Mortgage Rates Weekly Update for May 25, 2015

Mortgage Rates weekly market update for the Week of May 25, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

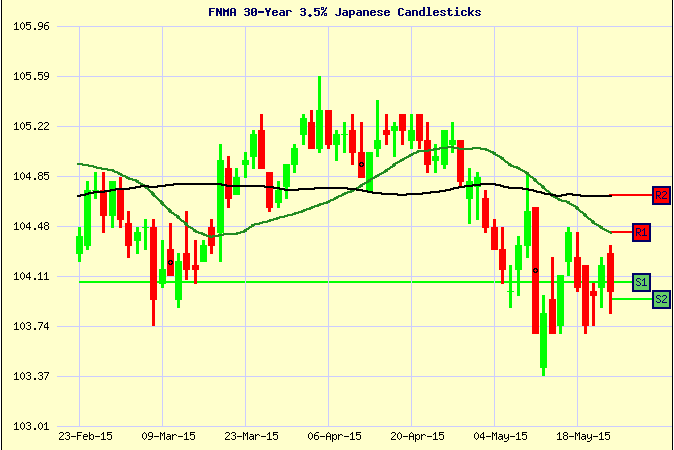

Mortgage Rates rose last week after the previous week’s move lower. If you look at the mortgage bond chart below you can see mortgage bonds sold off Monday and Tuesday to start the week which moved mortgage interest rates higher. Bonds broke below the 200-day moving average and below the 2-year long term trend line on Tuesday. This could have been very bad for mortgage rates but bonds were able to rally higher on Wednesday and close above the 200-day moving average. Mortgage bonds ended the week above the 200 days moving average so we are recommending FLOATING Your mortgage rate to start the week to see if bonds can move higher off the 200-day moving average and move interest rates lower.

In Economic News, Inflation came out hotter than expected on Friday with the report of the Consumer Price Index (CPI) for April 2015 increasing 0.3% from March to April. This was the biggest monthly gain on consumer inflation since January 2013. If inflation starts to increase on a regular basis this could be bad news for mortgage bonds.

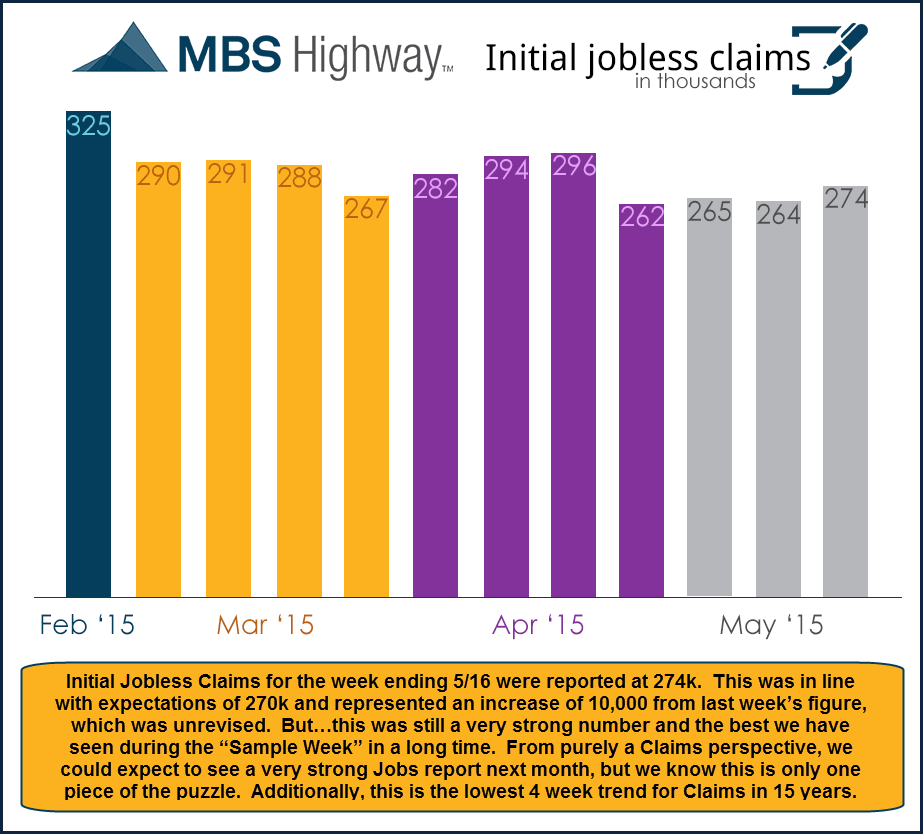

Weekly Initial Jobless Claims raised 10,000 claims to 274,000 claims for the week. This was another strong report for jobless claims and it is the week that will be used for the Jobs Report for May 2015. This could point to a better than expected Jobs Report for May 2015 which could move mortgage rates higher.

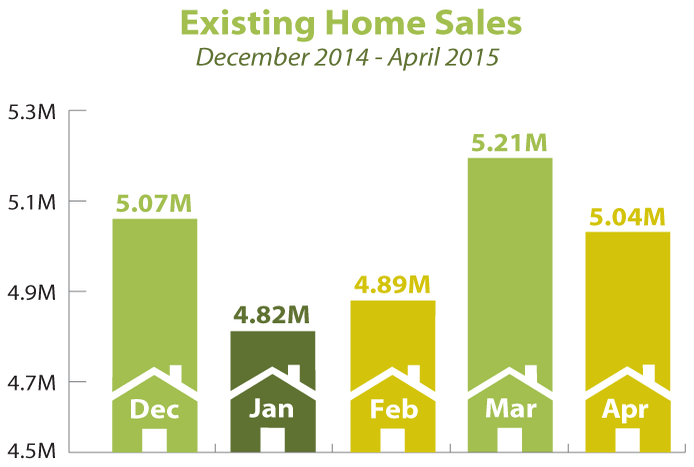

In Housing News, Existing Homes Sales for April 2015 dropped 3.3% from March to 5.04 Million units on an annualized basis. Despite the drop in existing home sales from March, sales are still up 6.1% from a year ago and the median home price for an existing home sale was up nearly 9% to $219,000 from April 2014.

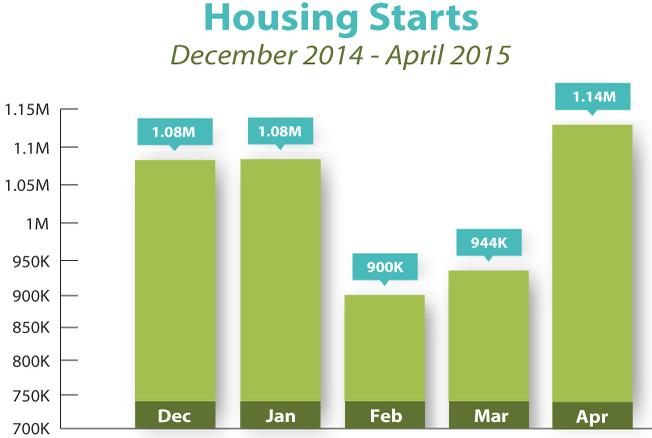

In New Home Construction, Housing Starts for April 2015 rose 20% above March to 1.14 Million Units on an annualized basis. Building Permits for April 2015 were up 10% from March to 1.143 Million Units. These were both solid reports for Home Builders and could signal a strong second quarter.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 5/15/2015 they are working on reviewing files that have been submitted on 4/23/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, May 30, 2015, n Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713