Mortgage Rates Weekly Update [January 21 2019]

Mortgage Rates Weekly Update for January 21, 2019

Mortgage Rates Update for January 21, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

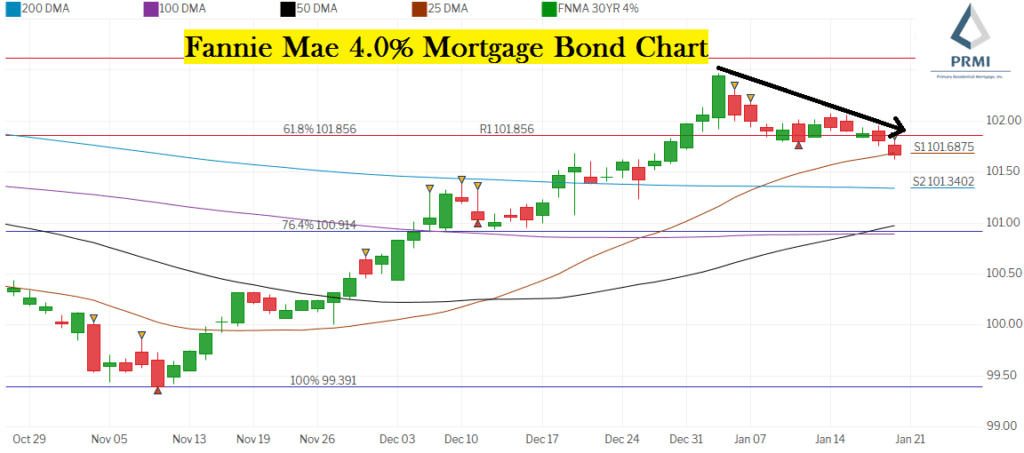

Mortgage Rates moved higher again last week as mortgage bonds continued to sell off and follow the down trend. If you look at the mortgage bond chart below you can see mortgage bonds have been selling off since hitting high on January 3rd. Mortgage bonds broke beneath support on Thursday and followed through on Friday. Bonds ended the day on Friday falling down to the next floor of support at the 25 day moving average at 101.6875. If stocks continue to do well, then bonds will fall through the 25 day moving average and continue to fall to the next floor of support at 101.3402. With the short term trend for mortgage bonds to continue to move lower, we are recommending LOCKING your mortgage rate to start the week. Borrowers should understand that the best loan pricing of the year was back on Thursday, January 3rd. The next day the Bond market received two punches in the mouth by way of the blockbuster Jobs Report and Fed Chair Powell’s overly “dovish” and stock-market friendly speech and it has shown no signs of revisiting those January 3rd levels at this time.

In Economic News

Day 31 of the Government Shut down falls on Monday Martin Luther King Day. So What is a Government shut down? In the normal US budget process each year, Congress has to appropriate funds by September 30th which they didn’t this year. When it doesn’t happen, a continuing funding resolution is enacted. When a funding resolution can’t be reached by Congress, it forces the government to shut down and non-essential discretionary federal programs close. Essential services continue during a shutdown as do mandatory spending programs, but essential workers do not get paid… although they will likely get those funds after shutdown, it doesn’t help them make mortgage and rent payments now. The current government shutdown began on December 21st at midnight and on January 12th it became the longest shutdown in US history.

The US Congress must be deemed “essential” as they still receive their pay during the government shut down as does the President.

Happy Martin Luther King, Jr Day from Primary Residential Mortgage

Producer Price Index (PPI) for December 2018 decreased by 0.2%. The PPI measures inflation at the wholesale level and shows that inflation is remaining tame which is good for mortgage rates in the long term.

The January 2019 Empire Manufacturing Index fell to 3.9 from 11.5 in December and well below the 12.2 expected. It was the lowest reading in over a year and the forecast read that the firms surveyed were less optimistic about the six-month outlook than they were last month. The Empire State Manufacturing Survey measures the health of the manufacturing sector in the New York area.

Weekly Initial Jobless Claims were released on Thursday and showed a drop of 3,000 claims to 213,000 claims for the week. This was the “sample week” to be used in the Bureau of Labor Statistics (BLS) Jobs Report for January 2019. Initial Jobless Claims at this low level point to a very strong jobs report which will be released on Friday February 1st.

In Housing News

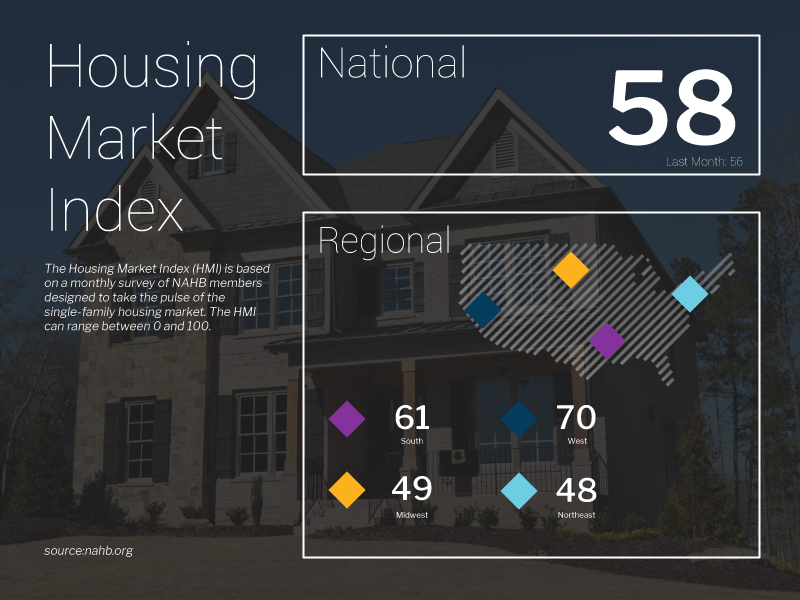

The NAHB Housing Market Index for January 2019 rose two points to 58, above the 56 expected. The NAHB housing market index is a gauge of home builder’s opinion on the relative level of current and future single family home sales. A reading above 50 indicates a favorable outlook and a reading below 50 indicates a negative outlook.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday February 16, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday January 23, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday February 23, 2019 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam