July 2018 were down 0.7% from June 2018 to 106.2 on the index. This was weaker than expected. Pending Homes Sales are down 2.3% year over year. The pending home sales index is the leading indicator of housing activity. It measures housing contracts based on the number of signed real estate contracts for existing single family homes, condos, and co-ops.

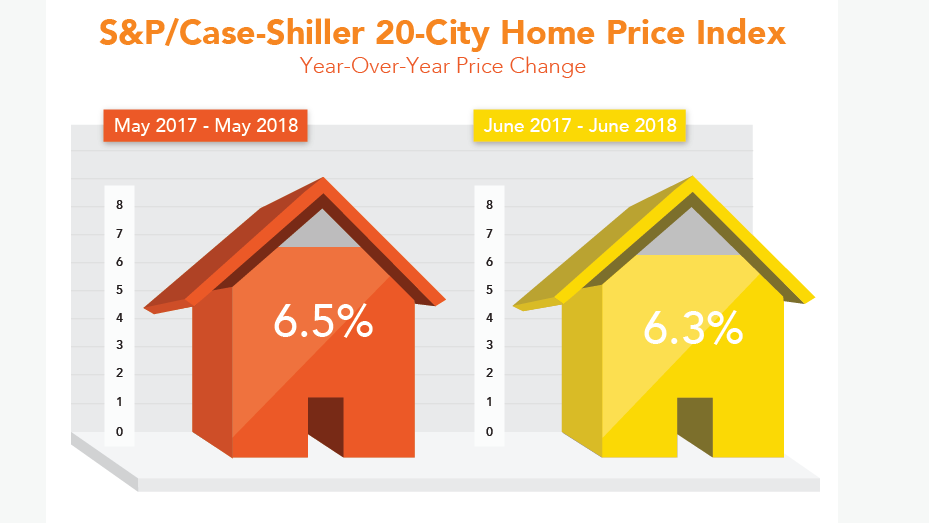

The S&P/Case Shiller 20 City Home Price Index rose 6.3 percent from June 2017 to June 2018. This was down from 6.5% in May 2018. Month over month home prices rose 0.1 percent from May to June. The pace of home price appreciation is slowly but home prices are still going up.

State of Delaware First Time Home Buyer News

Delaware Announced first time home buyer exemption to 0.5% of the state property transfer tax effective August 30, 2018 and retroactive back to August 1, 2018. Delaware first time home buyer transfer tax exemption applies to the state portion of the transfer tax which is 2.5%. The 2.5% is commonly split between the buyer and the seller so home buyers pay 1.25% of the purchase price. The new transfer tax exemption exempts Delaware first time home buyers from 0.5% of the 2.5%. If qualify for the county portion of the transfer tax exemption, then would only pay 0.75% total out of the whole 4% Delaware transfer tax.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday September 22, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday September 26, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday September 15, 2018 in Hyattsville, Maryland

Maryland First Time Home Buyer Seminar is Saturday October 27, 2018 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam