Mortgage Rates Weekly Update [February 26 2018]

Mortgage Rates Weekly Update for February 26, 2018

Mortgage Rates Update for February 26, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates have been stuck bouncing slightly higher and slightly lower for the last two weeks as mortgage bonds are stuck in a sideways trading pattern. If you look at the mortgage bond chart below, you can see mortgage bonds have been bouncing off support which is the blue line in the graph and being turned lower from a tough ceiling of resistance which creates a sideways trading pattern. The long term trend is still for mortgage bonds to move lower but in the short term we can float to see if mortgage bonds can move higher and break above this trading channel which will be good for mortgage interest rates. We are recommending FLOATING Your mortgage rate to start the week.

In Economic News

The Federal Open Market Committee released the minutes from their January 2018 meeting which showed members are committed to raising the short term Fed Funds Rate three or more times in 2018. Fed Funds Rate is the overnight lending rate between banks and does not directly affect long term rates but will affect home equity lines of credit with variable rates. The Fed members also believe inflation will pick up in 2018 which is one of the reasons they are committed to raising the Fed Funds Rate.

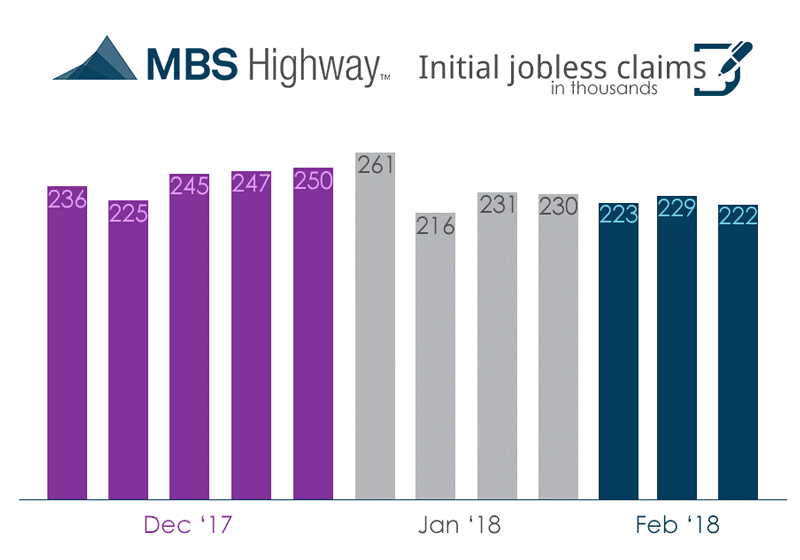

Weekly Initial Jobless Claims were released on Thursday and dropped 7,000 claims to 222,000 claims for the week. This is another great number and continues to show the labor market doing very well as employers are holding on to employees. This points to a strong March Jobs Report which will be released next Friday March 9, 2018.

In Housing News

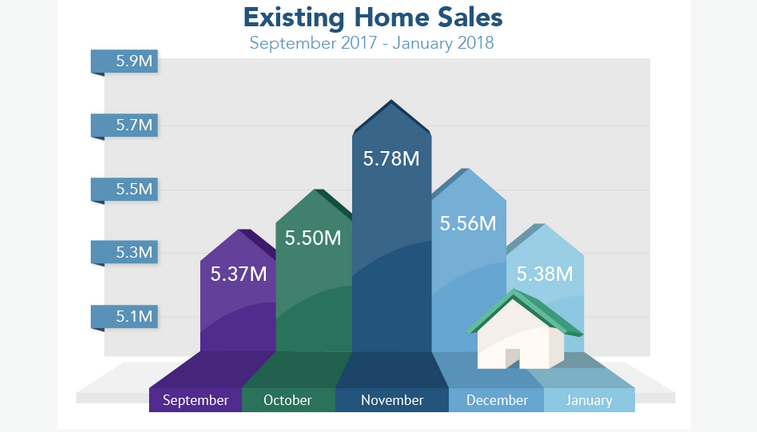

Existing Home Sales for January 2018 were down 3.2% t0 5.28 Million Units on an annualized basis. Existing Home sales are down because inventory remains tight and is getting worse. Inventory of homes for sale dropped 9.5% and has dropped for 32 consecutive months and stands at a 3.2 month supply of homes for sale. A normal market has a 6 month supply of homes for sale. The average median home price for an Existing home increased 5.8% to $240,500 in January 2018.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Saturday March 24, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday April 7, 2018 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates