Mortgage Rates Weekly Update [February 18 2019]

Mortgage Rates Weekly Update for February 18, 2019

Mortgage Rates Update for February 18, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

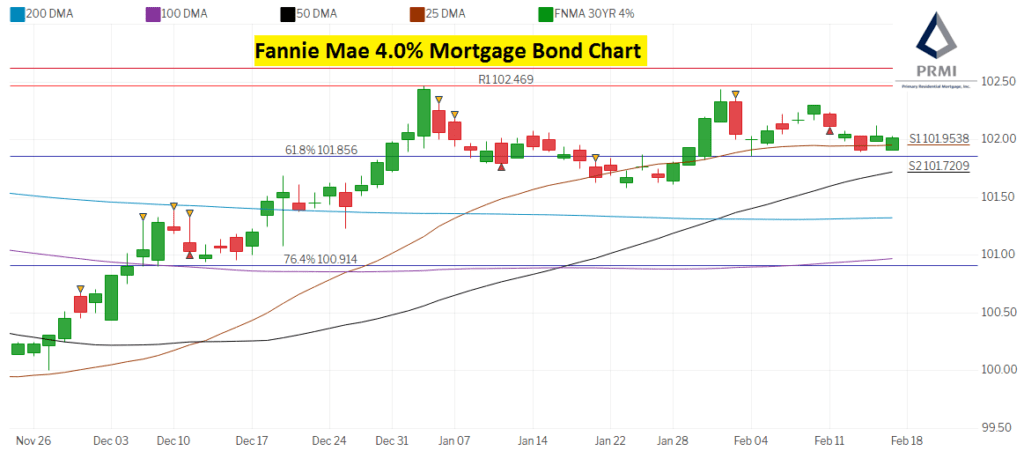

Mortgage Rates moved slightly higher to to end the week as mortgage bonds sold off. If you look at the mortgage bond chart below you can see mortgage bonds sold off on Monday with red candle after previous week’s run higher. Bonds fell to the floor of support which held on Friday. We are recommending FLOATING Your mortgage rate to start the week to see if mortgage bonds can rally higher off of support and move mortgage interest rates lower.

In Economic News

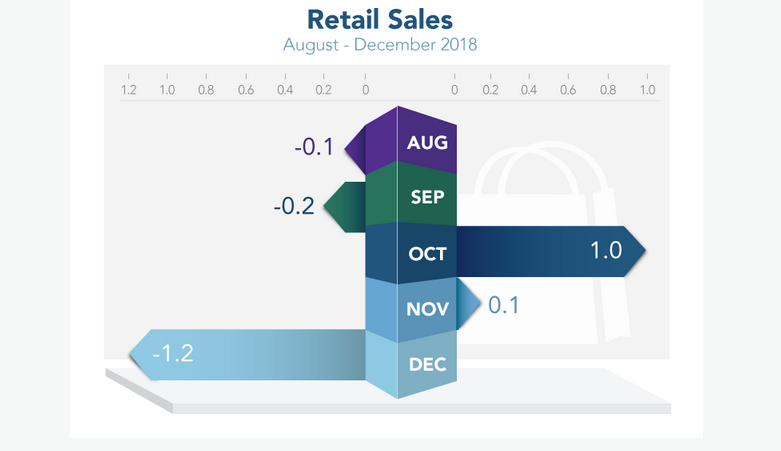

Retail Sales for December 2018 dropped by 1.2% to a 9 year low and is was a surprise to the market which was expecting a 0.1% gain. We need to watch if this is just one bad retail sales report or the start of a trend which could signal an economic slow down. The Retail Sales drop could be because of the big Drop in Stocks in December and if so we could see a rebound in Retail Sales in January as stocks rebounded nicely in January. The Retail Sales report is a measure of the total receipts of retail stores from samples representing all sizes and kinds of business in retail trade throughout the nation. It is the most timely indicator of broad consumer spending patterns and is adjusted for normal seasonal variation, holidays and trading-day differences.

The Producer Price Index for January 2019 dropped by 0.1% which is a measure of wholesale inflation. The market was expecting a 0.2% increase in wholesale inflation so this was good news for mortgage bonds. Lower wholesale inflation should translate into lower consumer inflation which would be bond friendly news. The year over year headline producer price index inflation reading dropped from 2.5% to 2.0%.

The Consumer Price Index for January 2019 (CPI) was unchanged but year over year dropped from 1.9% to 1.6%. The CPI measures inflation at the consumer level. The drop in year over year inflation is almost completely due to the drop in Oil prices. In the report it showed that rents were up 0.3% and are up year over year by 3.4% which means rents are rising faster than inflation. It is a good time to consider buying versus continuing to rent.

Weekly Initial Jobless Claims were released on Thursday and increased 4,000 claims to 239,000 claims for the week. Jobless claims have been rising over the last couple of weeks which is something to be watching. One of the first signs of a slowing economy and potentially a pending recession is companies began to lay off workers. Once the unemployment rate bottoms out and begins to rise, there has been a recession to follow 100% of the time in the past.

In Housing News

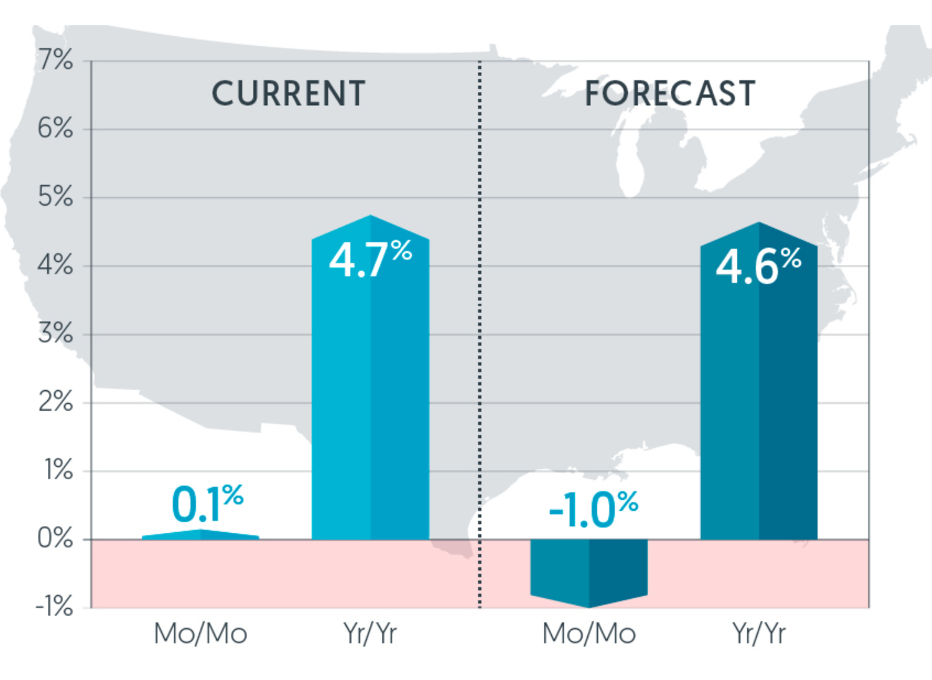

CoreLogic Home Price Index for December 2018 and it showed home prices were up 0.1% from November and are up 4.7% year over year from December 2017. CoreLogic is predicting home prices will be up next year by 4.6% which is still a very solid number for home price appreciation.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Wednesday February 20, 2019 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday March 16, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday February 23, 2019 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday February 23, 2019 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam