Mortgage Rates Weekly Update [July 30 2018]

Mortgage Rates Weekly Update for July 30, 2018

Mortgage Rates Update for July 30, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

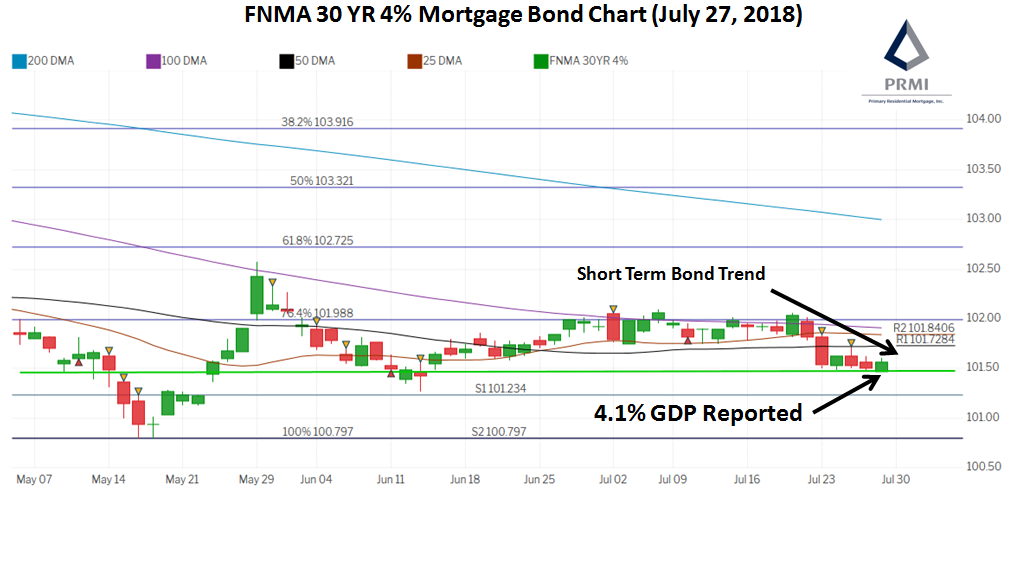

Mortgage Rates ended the week lower as mortgage bonds broke beneath the 50 moving average. If you look at the mortgage bond chart below for hr Fannie Mae 30 year 4.0% coupon, you can the short term trend is for mortgage bonds to sell off and move mortgage interest rates higher. Bonds rallied off a very weak support line in Green after GDP was reported on Friday. We are recommending LOCKING your mortgage rate to start the week as mortgage bonds are trading below the 50 day moving average and have a lot of room to move lower if break below current levels.

In Economic News

Stock Market rallied to end the week after the United States (US) was able to get the European Union (EU) to give concessions to the US to keep from having a trade war. The EU agreed to lower industrial tariffs that have been in place against US industrial goods and also agreed to import more soybeans and natural gas from the US. President Trump and European Commission President Juncker agreed to work to zero tariffs trade policy and agreed to not impart any new tariffs while talks continue.

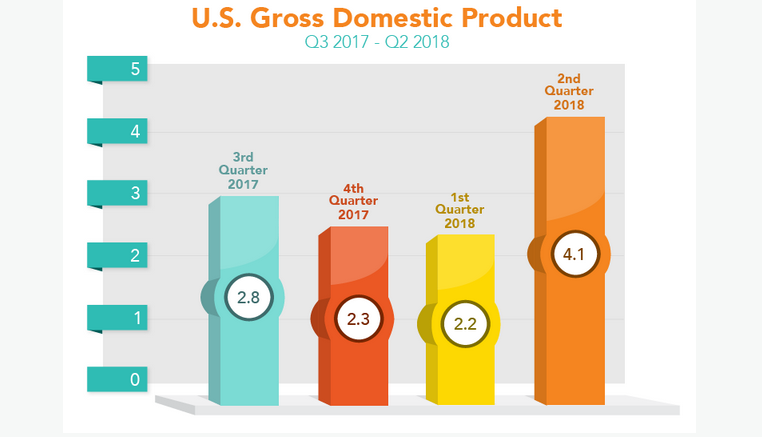

Gross Domestic Product (GDP) for 2nd quarter surged higher to 4.1% from 1st quarter reading of 2.2% based in part on a big rise in consumer spending by 4 percent compared to only 0.5 percent in the quarter GDP is a measure of the value of all finished products and services produced in a country’s borders for a specific period of time and is considered the broadest measure of economic activity. This is the highest GDP reading

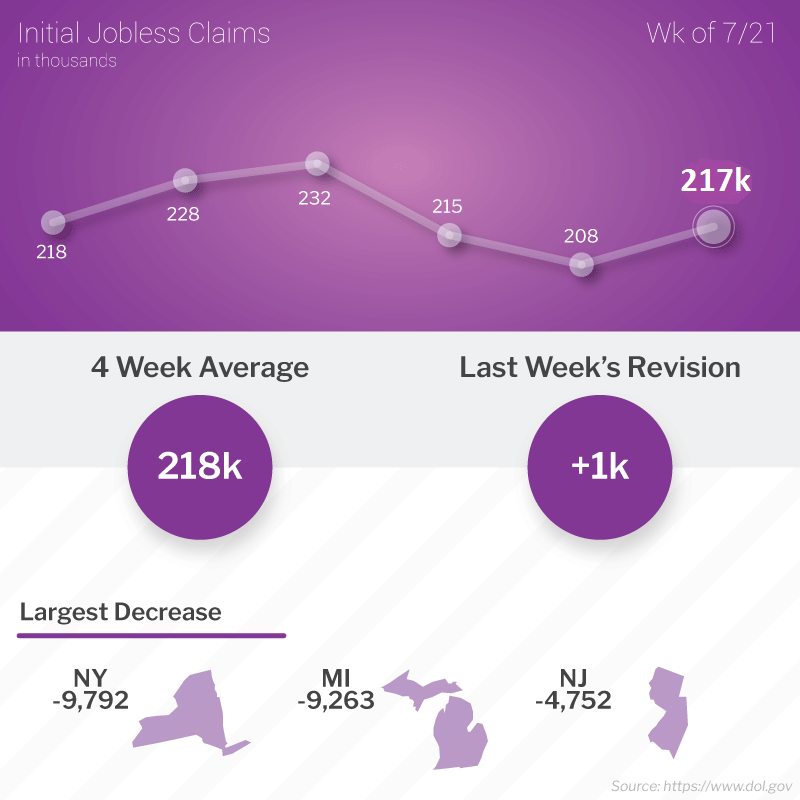

Weekly Initial Jobless Claims were released on Thursday and showed an increase of 9,000 claims to 217,000 claims for the week. The previous week’s claims is the “sample week” to be used in the Bureau of Labor Statistics Job Report for July 2018 and claims were revised higher by 1,000 claims from 207,000 to 208,000. This is still historically low number initial jobless claims so points to a very strong jobs report this Friday. In order for someone to qualify for Unemployment Insurance Benefits, a person must:

- have lost a job through no fault of his or her own

- be “able to work, available to work, and actively seeking work”

- have earned at least a certain amount of money during a “base period” prior to becoming unemployed

The Week Ahead in Mortgage Rates

For the Week of July 30 thru August 3, 2018

Economic Data will be plentiful this week as reports coming out will cover a wide portion of the U.S. Economy.

Jobs Report for July 2013 will be front and center when it is report this Friday August 3, 2018

And If that wasn’t enough, the two-day Federal Open Market Committee (FOMC) meeting kicks off on Tuesday

In Housing News

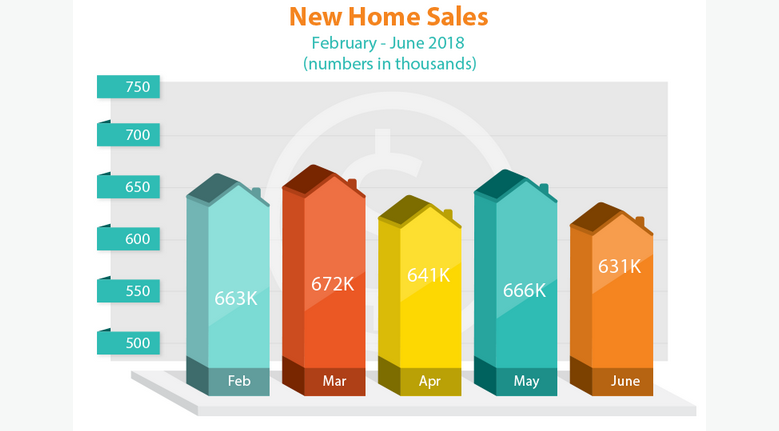

New Homes Sales for June 2018 were released last week and fell 5.3 percent from May 2018 to 631,000 units on an annualized basis. Sales for new single family homes dropped to an eight month low but new home sales are still up 2.4% year over year. The median new home price is $302,000.

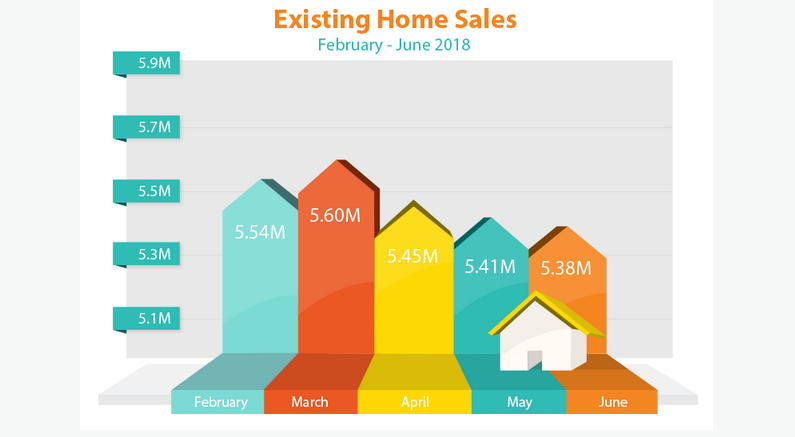

Existing Home Sales for June 2018 were down 0.6% to 5.3 million units on an annualized basis. The was lower than expectations of a 0.4% gain in exising home sales. Existing Home Sales are down 2.2% year over year from lack of inventory and higher mortgage interest rates. The median Existing Home Sale Price was reported at $276,900 which is an all time high and up 5.2% year over year.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Saturday August 18, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday August 22, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam