Mortgage Rates Weekly Update [January 22 2018]

Mortgage Rates Weekly Update for January 22, 2018

Mortgage Rates Update for January 22, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved higher last week as mortgage bonds fell through floor of support and sold off as the stock market continued to rally. If you look at the mortgage bond chart below you can see mortgage bonds broke beneath the floor of support and continued the trend for mortgage bonds to move lower which is moving mortgage interest rates higher. We are recommending LOCKING Your mortgage rate until mortgage bonds can find a firm floor of support.

In Economic News

The Government shut down after the Senate failed to pass a bill to fund the government for the next 30 days on Friday. The government shut down means only services deemed essential will still be available. Below is how this will effect housing and mortgages:

Conventional Loans will be able to close as normal

VA Loans & FHA loans will be able to close as normal except nobody will be available to answer underwriting questions

USDA Loans will NOT be able to close as cannot get a commitment from Rural Development

Reverse Mortgages will be able to close as normal.

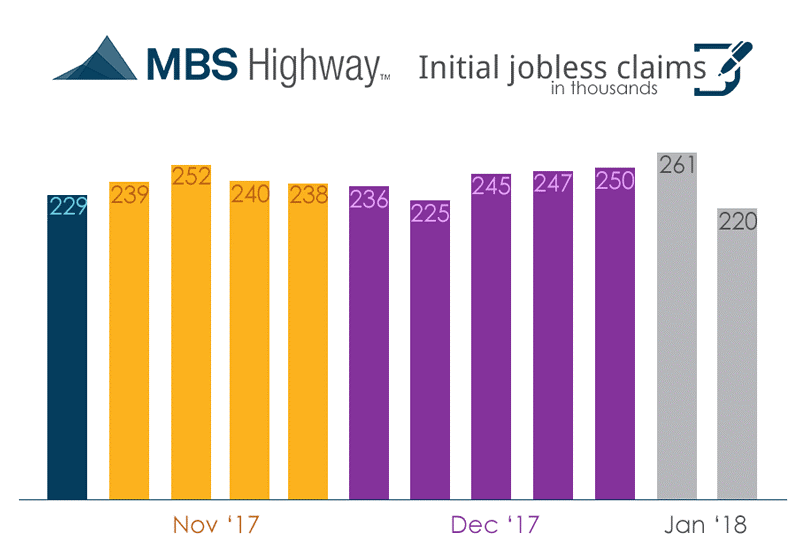

Weekly Initial Jobless Claims dropped 41,000 claims to 220,000 claims for the week . This was surprising job but shows the labor market is doing very well as the US Economy is running good. This was the lowest initial claims reading in several months.

In Housing News

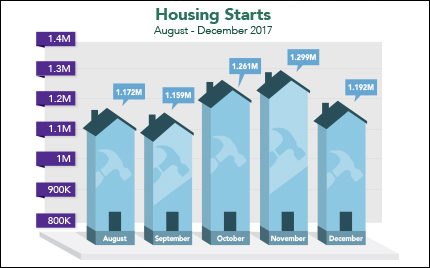

Housing Starts for December 2017 dropped 8.2% to 1.192 million units which was the lowest reading since September on housing starts. Housing starts measure the number of homes that home builders have started building for the month. Building Permits for December 2017, a sign of future construction, remained about the same as November 2017 at 1.302 million units.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday February 10, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday February 21, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates