Mortgage Rates Weekly Update [February 19 2018]

Mortgage Rates Weekly Update for February 19, 2018

Mortgage Rates Update for February 19, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

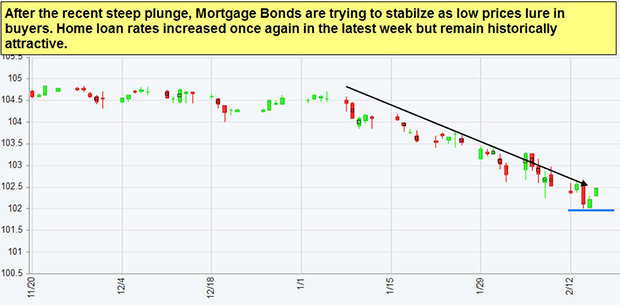

Mortgage Rates were able to finally stabilize last week after mortgage bonds found a floor of support. If you look at the mortgage bond chart below you can see mortgage bonds were able to bounce higher off a floor a off support (Blue Horizontal line) and end the week higher just below a ceiling of resistance. We are recommending FLOATING your mortgage rate to start the week to see if mortgage bonds can continue to rally break through the ceiling of resistance which would move mortgage interest rates lower. The long term trend is still for mortgage rates to move higher but in the short term we might be able to catch a slight improvement in interest rates by floating. If mortgage bonds switch course and break below the support from last week, we will quickly switch to a locking stance.

In Economic News

Redfin conducted a survey among potential home buyers to see what affect higher mortgage rates would have on their buying decisions in the next 12 months if mortgage interest rates rose above 5%. Only 6% said they would cancel their plans to purchase a home. 27% said they would slow their search in hopes rates would come back down. These people are missing the huge opportunity for the appreciation on their home as well as the increased costs associated with waiting they you pay over a life time.

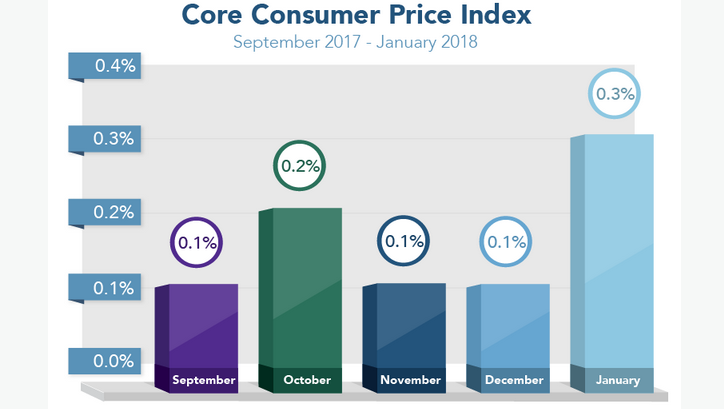

Inflation edged higher in January at the Core Consumer Price Index (CPI) for January 2018 showed an increase of 0.3% from December 2017 and is the biggest jump in over a year. The rise in consumer inflation spooked the stock and the bond market alike. Higher inflation could cause the Federal Reserve to raise the Fed Funds Rate at faster pace than anticipated. The Producer Price Index (PPI) for January 2018 came in at 0.4% increase from December and was hotter than expected. The PPI measures inflation at the wholesale level.

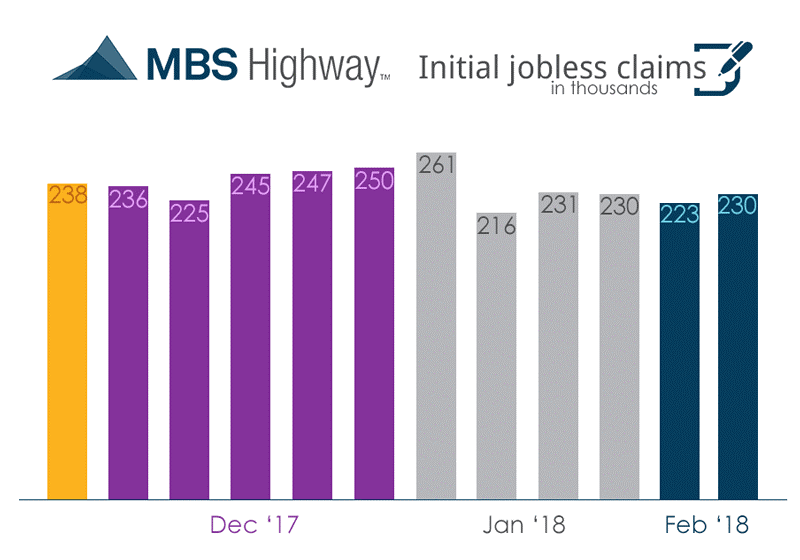

Weekly Initial Jobless Claims were released on Thursday and came out at 230,000 claims for the week which is up 7,000 claims from the previous week. The jobless claims have remained very steady as employers are having tough time finding qualified employees so are holding tight to the ones they have.

In Housing News

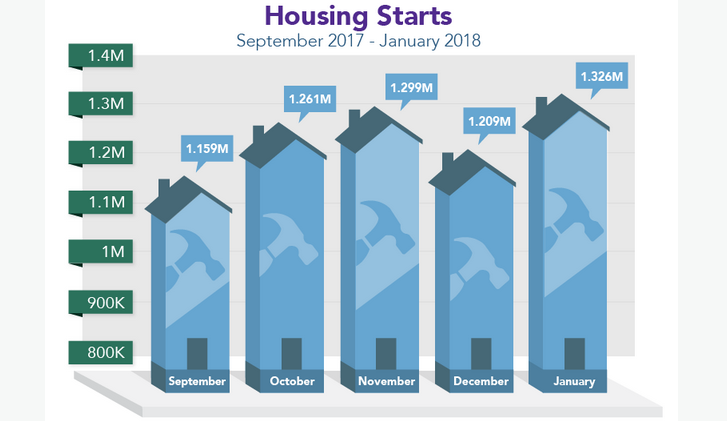

Housing Starts for January 2018 jumped higher 9.7% from December 2017 to 1.326 Million units on an annualized basis. This was the highest level for Housing Starts since October 2016 and was above expectations of 1.24 million units. Housing starts are up 7.3% from January 2017. This report shows new home construction is doing very well as we start the new year. Building Permits for January 2018 rose 7.4% from December to annual rate of 1.396 million units. Building permits are a measure of future construction so is another sign that new home construction should do very well in 2018.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Wednesday February 21, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday March 24, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday April 7, 2018 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates