Mortgage Rates Weekly Update [January 29 2018]

Mortgage Rates Weekly Update for January 29, 2018

Mortgage Rates Update for January 29, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week lower as mortgage bonds broke below support on Friday to end the week. If you look at the mortgage bond chart below you can see mortgage bonds traded sideways most of the week but broke through support on Friday as the Stock Market continues to rally. We are recommending LOCKING your mortgage rate until mortgage bonds can find a floor of support. Long term outlook is for mortgage interest rates to continue to move up throughout 2018 as the bond market looks to turn to a bear market. If Treasury yields continue to rise it will force mortgage bond prices to fall which will move mortgage rates higher.

In Economic News

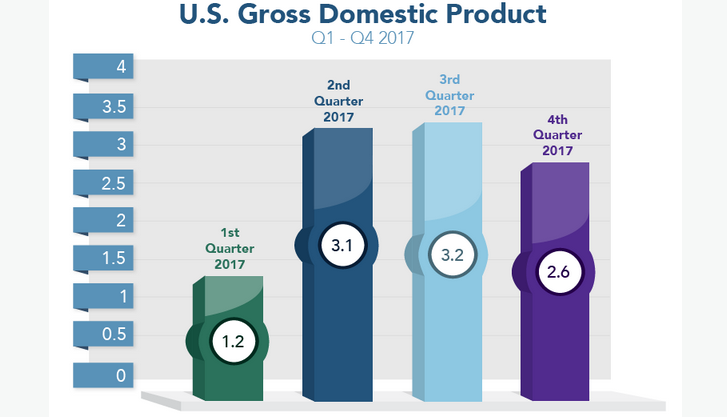

Gross Domestic Product (GDP) for the fourth quarter of 2017 came in at 2.6% on the first reading. This is slightly below the expectations of 2.9% and a drop from the third quarter reading of 3.2%. The GDP report showed that personal spending was up 3.8% and residential construction was up 11.6% while trade and inventories were lower.

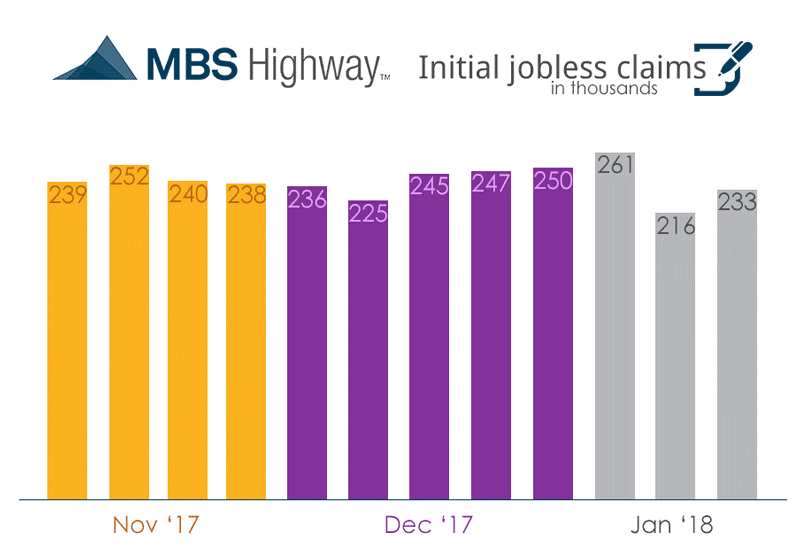

Weekly Initial Jobless Claims moved up 17,000 claims to 233,000 claims for the week. This number is still very good and well below the 300,000 which marks a point where labor market is having trouble. Last week’s report was revised lower from 220,000 claims to 216,000 claims and is also the sample week that will be used in January 2018 Jobs Report. This points to a good jobs report for January.

In Housing News

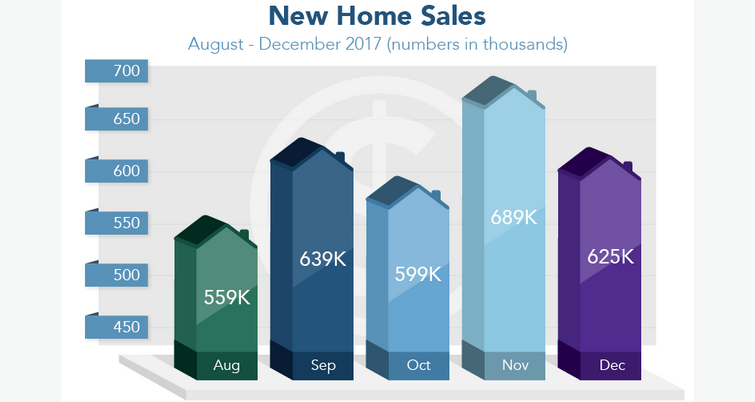

New Homes Sales for December 2017, which measures signed contracts on new homes, were down 9.3% at an annual rate of 625,000. The market was expecting a drop in New Home Sales of only 7.2%. November’s new home sales were revised lower from 733,000 to 689,000 but is still the best number in 10 years. The report is still very good for new home construction because new home sales are still 14.1% higher year over year.

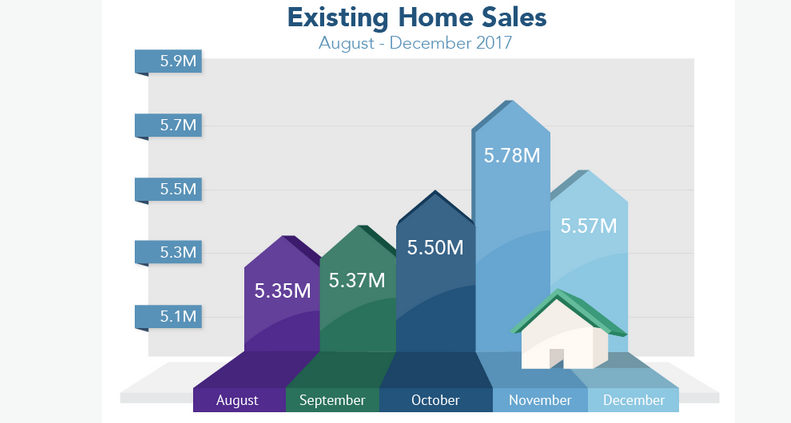

Existing Home Sales for December 2017 were down 3.6% to 5.57 Million units. This is coming off the best number in 11 years for November so a pull back was expected. Inventory of homes for sale remains tight so still very much a seller’s market and will be for the rest of the year. Housing inventory nationally dropped 10.3% on year over year basis and December was the 31st consecutive month of inventory dropping. The tight inventory has pushed home prices up and they were up 5.8% nationally year over year to an average price of $246,800.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday February 10, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday February 21, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates