Mortgage Rates Weekly Update [February 5 2018]

Mortgage Rates Weekly Update for February 4, 2018

Mortgage Rates Update for February 4, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved sharply higher again last week as mortgage bonds sold off all week. If you look at the mortgage bond chart below you can see mortgage bonds continued the downward trend and bonds broker below another floor of support as US Treasury rates continue to move higher. We are recommending LOCKING your mortgage rate as mortgage bonds have more room to move downward which would move mortgage interest rates higher.

In Economic News

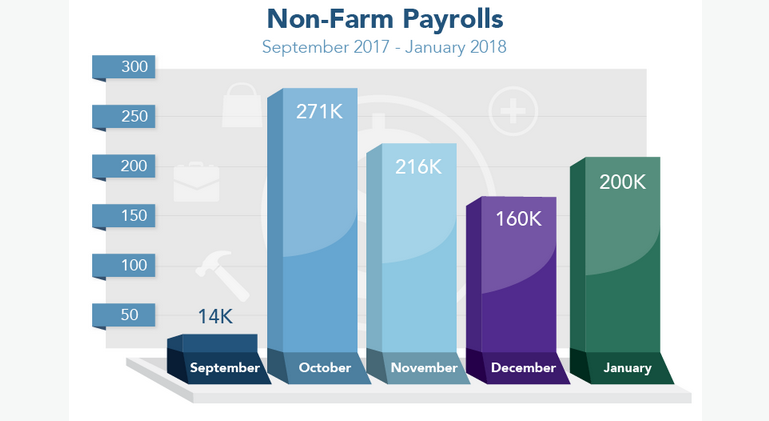

The Jobs Report for January 2018 was released on Friday and showed 200,000 jobs were created which was above expectations of 175,000. The Unemployment Rate remained the same at 4.1% but the U6 Unemployment Rate moved up from 8.1 t o 8.2%. The report did show a significant rise in annual wage growth, it rose from 2.5% to 2.9% on a year over year basis from last month. Wage growth inflation is the enemy of mortgage bonds and is the big factor that caused mortgage bonds to sell off on Friday even in the face of the DOW Jones Stock Index dropping over 600 points.

Inflation remained tamed as the Core Personal Consumer Expenditures (PCE) for December 2017 came in at 1.5% year over year which remains well below the Feds target of 2.0%. Low inflation is bond friendly news.

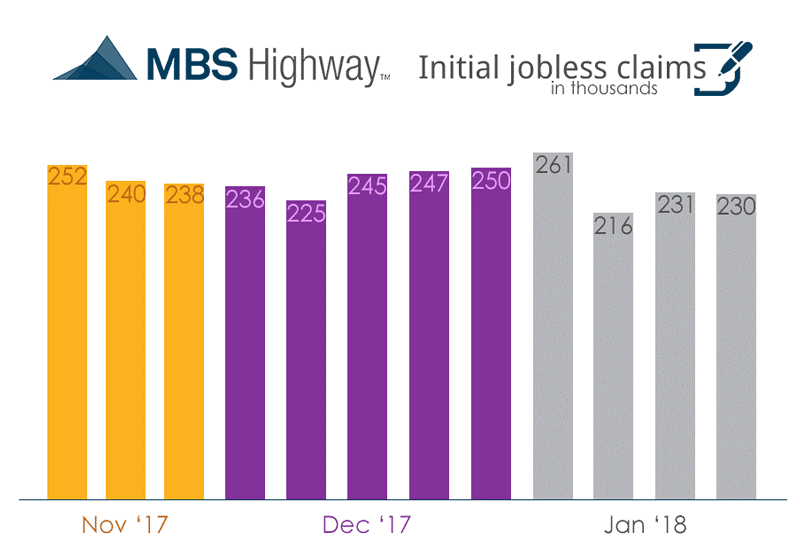

Weekly Initial Jobless Claims dropped 1,000 claims to 230,000 claims for the week. Weekly initial jobless claims measure the number of individuals filing for unemployment benefits for the first time. This report was better than expectations of 235,00 claims and is another solid report on the labor market.

In Housing News

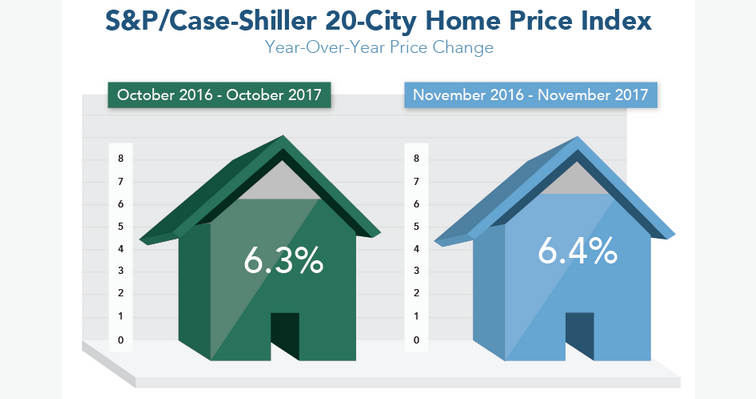

The S&P Case Shiller 20 City Home Price Index for November 2017 was up 6.4% year over year which was up 1.0% from October 2017. Home prices continue to rise as low inventory puts upward price pressure on home values. Home prices are rising three times faster than inflation and mat continue to do so as long as inventory stays low.

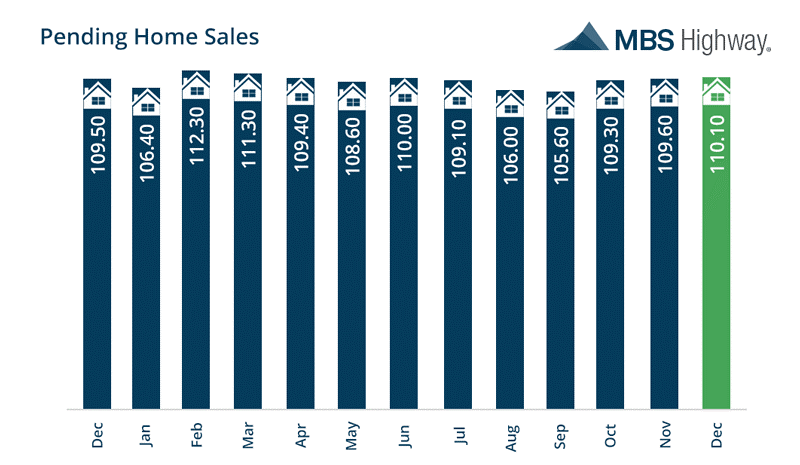

Pending Home Sales for December 2017 were up 0.5% to 110.1 reading on the index. Pending home sales are also up 0.5% year over year. Low Inventory is holding down the sales of existing homes and pushing home prices up.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday February 10, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday February 21, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates