Mortgage Rates Weekly Update [September 10 2018]

Mortgage Rates Weekly Update for September 10, 2018

Mortgage Rates Update for September 10, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week higher as mortgage bonds sold off on Friday after the August Jobs Report was released. If you look at the mortgage bond chart below you can see mortgage bonds started the week on Tuesday by selling off and continued on Wednesday but were able to find a floor of support and produce a good technical signal that was followed through on Thursday with a rally shown with the green candle. Mortgage bonds on Friday sold off and gave back all the gains after the jobs report was released. Mortgage bonds broke through the floor of support at the 100 day moving average and broke through another floor of support set back on August 3rd. With more room to the downside for mortgage bonds, we are recommending LOCKING your mortgage rate to start the week to protect yourself from mortgage interest rates moving higher.

In Economic News

The Jobs Report for August 2018 was released on Friday and came in at 201,000 jobs created which was above expectations of 195,000 jobs. There was a net revision of 50,000 less jobs created for June and July in the report. The Unemployment Rate remained stable at 3.9% which is the lowest since May 2018. The jobs report contains two surveys, the Business Survey and the Household Survey. The Business Survey is used for the headline jobs which was the 201,000 jobs created. The Household Survey is used for the unemployment rate and it showed 423,000 jobs lost and at the same time the labor force dropped by 469,000 so unemployment stayed the same at 3.9% but not for the right reasons! The Labor Force Participation Rate (LFPR) dropped from 62.9% to 62.7%.

The Reason mortgage bonds sold off on Friday was because the hourly average earnings increased by 0.4% to year over year rate of 2.9% which is the highest wage inflation in 9.5 years.

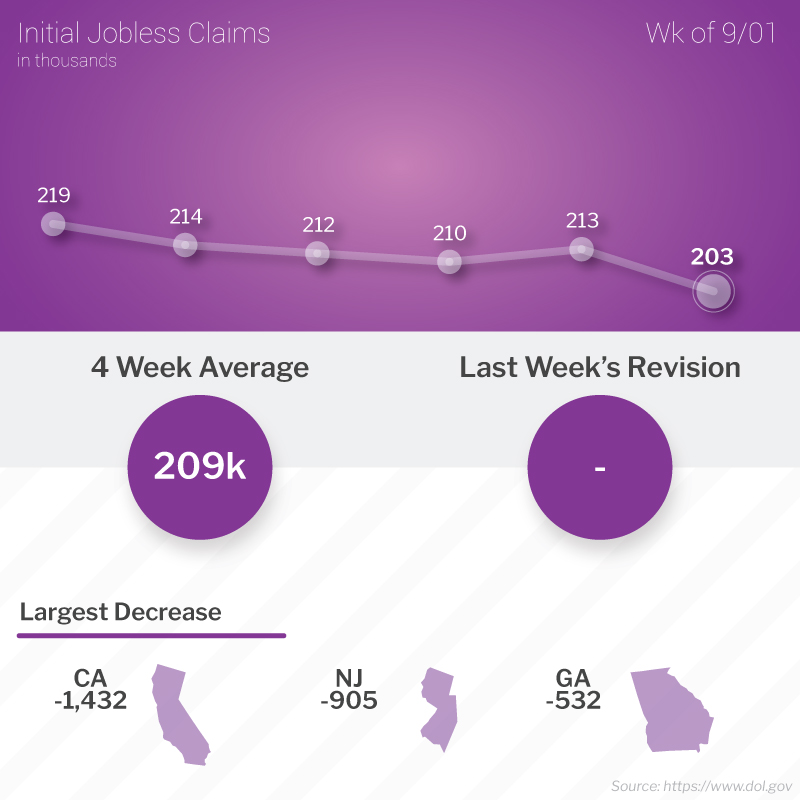

Weekly Initial Jobless Claims were released on Thursday and decreased 10,000 claims to 203,000 claims for the week. This was the lowest level in almost 49 years which is very strong. The labor market continues to be very tight with employers holding on to employees and having tough time finding good employees to fill positions. This is supported by the low unemployment rate of 3.9%.

The Week Ahead in Mortgage Rates

For the Week of September 3, 2018 thru September 7, 2018

Wholesale Inflation with Producer Price Index (PPI) on Wednesday

Consumer Inflation with Consumer Price Index (CPI) on Thursday

Weekly Initial Jobless Claims on Thursday

Retails Sales and Consumer Sentiment Index on Friday

In Housing News

CoreLogic Home Price Index for July 2018 was up 0.3% from June 2018 and year over year home prices are up 6.2%. Home Prices appreciation is decelerating which means home prices are STILL going up, they are just going up at a slower pace than previously. For example, home prices increased 7.1% year over year in May 2018 and dropped to 6.8% year over year in June 2018 and are now at 6.2% year over year in July 2018. Home prices are NOT dropping, just the rate at which home prices increase is slowing. Corelogic predicted home prices will be up 5.1% from July 2019 so home prices are predicted to continue to increase and the pace is predicted to continue to decelerate. This means housing is still a good investment as the value of homes will continue to increase.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday September 22, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday September 26, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday September 29, 2018 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday October 27, 2018 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam