Mortgage Rates Weekly Update [September 18 2017]

Mortgage Rates Update for September 18, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

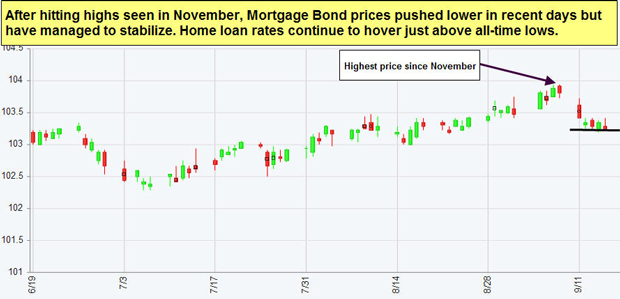

Mortgage Rates moved lower last week after hitting the lows since November 2016 the previous week. If you look at the mortgage bond chart below you can see bonds hit a tough ceiling of resistance the previous week which was the highest price seen since November. Mortgage bonds were turned lower as the stock market rallied pushing mortgage bonds down to the next floor of support which did hold last week. With mortgage bonds sitting on a floor of support we are recommending FLOATING your mortgage rate to start the week to see if mortgage bonds can rally higher off support and move interest rates lower.

In Economic News

Consumer Price Index (CPI) for August 2017 had the biggest one month increase in seven months rising 0.4% from July 2017. CPI measures inflation at the consumer level. The big jump in consumer inflation was attributed to a spike up in gasoline prices from Hurricane Harvey. The Core CPI which stripes out food and energy was in line with expectations of a 0.2% rise.

The Producer Price Index (PPI) for August 2017 came in at expectations and was 2.4% year over year. The PPI measures inflation at the wholesale level. Inflation is a measure we closely monitor because an increase in inflation will translate into higher interest rates.

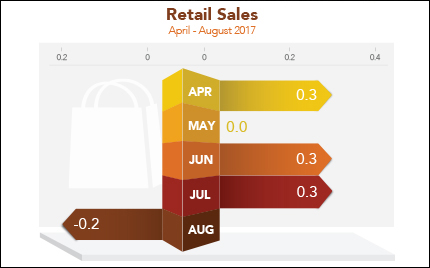

Retail Sales for August 2017 was reported on Friday by the US Commerce Department and it was below expectations as sales dropped 0.2% from July. Consumers pulled back from Back to School Shopping and a drop in auto sales in southern Texas from Hurricane Harvey. Online Sales were down 1.1% which was the biggest drop since April 2014.

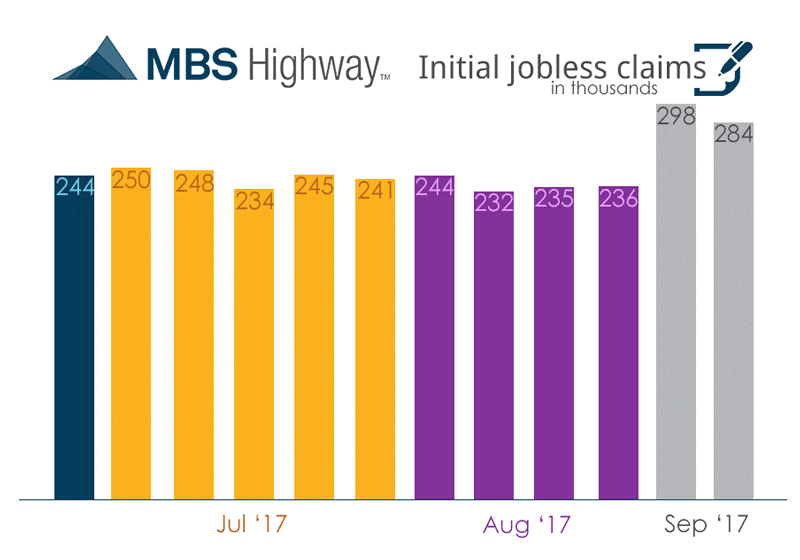

Weekly Initial Jobless Claims were released on Thursday and dropped 19,000 claims to 284,000 claims for the week. These numbers continue to be skewed from Hurricanes Harvey in Texas and Irma in Florida and will probably continue once power has been restored and people can file claims in areas without power now.

In Housing News

CoreLogic Released its Loan Performance Insights for June 2017 which showed loans that are 30 day past due remained stable at only 4.5% of all mortgage loans. The report also showed that seriously delinquent loans dropped from 2.0% to 1.9%. Seriously delinquent homes that are in foreclosure remained stable at 0.7%. This shows the housing market doing very well.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday September 23, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage