Mortgage Rates Weekly Update [February 24 2019]

Mortgage Rates Weekly Update for February 24, 2019

Mortgage Rates Update for February 24, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

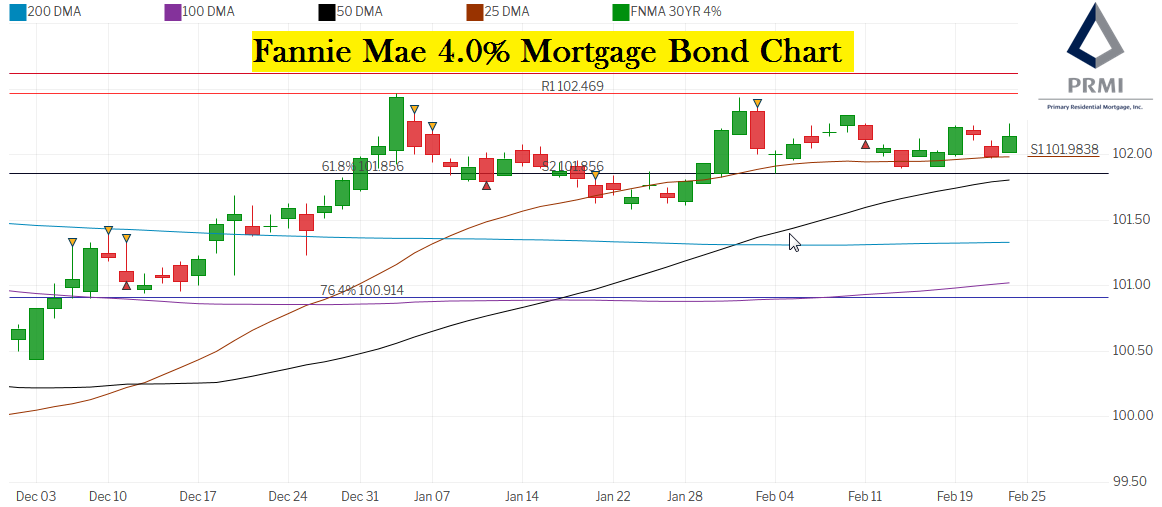

Mortgage Rates moved slightly Lower to end the week as mortgage bonds were able to rally of floor of support. If you look at the mortgage bond chart below you can see bonds were able to rally off the floor of support to end the week Friday. Mortgage bonds have finished in the middle of a sideways trading channel with some room to move higher so we are recommending FLOATING your mortgage rate to start the week.

In Economic News

Fed Minutes from January 30th Meeting – The Feds released the minutes from their January 30th meeting which showed very important insight into the Feds thinking and hints at their future plans. The Feds accumulated $4.5 Trillion of Bonds and Treasuries after instituting Quantitative Easing (QE) after the recession in 2008.

After the Feds stopped outright buying of bonds & treasuries, they continued to reinvest dividends and run off to the tune of $50 Billion a month. Beginning in 2017 they began to reduce the amount they were purchasing each month and by October 2018 they had completing stopped reinvesting and were letting their balance sheet run off and shrink over time.

The January 30th minutes now lead us to believe that the Feds will start their reinvestment of dividends and run off into the purchase of new bonds and treasuries as they believe the economy may be slowing with interest rates rising. By reinvesting again in Bonds and Treasuries this should help keep interest rates low. This was very good news for mortgage bonds.

Weekly Initial Jobless Claims were released on Thursday and claims dropped 23,000 claims to 216,000 initial claims for the week. This is a reversal of the rising jobless claim trend we have been seeing over the last several weeks. This will also be the “sample week” used in the February Jobs Report and claims of only 216,000 points to a strong jobs report which will be released on Friday March 8th.

In Housing News

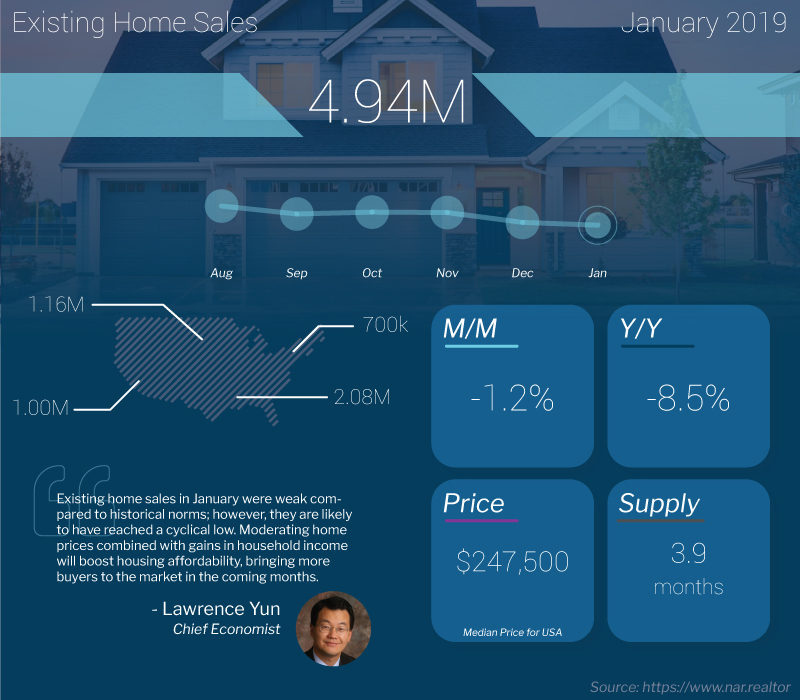

Existing Homes Sales for January 2019 dropped 1.2% from December to 4.94 million units on an annualized basis. Existing home sales are down 8.5% year over year. The inventory of existing homes for sale is still very low at only a 3.9 month supply which hampers existing home sales. The Median Home Price of Existing home sale moved up 3.3% to $247,500.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday March 16, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday March 20, 2019 in Wilmington, Delaware.D

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday March 30, 2019 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam