Mortgage Rates Weekly Update [July 16 2018]

Mortgage Rates Weekly Update for July 16, 2018

Mortgage Rates Update for July 16, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were unable to break out above the 100 day moving average last so mortgage rates ended the week about where they started. If you look at the mortgage bond chart below you can see mortgage bonds traded in a tight channel last week after failing to continue to rally from previous week and fell back below the 100 day moving average. Bonds closed right at the top of the channel to end the week but failed to break through so we are recommending LOCKING your mortgage rate on any loans closing in the next 30 days, if you are more than 45 days out you could float to see if mortgage bonds can get some momentum to break through the 100 day moving average but if bonds break below the floor of support we would recommend switching to a locking stance.

In Economic News

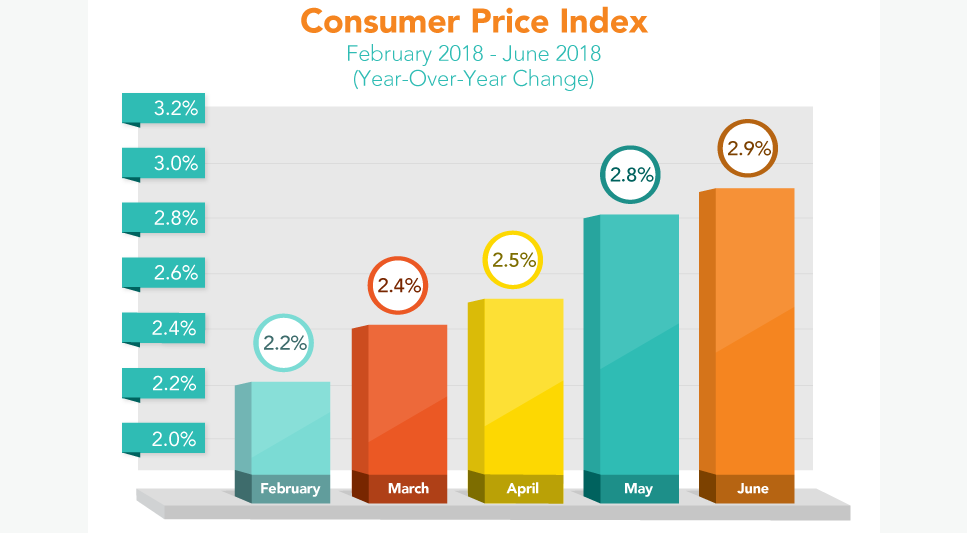

Consumer Price Index for June 2018, which measures consumer inflation, was released last week and moved higher by 0.1% to 2.9% for the 12 month period which was up slightly from 2.8% in May 2018. June’s CPI reading of 2.9% was the largest annual increase since February 2012. The increase in consumer inflation was led by higher energy costs. The Producer Price Index for June 2018, which measures wholesale inflation, rose by 0.3% which grew from 3.1% to 3.4%. This is a big jump and shows that producer inflation is heating up.

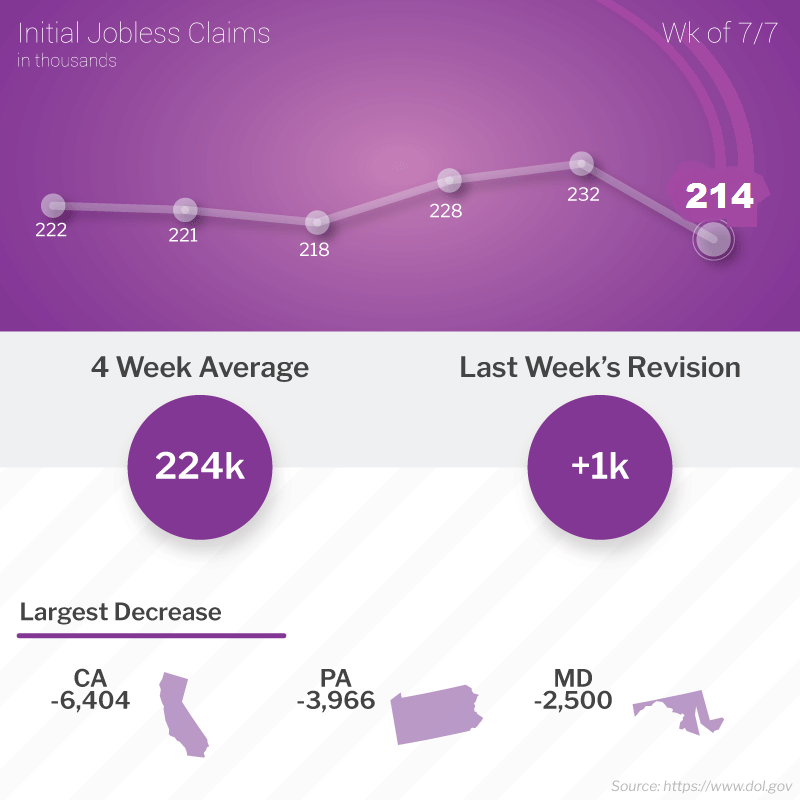

Weekly Initial Jobless Claims were released on Thursday and showed a decrease of 18,000 claims to 214,000 claims for the week. This was an extremely low level of claims, showing that the jobs market remains tight and employers are holding onto their workers and firing less. We would predict that we should see wage pressured inflation in the near future. Increase in wage inflation would be bad for mortgage bonds in the long term.

In Housing News

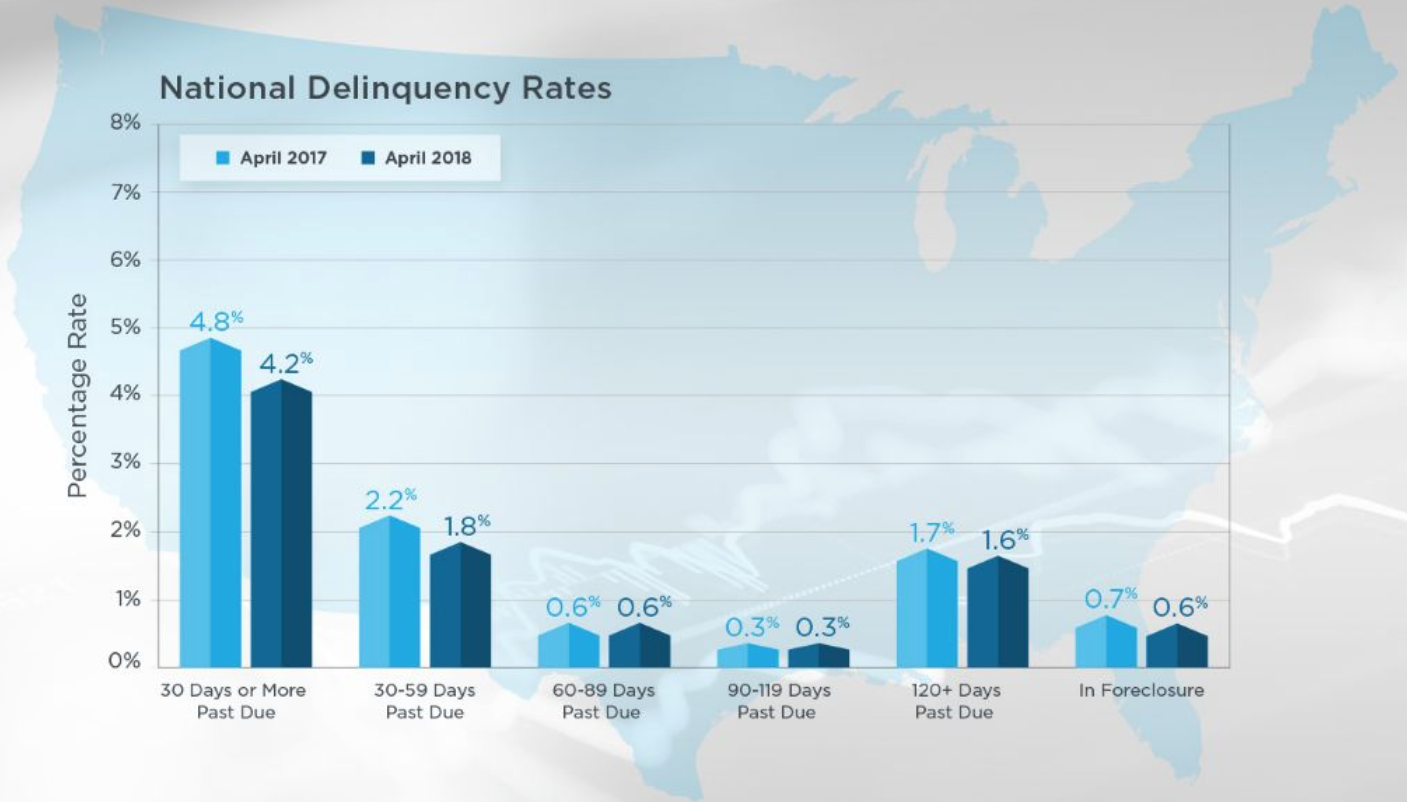

CoreLogic released their Loan Performance Insights for April 2018 showing that loans 30 days or more past due decreased from 4.3% to 4.2% and seriously delinquent loans, which is defined as 90 days or more past due, remained stable at 1.9%. Seriously delinquent homes in foreclosure also remained stable at 0.6%.

Rent Vs Buy Analysis for July 2018:

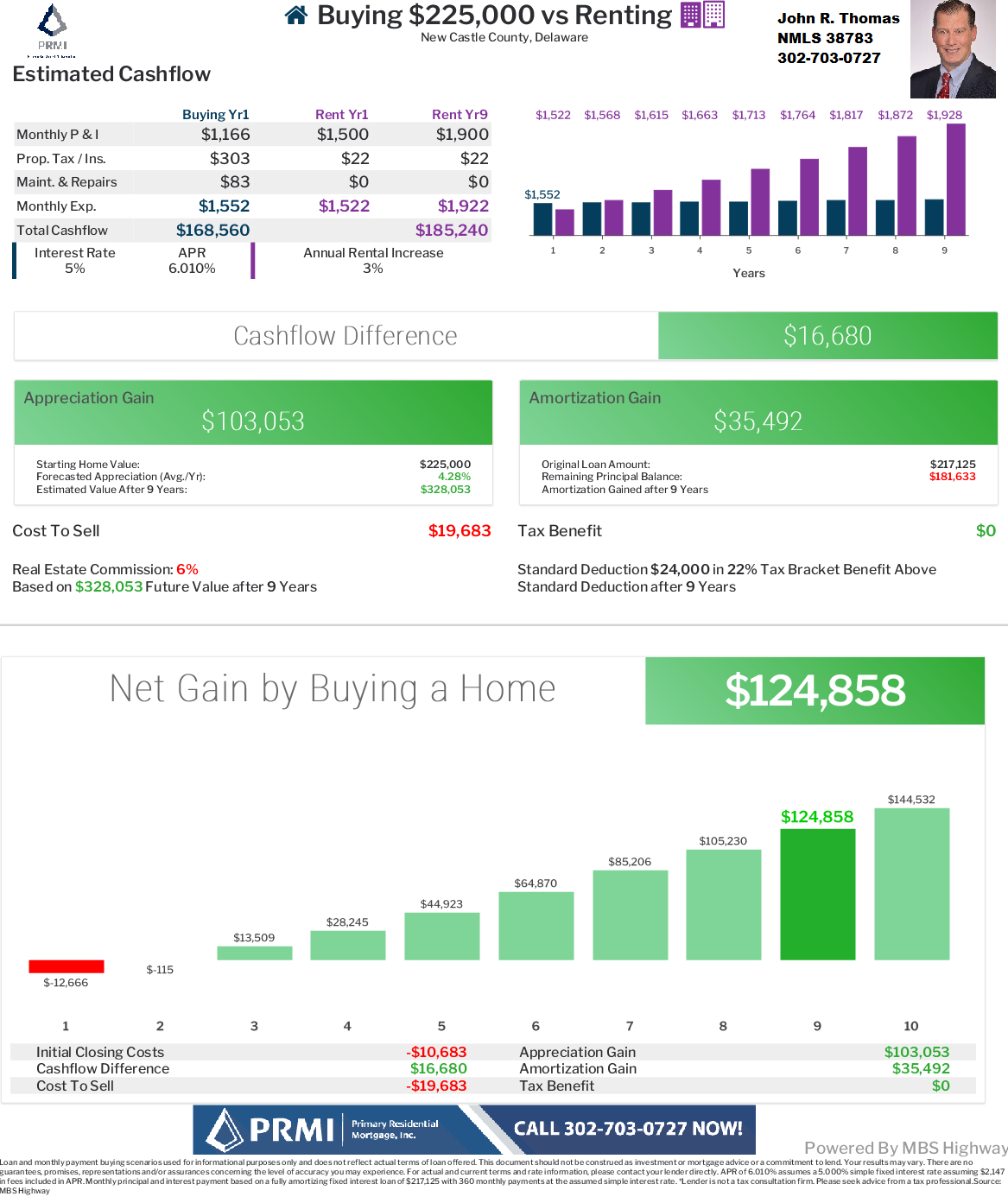

If we compare a person buying a $225,000 Home and paying $1,552 for a mortgage versus Renting a home for $1,500 per month. Owning the home nets a person $124,858 after 9 years!! Average rental payment after 9 years would be $1,928 while mortgage payment is still about $1,552. View the info graphic below for more information:

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday July 18, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday July 28, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam