Mortgage Rates Weekly Update [March 3 2019]

Mortgage Rates Weekly Update for March 3, 2019

Mortgage Rates Update for March 3, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

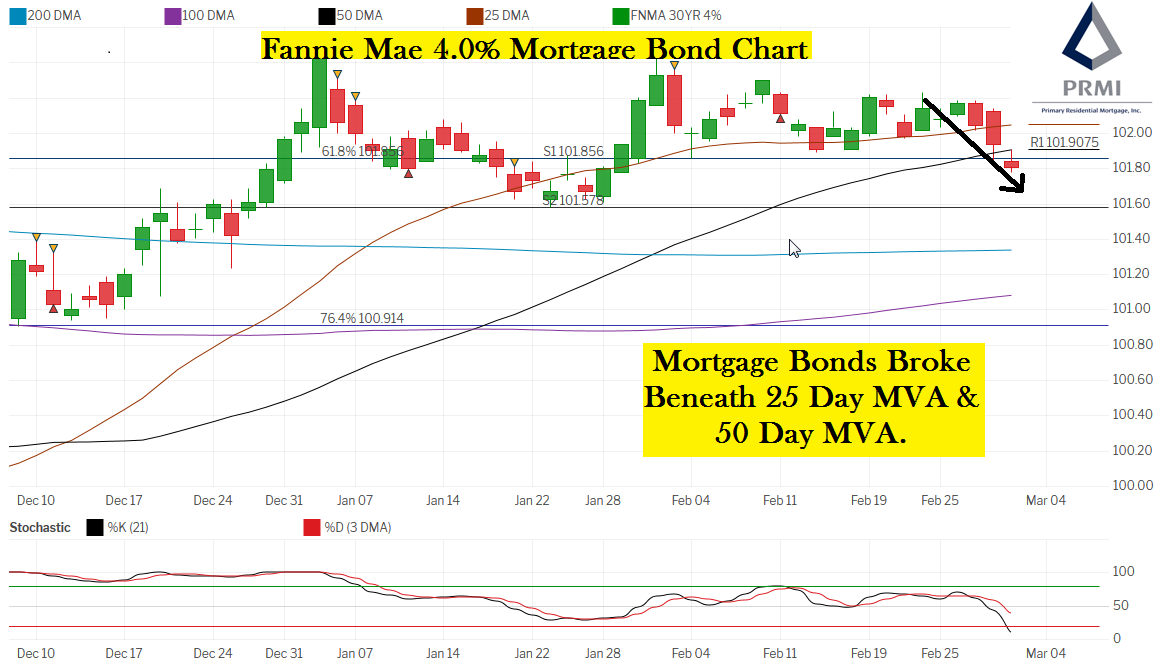

Mortgage Rates moved higher last week as the stock market continued to rally higher. If you look at the mortgage bond chart below, you can see mortgage bonds sold off and broke beneath three floors of support: the 25 day moving average, the 50 day moving average, and the Fibonacci level at 101.85. This is very bad news for mortgage bonds as they can’t seem to find a floor of support so we are recommending LOCKING your mortgage rate to start the week.

In Economic News

US Stock Market is Surging Higher – Stocks had very good week last week as stocks are anticipating a deal with China on trade talks. The DOW closed the week at 26,026.32. This is not too far from the highest closing ever for the DOW at 26,828.39 set in October 2, 2019.

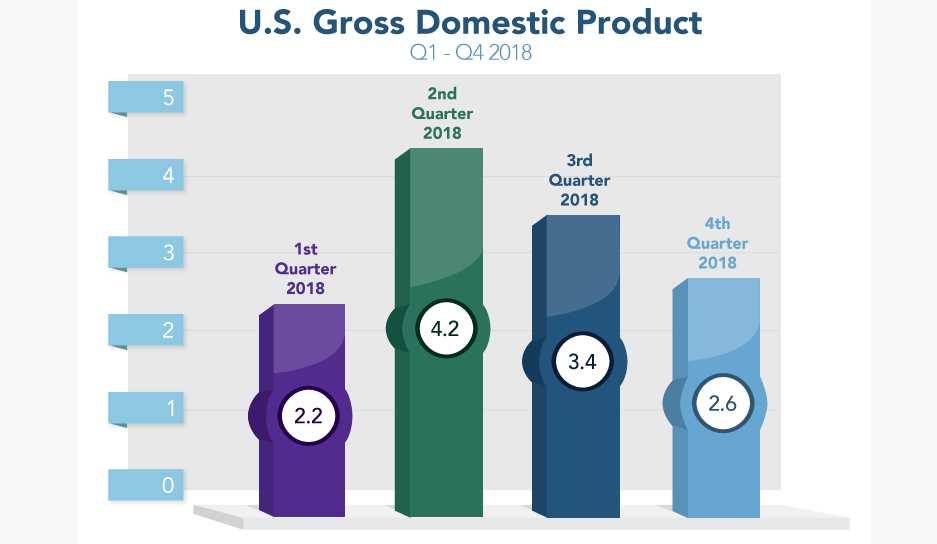

Gross Domestic Product for Q4 of 2018 showed US economy grew 2.6% which was much stronger than expectations of 1.8% The full year GDP for 2018 ended at 3.1%.

Personal Consumption Expenditure (PCE) for December 2018 remained tame. The PCE is the Federal Reserves favorite measure of inflation at the consumer level. The headline PCE fell from 1.9% to 1.7% on a year over year basis. The Core Rate which strips out food and energy remained stable at 1.9% Tame inflation is bond friendly news so is good for mortgage bonds.

Weekly Initial Jobless Claims were released on Thursday and moved up 8,000 claims to 225,000 initial claims for the week. The previous week reading of 217,000 is the sample week to be used in the Jobs Report being released this Friday so points to good jobs report.

In Housing News

Housing Starts for December 2018 were down 11.2% to 1.078 million units on an annualized basis. This was worse than expectations of only a 1.3% drop. Housing starts measure the number of new homes that builders start constructing. Building Permits for December 2018 were up 0.3% to 1.326 million units on an annualized basis, which was stronger than expectations. Building permits is a sign of future home construction so looks like new home construction could be picking up in the months ahead.

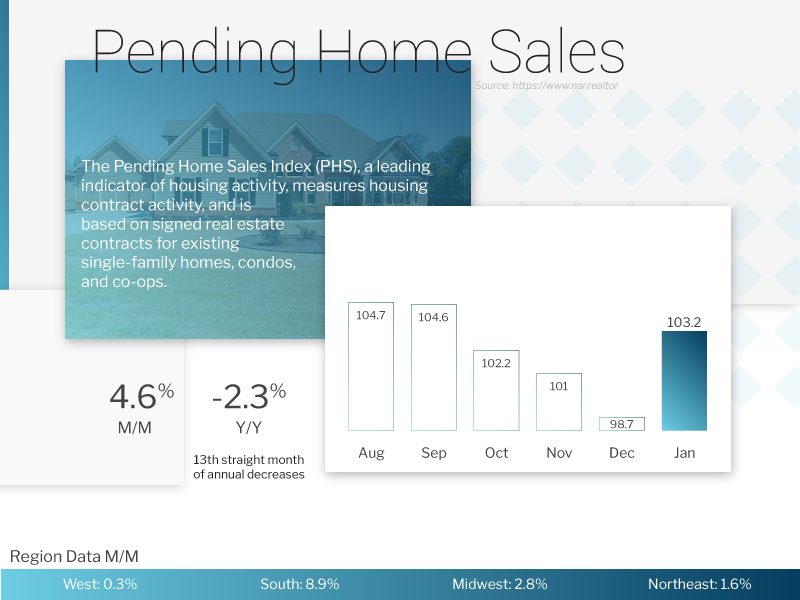

Pending Homes Sales for January 2019 were up 4.6% on the index to 103.2 from December 2018. This was much better than the 0.8% gain expected. Pending Home Sales are down 2.3% year over year, which is a very big improvement from the 10% we were down last month.

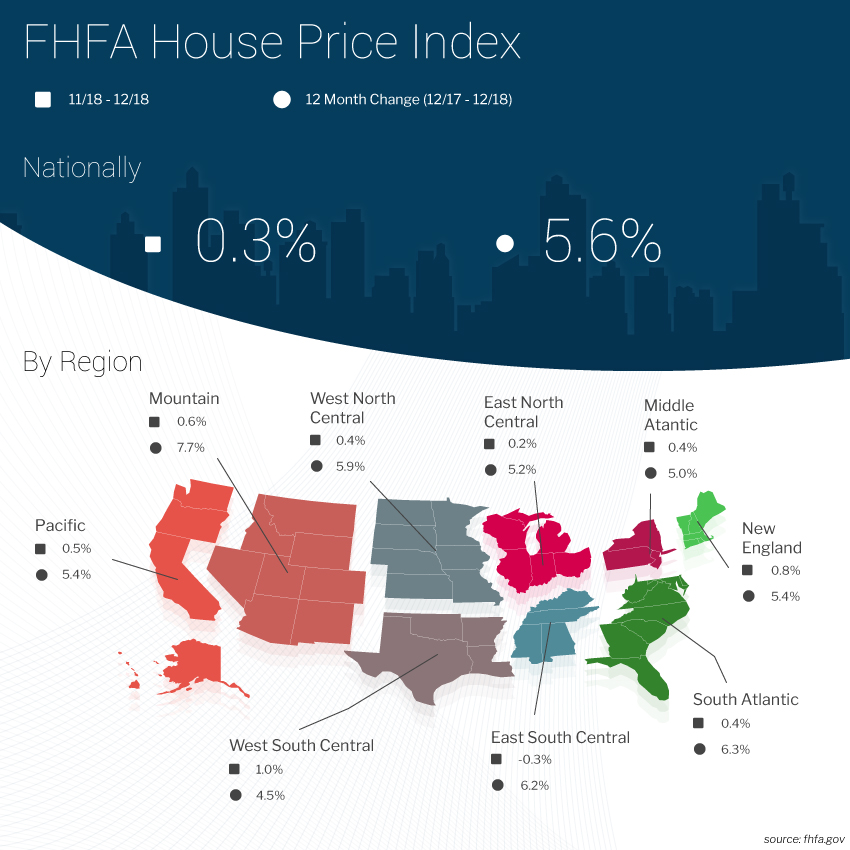

The Federeal Housing Finance Agency (FHFA) Home Price Index for December 2018 showed that home prices rose on average 0.3% from the previous month and year over year home price appreciation dropped slightly from 5.8% to 5.6% We are looking to see a very strong spring housing market.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday March 16, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday March 20, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday March 30, 2019 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam