FHA Mortgage Insurance Premium Reduced January 27, 2017

FHA Mortgage Insurance Premium Reduced January 27, 2017

FHA Mortgage Insurance Premium reduced January 27, 2017 by 0.25% on new FHA Loans. Monday January 9, 2017 HUD secretary Julian Castro announced FHA will reduce the annual mortgage insurance premium most borrower’s pay by 0.25% for new FHA loans originated on/or after January 27, 2017. Call 302-703-0727 to apply for a FHA Loan or APPLY ONLINE

2016 marked the fourth consecutive year that the FHA Mutual Mortgage insurance fund has grown and now has sufficient reserves with the capital ratio at 2.32 percent of all insurance in force which is above the 2% requirement. The drop in mortgage insurance premium comes at a time when consumers are facing higher credit costs as mortgage rates are increasing.

2016 marked the fourth consecutive year that the FHA Mutual Mortgage insurance fund has grown and now has sufficient reserves with the capital ratio at 2.32 percent of all insurance in force which is above the 2% requirement. The drop in mortgage insurance premium comes at a time when consumers are facing higher credit costs as mortgage rates are increasing.

FHA Mortgage Insurance Premium Mortgagee Letter

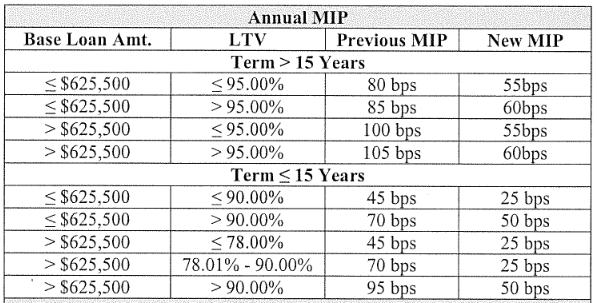

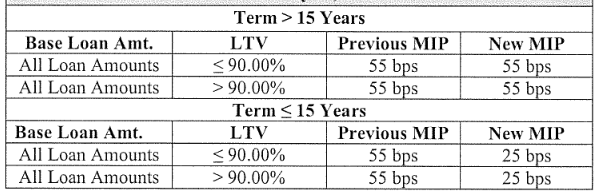

Mortgagee Letter 2017-01 released January 9, 2017 states the new lower FHA annual mortgage insurance premium will be effective on FHA loans that close and/or disburse on or after January 27, 2017. This means that if you are already in the process of purchasing a home and have a FHA case number, you will receive the new lower premium if closing or disbursing on or after January 27, 2017. FHA is also eliminating the premium difference on loan amounts for High Balance FHA loans, they will now have the same MIP as the lower loan amounts which is shown in the mortgage insurance table below.

FHA Mortgage Insurance Premium Tables

Below is table comparing old annual mortgage insurance premium versus new annual mortgage insurance premium.

FHA 30 Year Mortgage Insurance Premium & FHA 15 Year Mortgage Insurance Premium Table

FHA Streamline Refinances for Loans prior to June 1, 2009

FHA Upfront Mortgage Insurance Premium

The Upfront FHA Mortgage insurance premium is remaining the same at 1.75% of the base loan amount. The upfront mortgage insurance may be financed into the total FHA loan amount. For example if you are purchasing a home for $100,000, FHA will allow you to finance up to 96.5% of the purchase price which would be $96,500. The upfront mortgage insurance premium is $1,688 so the total amount of the FHA loan is $98,188.

How Much Will I Save from Mortgage Insurance Reduction?

The best way to illustrate how much you will save from the FHA MI premium reduction is with an example. If you are currently applying for a FHA Loan for a purchase price of $200,000 we will show the difference in payment between the current MI premium of 0.85% and the new MI premium of 0.60% on a 3.5% down payment.

Current FHA Mortgage Insurance Premium

Purchase Price – $200,000

Down Payment – $7,000

Rate – 4.5%

Monthly Payment of P&I plus MI – $1,130.72

New Reduced FHA Mortgage Insurance Premium

Purchase Price – $200,000

Down Payment – $7,000

Rate – 4.5%

Monthly Payment of P&I plus MI – $1,090.80

So you would save $39.93 per month which is $479.04 per year or $14,371.20 over the life of the loan. Compare this to a purchase price of $300,000 the savings on the mortgage insurance would be $59.87 per month.

Need to Apply for a FHA Loan?

If you have questions or would like to apply for a FHA Mortgage Loan please call 302-703-0727 or APPLY ONLINE

John R. Thomas – NMLS 38783

Primary Residential Mortgage, Inc.

248 E Chestnut Hill Rd

Newark, DE 19713

302-703-0727 Office

Delaware FHA Loans

FHA Loans

FHA Mortgage Insurance Premium

#FHALoan