Mortgage Rates Weekly Update [February 4 2019]

Mortgage Rates Weekly Update for February 4, 2019

Mortgage Rates Update for February 4, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

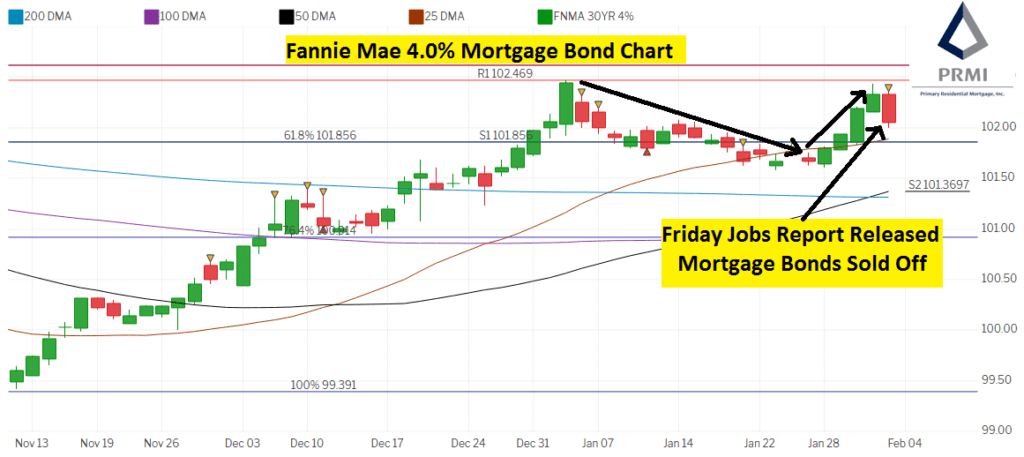

Mortgage Rates moved lower last week as mortgage bonds were able rally higher after a recent sell off that broke through two floors of support. If you look at the mortgage bond chart below you can see mortgage bonds had been selling off since hitting their high on January 3rd. Mortgage bonds finally found a floor of support on Monday January 28th which they were able to rally off of and break through ceiling of resistance. Bonds rallied up to the high of January 3rd on Thursday but retreated back lower. Friday mortgage bonds sold off after a very strong jobs report and have room to continue to move lower so we are recommending LOCKING Your mortgage rate to start the week.

In Economic News

The Jobs Report for January 2019 was released on Friday by the Bureau of Labor Statistics and it showed a whopping 304,000 jobs created which was almost double expectations of 160,000 jobs created. The Unemployment Rate increased from 3.9% to 4.0% mostly from the government shutdown. The big news in the report was that Average Weekly Earnings increased from 3.2% to 3.5% which is a significant increase. This would cause wage pressure inflation if it continues which is not bond friendly news.

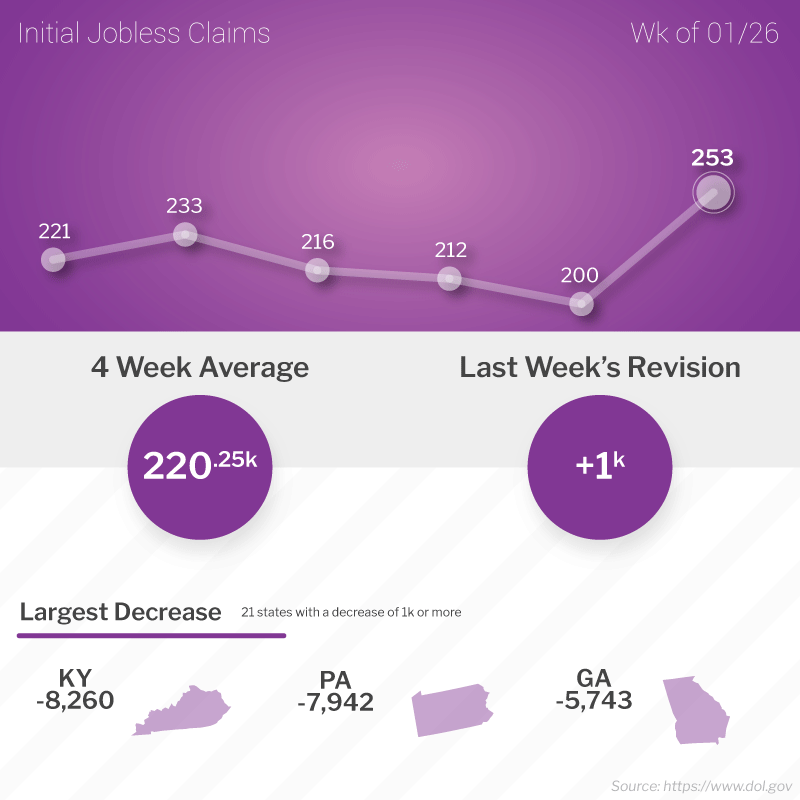

Weekly Initial Jobless Claims were released on Thursday and showed a huge surge higher by 53,000 claims to 253,000 claims for the week. The low levels of jobless claims last week was due mostly to the MLK Holiday.

In Housing News

Pending Home Sales Index for December 2018 dropped 2.2% to 99 from 101.2. This was worse than expectations of an increase of 0.5%. Pending Home Sales are now down 9.8% year over year. NAR Chief Economist Laurence Yun said he is confident the housing market will see improvement in 2019 and he thinks the longer term growth potential for housing is high.

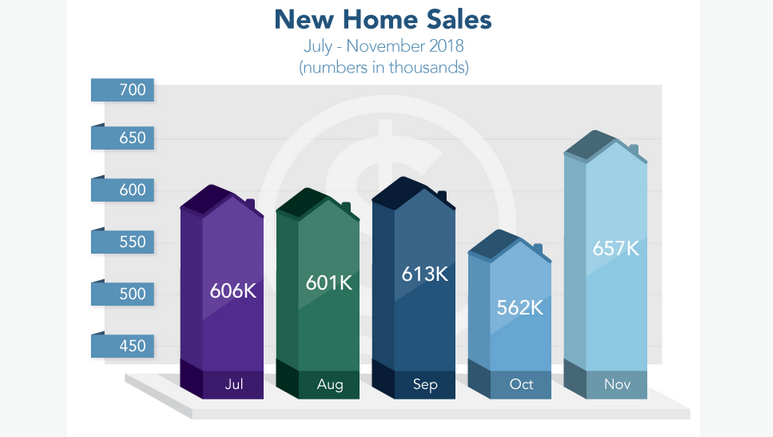

New Home Sales for November 2018 were delayed in being released because of the government shut down, but were finally released last week and surged higher by 17% to 675,000 units on an annualized basis. However, New Home Sales are down 7.7% from November 2017.

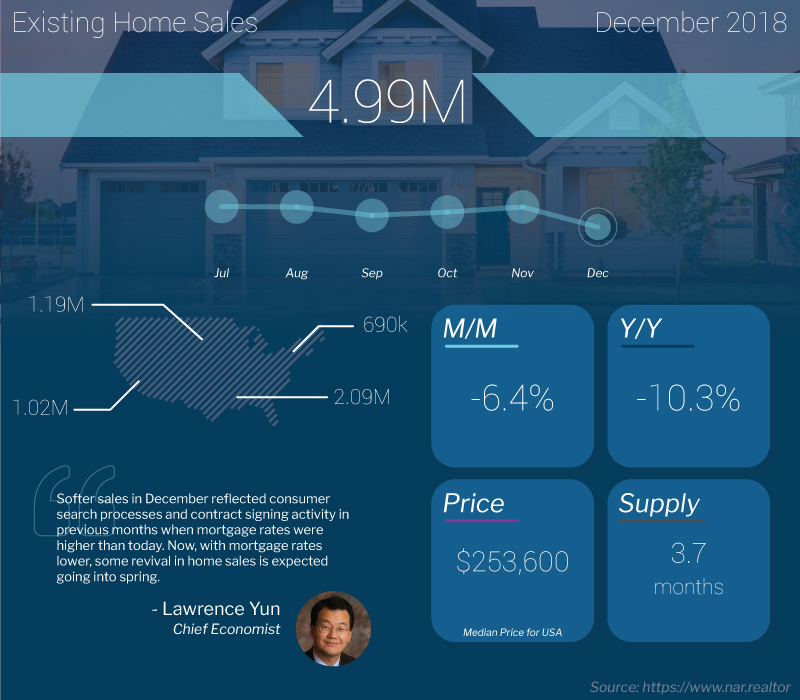

Existing Home Sales for December 2018 dropped 6.4% to 4.99 Million Units on annualized basis which was below the 5.22 Million units expected. Lower sales in December 2018 were due in part to higher mortgage rates in early December along with an ease in buyers due to the holiday season. Existing Home Sales are down 10.3% year over year. Monthly inventory of existing homes for sale is at 3.7 month supply which is still well below healthy inventory of 6 month supply.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday February 16, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday February 20, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday February 23, 2019 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam