Delaware First Time Home Buyer State Transfer Tax Exemption

Delaware First Time Home Buyer State Transfer Tax Exemption

Delaware First Time Home Buyer State Transfer Tax Exemption was enacted on August 30, 2018 and was made retroactive back to August 1, 2017 when the State of Delaware increased the transfer tax from 1.5% to 2.5% on the state portion, so effective immediately, Delaware First Time Home Buyer‘s portion f the State transfer tax is reduced from 1.25% to 0.75%. The Seller’s portion remains at 1.25%. The first time home buyer exemption applies to purchase price of up to $400,000. If purchase price is above $400,000 then the Delaware first time home buyer pays the full 1.25% on the amount above $400,000.

The transfer tax in Delaware is currently 4% of the sales price with the State portion at 2.5% and the county portion at 1.5%. The transfer tax is commonly split evenly between the buyer and the seller so buyer pays 2% and the seller pays 2%. First time home buyers have been exempt from the county portion of 0.75% as long as the property is not located inside a municipality such as the town of Middletown. Now Delaware first time home buyers are exempt from 0.5% of the state portion up to $400,000 so the total exemption is 1.25% of the 2% paid by the home buyer. So essentially a first time home buyer could pay only 0.75% which can save thousands of dollars.

Who Qualifies for the Delaware First Time Home Buyer State Transfer Tax Refund?

Individuals who purchase their first home after August 1, 2017 and paid the increased Delaware State transfer tax rate of 1.25% to the buyer may be entitled to request a refund from the Delaware Division of Revenue. The refund is 0.5% of the purchase price up to $400,000 so max amount one can get back as a refund is $200,000. The time to process the refund being quoted by State of Delaware is 4-6 weeks.

What if you never owned a home but your spouse has, Do you qualify for the first time home buyer rate reduction?

The short answer is No. Unfortunately the law requires that every person who purchases the property must have never owned an interest in a residential real estate in the past so even if owned an investment property, you would not meet definition of first time home buyer. Now if your spouse is not on the mortgage, the sales contract and is not on the deed to the property you are buying, then you would be eligible for the rate reduction.

Delaware First Time Home Buyer State Transfer Tax Exemption Retroactive!

The first time home buyer exemption is retroactive back to August 1, 2017 for all first time home buyers that paid the increased transfer tax since August 1, 2017. There will be an application to send in for a refund of the money collected at settlement for the increased transfer tax. Anyone who entered into a sales contract prior to August 1, 2018 and closed after August 1, 2018 was exempt from the property tax increase so they would not be entitled to a refund.

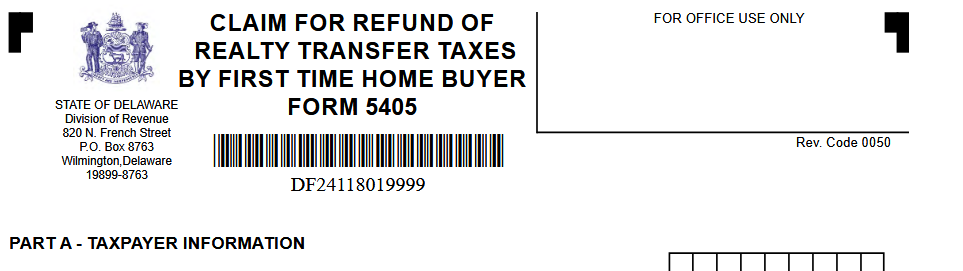

To request a refund of the state transfer tax increase, complete Form 5405 and submit it to the Delaware Division of Revenue. They will process the refund request and issue the refund directly to the home buyer. Get your copy of Form 5405 at this Link: LINK FOR FORM 5405

Below is Example of the Form:

How Much Will I Save with Delaware State Transfer Tax Exemption for first time home buyers?

Delaware first time home buyers will save 0.5% of the purchase price up to $400,000 so how much you save depends on the purchase price of your home. Below is an example calculation of how much a Delaware home buyer will save:

Purchase Price – $250,000

Total Delaware Property Transfer Tax – $10,000 (4%)

Seller Portion of Transfer Tax – $5,000 (2%)

Buyer Portion of Transfer Tax – $5,000 (2%)

- State Portion – $3,125 (1.25%)

- County Portion – $1,875 (0.75%)

First Time Home Buyer Exemption from State of Delaware – $1,250 (0.5%)

So Will Save $1,250 of the state transfer tax on the purchase of a $250,000 home in Delaware. The county portion of $1,875 may also be exempt for Delaware First Time Home Buyers if property is located in the county and not inside the city limits of a municipality.

How do you claim the Delaware First Time Home Buyer State Transfer Tax Exemption at Settlement after August 30, 2018?

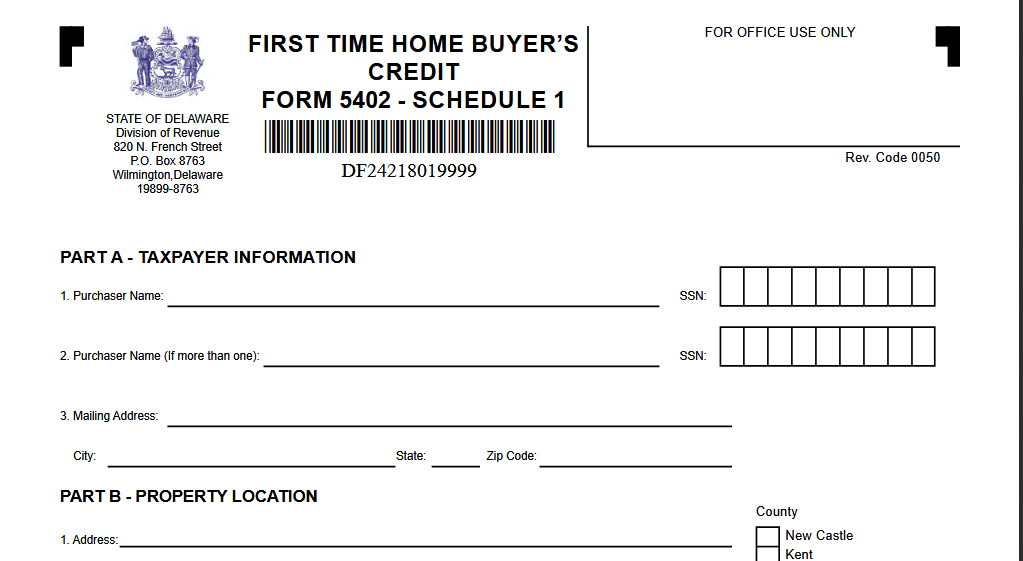

If you have not yet purchased a home, the settlement attorney handing the real estate closing should fill out Form 5402 schedule 1 at the time of settlement and will submit it to the Delaware Division of revenue on your behalf so you will not have to pay the transfer tax of 0.5% at the closing. You must have not ever owned a home and must occupy or intend to occupy the property within 90 days after the date on which the purchase closed.

Below is Example of the Form:

If you have questions or need help with a Delaware Mortgage Loan, please give the John Thomas Team a call at 302-703-0727 or you can APPLY ONLINE