Mortgage Rates Weekly Update [July 23 2018]

Mortgage Rates Weekly Update for July 23, 2018

Mortgage Rates Update for July 23, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

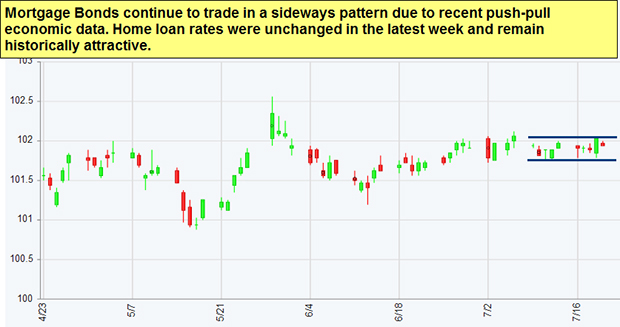

Mortgage Rates ended the week about where they started as mortgage bonds failed to break above the 100 day moving average again. If you look at the mortgage bond chart below you can see mortgage bonds have been stuck trading in a sideways pattern and have been unable for several weeks to break out higher by closing above the 100 day moving average to mount a rally higher in bonds which would move mortgage interest rates lower. We are recommending LOCKING your mortgage rate on any loans closing in the next 30 days, if you are more than 45 days out you could float to see if mortgage bonds can get some momentum to break through the 100 day moving average but if bonds break below the floor of support we would recommend switching to a locking stance.

In Economic News

The US Dollar has strengthened against other currencies such as the Chinese Yuan and the Euro. If this trend continues foreign buyers of US Real Estate could take a step back from purchasing. Foreign buyers are an important component in the US Housing Market in some parts of the United States. US real estate is becoming pricy because of appreciation and now because of the strength in the dollar, currency exchange is becoming more expensive. For Example a Chinese Investor seeking to purchase US Real Estate has to now pay 8.5% more due to the currency exchange rate moving up on the strength of the Dollar against the Yuan. This situation could get worse before it gets better because the Fed Chair Powell said they will continue with their gradual hikes in the Fed Funds Rate which strengths the Dollar every time they raise the Fed Funds Rate.

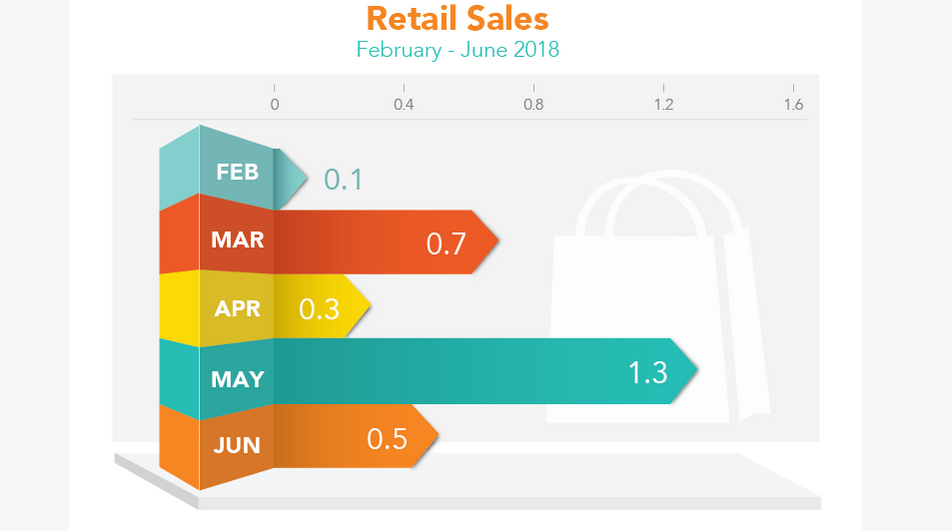

Retail Sales for June 2018 were up 0.5% from May 2018 as reported by the US Commerce Department last Monday. May was revised higher from 0.8 percent to 1.3 percent. Retail Sales have increase 6.6 percent from June 2017 to June 2018. This was a good report on consumer spending and the report showed that consumers spent their money on health, personal care, motor vehicles, gas, nonstore retailers and food services. If we look at the average Retail Sales for the past 5 months it is 0.58% so we were almost right at the average for June.

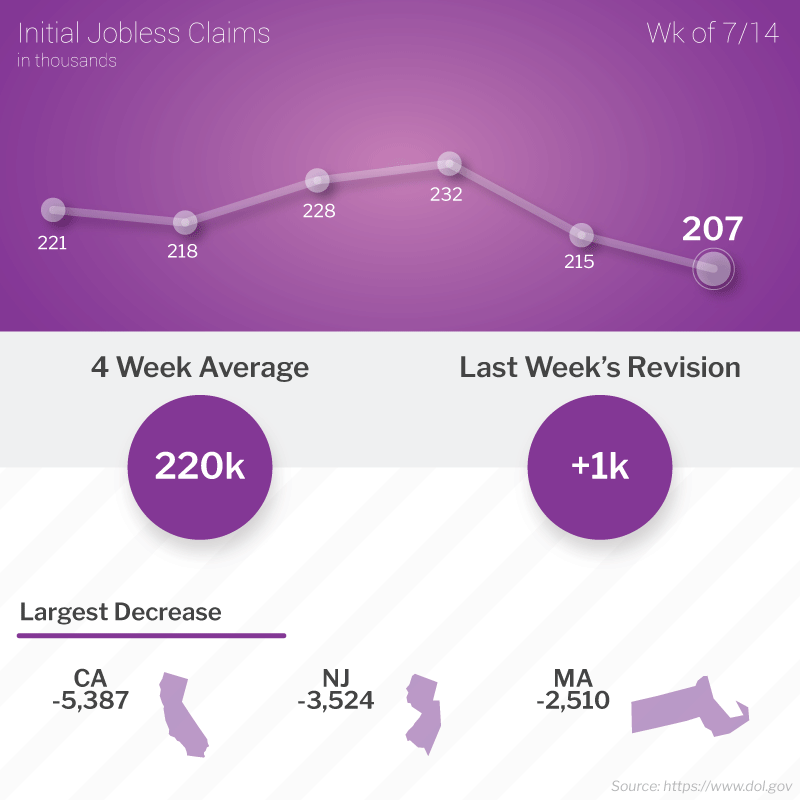

Weekly Initial Jobless Claims were released on Thursday and showed a drop of 8,000 claims to 207,000 claims for the week. This was the lowest level of initial jobless claims in 49 years! The weekly initial jobless claims report shows that the jobs market remains very tight and employers are holding onto their workers and firing less. This week was also the “Sample Week” to be used in the Jobs Report for July 2018 by the Bureau of Labor Statistics. This very low claims number points to a strong Jobs Report which comes out August 3, 2018.

In Housing News

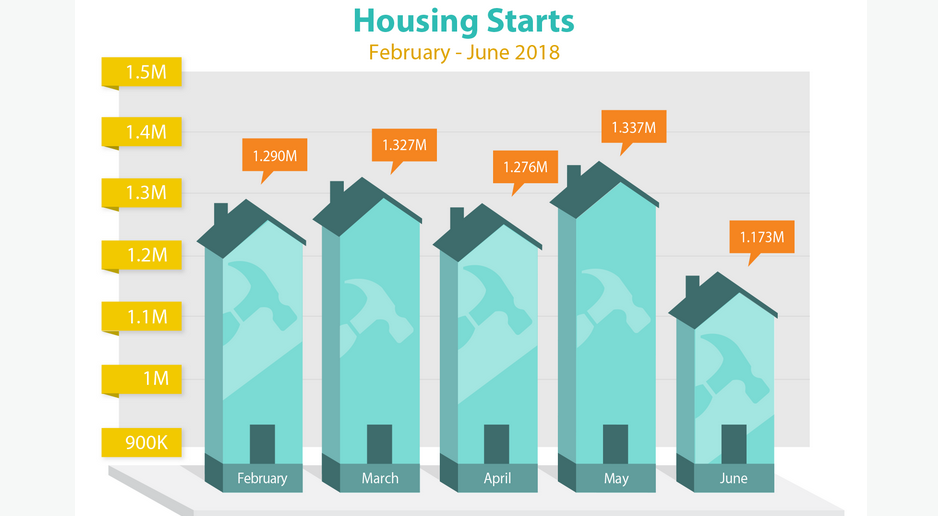

Housing Starts for June 2018 plunged from May 2018 by 12.3 percent to an annual rate of 1.173 million units which was below the expectations of 1.318 million units. U.S. homebuilders broke ground on fewer homes in June and it was the lowest level of housing starts since September 2017. Building Permits for June 2018 declined 2.2% from Mary 2018 to an annual rate of 1.273 million which was below expectations of 1.330 million units. Building permits is a sign of future construction so this could show a slight slow down in new home construction.

Home Price Appreciation Forecast for Next Year

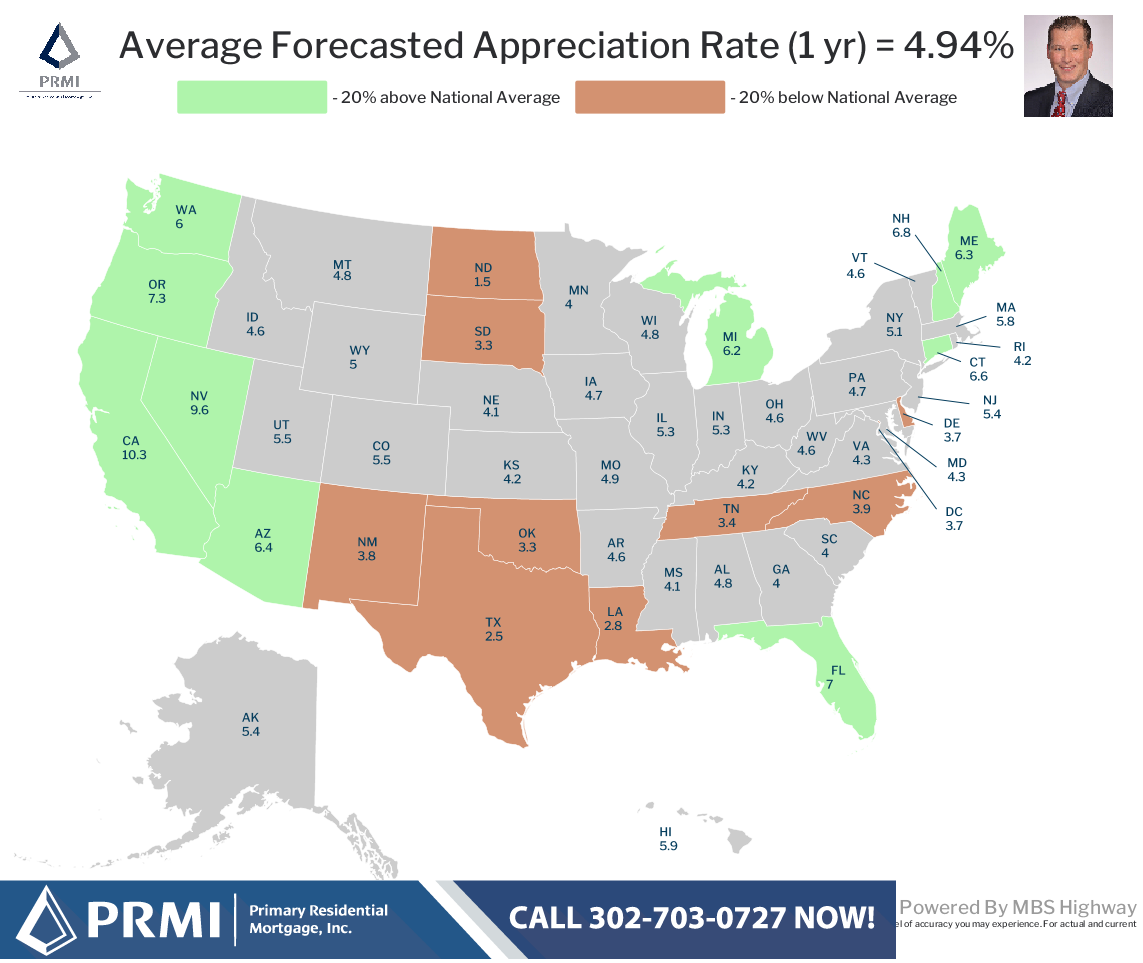

Below is picture showing the home price appreciation rate forecast for each state from July 2018 to July 2019. Highlight are as follows:

Delaware Home Price Appreciation Rate – 3.7%

Maryland Home Price Appreciation Rate – 4.3%

New Jersey Home Price Appreciation Rate – 5.4%

Pennsylvania Home Price Appreciation Rate – 4.7%

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Saturday July 28, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday August 22, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam